While Ford will offer the Edge as a belated replacement for the Australian-built Territory which reaches the end of the line next month, Holden last week revealed that it will replace the long-in-the-tooth Captiva with a lion-badged version of GMC’s Acadia.

Both are North American-developed ‘soft-roader’ models based on a passenger car platform and offering up to seven seats that will sit alongside their more rugged off-road-oriented stablemates in the Ranger-based Everest and Colorado-based Trailblazer respectively.

This is the same formula that has proven so successful for Toyota, which has the American-derived Kluger (aka Highlander) as one of four formidable troopers in the segment – the venerable Prado, new HiLux-based Fortuner and outgoing FJ Cruiser make up the full brigade and together account for more than a quarter of all sales across the entire segment.

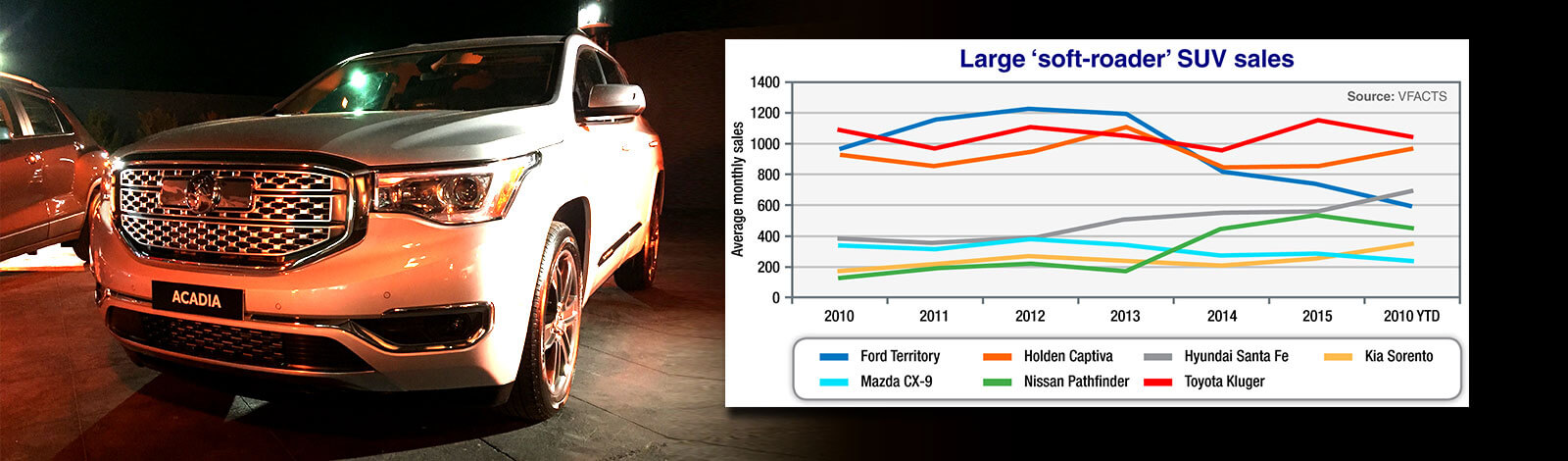

Toyota sold 13,955 examples of the Kluger last year, up 21.5 per cent on 2014 and second only to Prado (15,255) among the disparate collection of more than 20 SUVs in the segment with varying degrees of off-road ability and suitability as a large family wagon.

Captive audience: The second-generation GMC Acadia made its debut at the Detroit motor show in January, and now Holden is preparing to finetune the model for sale in Australia from 2018, replacing the ageing Captiva.

This year, Kluger sales are down 10 per cent but its 8311 units to the end of August is still enough to lead its direct rivals and place second overall behind Prado, with the downturn at least partly attributable to the Fortuner (3054) now standing next to it in the showroom.

A major model upgrade is also coming for Kluger in the first half of next year.

In comparison, Holden managed 10,239 sales last year of the Captiva 7 (+0.8 per cent) – which since the axing of the Captiva 5 in December has simply been known as Captiva – while Ford recorded 8902 sales of Territory (-9.4 per cent).

Captiva sales this year are pushing upward again – 7700 units to the end of August marks a 17.1 per cent increase and a solid average of 962 per month, although it remains behind its peak performance in 2013 when it was doing more than 1100 at each turn of the calendar page.

The heavily upgraded Trailblazer – known as Colorado 7 up until now and accounting for 1754 sales YTD (-3.2 per cent) – might have a similar effect on Captiva when it reaches dealerships next month, just as Fortuner appears to have had on Kluger, meaning it could be a challenging 18 months or so ahead for Holden as it works on increasing its sales across the fast-growing SUV sector as a whole.

As we have reported, Ford is on a similar road with the end of Territory production on October 7 and a delay until 2018 before Edge arrives.

Territory sales to the end of August are at 4795 units – down 25.3 per cent on the same period last year – which is being offset by the Everest (2468) but still represents important volume for the Blue Oval brand that is beginning to dry up.

There are other significant players in this genre, with the Mazda CX-9, Nissan Pathfinder, Hyundai Santa Fe, Kia Sorento and Skoda’s all-new Kodiaq – revealed late last week and due to launch here in the third quarter of 2017 – all lining up directly against the Kluger and the forthcoming Edge and Acadia.

Mazda is on record as saying it expects its freshly launched second-generation CX-9 to double sales compared to its predecessor, which translates to more than 6000 units a year – up from 3384 last year.

The changeover to the new model had pushed CX-9 sales down 43.9 per cent to the end of July, but the new model is quickly reversing the trend. With 439 units in July and 738 units in August, CX-9 is now up to 1899 units for the year.

Hyundai has pushed Holden back to third place in terms of overall brand sales this year and wants to keep it that way, with Santa Fe making a useful contribution – 5559 sales to the end of August, up 10.4 per cent, following a mid-life update introduced at the end of last year.

In 2015, Santa Fe sales finished at 6760 units (+3.5 per cent), which was around the same mark as Nissan’s Pathfinder, which delivered strong 20.4 per cent increase to 6433 sales for the year.

This year, however, Pathfinder has slipped 11.8 per cent to be at 3577 units at the end of August. As reported, a recently revealed mid-life facelift is due early next year, bringing useful mechanical improvements as well as extra technology.

In terms of year-on-year growth from an established model, Kia’s Sorento is at the top end of the field, racking up 2795 sales to the end of August (+33.8 per cent) but with senior management demanding much more from the model that entered a new generation in June last year – and which the company expects to be among the top five in the segment.

Despite a 22.8 per cent increase last year to 3202 units, Sorento was still behind all the major players in what is a crucial segment, accounting for 12 per cent of all new-vehicle registrations in 2015 (around 140,000 sales).

What this means is that the competition is certain to intensify in the months ahead, and could be at fever pitch by the time 2018 rolls around and launch dates are set for Edge and Acadia.

By Terry Martin

Read More: Related articles

Read More: Related articles