Tony Sesto

MINI Australia general manager Tony Sesto has declared that the BMW-owned British brand is no longer a niche player locally and will not return to that position, forecasting continued strong sales growth largely on the back of new products.

Speaking at the national media launch of the Mini JCW Convertible in Queensland recently, Mr Sesto said a focus on five core body styles instead of niche spin-offs was paying off as the brand moves towards capitalising on the booming SUV segment with the next-generation Countryman due in 2017.

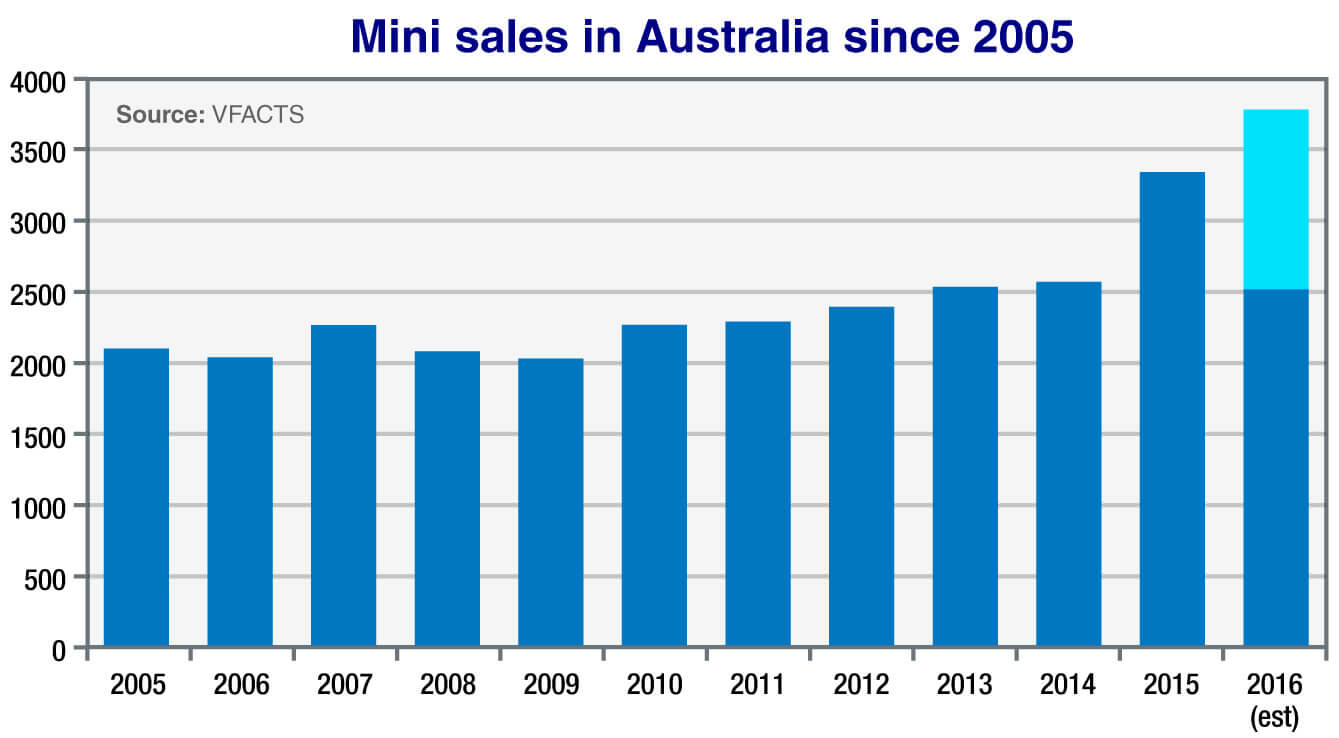

“If you look at our growth year to date we’re up 13.2 per cent and you’ve got to keep in mind that that’s off the back of another record year as well,” he said.

“We don’t have any expectation that we’re going to taper off or go backwards, we’re still a very ambitious brand and we still expect to grow this year and we’ve got very strong plans to continue growth next year as well.

