With the large seven-seat wagon to be followed in the second quarter of next year by the equally all-new Karoq mid-sizer – a scaled-down five-seat version dubbed ‘Kodiaq Junior’ – Skoda is now embarking on a product offensive that hands it more appealing new models in high-volume segments.

These are important new entrants for the Czech brand as it builds a more cohesive range and sheds its offbeat image that stemmed from models with polarising designs such as the discontinued Roomster and the current Yeti.

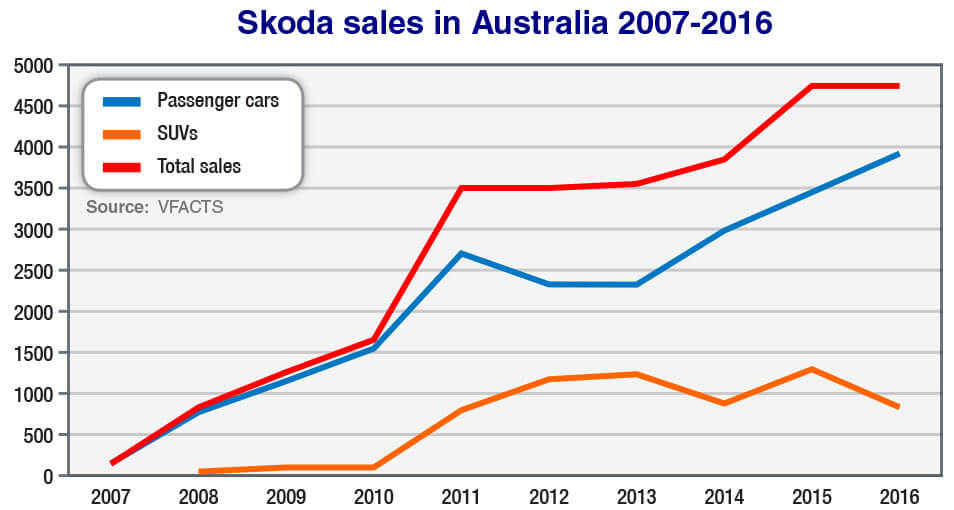

The aim is to lure a higher percentage of prospective buyers into Australian showrooms – generating more sales, currently below 5000 per annum, and improving its share of the overall new-vehicle market, sitting at 0.4 per cent – with thoroughly modern vehicles that are both affordable and aspirational to own.

Whereas Volkswagen Group Australia has taken an elevated position for VW under its ‘premium for the people’ mantra, the company’s stated aim for Skoda is to have it slot in between Volkswagen and high-volume Korean brands Hyundai and Kia.

Its obvious key rivals are the top Japanese brands, particularly those aiming directly at private buyers, with Skoda offering points of difference with its European heritage, unique (though increasingly conventional) styling and high content for the money involved, particularly now the Czechs are given access to all the latest VW Group technology.

Supply issues have at times hampered Skoda Australia’s progress in previous years, and strong worldwide demand for Kodiaq will restrict numbers through to next year.

A diesel variant will bolster the local range late this year, while the anticipated easing up of supply restrictions should bring further growth and allow the local subsidiary to broaden the range, opening at a lower point than the current $42,990 starting price for the single-grade 4×4 132TSI turbo-petrol variant.

With Kodiaq and Karoq in the mix, Skoda’s SUV sales should skyrocket after spending years relying on an inadequate range comprising the small-medium Yeti and the high-riding ‘Scout’ version of the mid-size Octavia station wagon.

High marks: The Kodiaq attracted more than 4000 expressions of interest on Skoda’s website prior to launch, pointing to strong early demand for the all-new seven-seat large SUV.

The latter is no longer on sale in Australia with the launch in May of the updated Octavia range – and is not expected to return – while Yeti will make way for Karoq next year.

Between them, Yeti and Octavia Scout contributed just 830 units last year, down 35.8 per cent on the previous year and accounting for 17.4 per