“Mini is very focused on the five core models that we have, and when you look at the sales that we’re experiencing and the growth we have as well, to me that’s evidence that we’ve got it right and we’re focusing on the right core models.”

Mr Sesto confirmed the three- and five-door hatch, convertible, Clubman and Countryman as the five in focus as the Mini brand sheds small-volume players such as the Paceman.

Country life: A new Countryman is on the way but the current model is still one of Mini’s best sellers in Australia.

The Mini Roadster and Coupe were also discontinued in 2015, two models that Mr Sesto admitted: “I don’t think they were massive players.”

“I think Mini has become more than a niche brand in this market, we’re a lot stronger than that,” he added. “We do have things (new models) coming, so I’m very confident that the growth will continue next year and in the years to come.”

Mini has racked up 2509 sales to the end of August this year, which, if the company continues at this rate, will see it finish the year with 3700-plus units – up from 3342 for the 2015 calendar year.

While 78 per cent of last year’s volume was taken by the Mini hatch (2608), this has reduced to 65 per cent so far this year – and in a skew that for the first time has favoured the five-door ahead of the three-door, 55 to 45 per cent.

Compared with the same period last year, Mini has lost only 24 sales by culling the Roadster, Coupe and Paceman. However, the Convertible (up from 63 to 161 sales) and Clubman (rising from just six to 361 units) has more than filled the void, while the Countryman crossover is steady (346 versus 364 sales) ahead of the redesigned model’s arrival next year.

While refusing to comment specifically on the new Countryman, Mr Sesto said the premium small SUV segment offers the brand a huge opportunity.

“If you look at the premium segment, that is definitely out-growing the overall car market, there’s double-digit growth (not) single digits, and if you look at that small SUV part of the premium segment, there’s enormous growth,” he said.

“That segment is a big interest to Mini and that’s where we need to be if we want the brand to continue to grow.”

While acknowledging that the Clubman was not technically a small SUV, Mr Sesto said it has played “a huge part of the growth we’re experiencing at the moment”.

“I wouldn’t say they (buyers) see it as an SUV but they see it as a bigger car to what the hatch is, and obviously the Clubman has the ability to be the primary car in the family household,” he said.

“The Mini brand is drawing people from everywhere at the moment, we’re becoming I think a brand that is getting stronger and stronger in this market.”

Mr Sesto ruled out lowering the entry price to the Mini line-up to chase extra volume, following the example of the UK where the brand is in the top 10.

“Right now we’re in the market with the Mini Ray, and that for us is an amazing entry point we can offer the market at under $30,000 driveaway,” he said.

“For me (that is) a fantastic entry point for a lot of customers wanting to get into a new Mini. I think it’s very difficult when you try to compare us to other markets. The UK is the home of the Mini, it’s a different demographic, it’s a different marketplace (and) it’s difficult to make a direct comparison.

“We see it on the BMW side as well, our customers want all of the bits and pieces when they’re purchasing the car. For us even though we offer these entry models … we still see a lot of our sales are at the top end.”

Indeed, 53 per cent of Mini three-door hatch sales volume is reserved for Cooper S and JCW models, which Mr Sesto said was “one of the strongest in the world”.

“So for us our focus is not all on trying to reduce pricing and spec … it’s about making sure we introduce the substance in the car that our customers want,” he said.

Mr Sesto would not be drawn into suggestions that the popularity of the S and JCW variants was perhaps due to perceived extra value of those models relative to the competitor set, versus the Mini Ray and its price-point rivals.

When it was suggested that a Mini Ray was similarly equipped to an entry Volkswagen Golf, but more expensive, whereas a Mini Cooper S largely matched the $40,000 price and specification of a Golf GTI, Mr Sesto replied: “You can compare pricing of the Mini to a lot of other brands that are much cheaper, but it’s not about the price, it’s about what we’re trying to offer our customers.

“You need sustained growth but also sustained profitability at the same time. Mini is a brand that I want to protect, we’re not a brand that’s ‘on sale’ all of the time.”

By Daniel DeGasperi

Read More: Related articles

Read More: Related articles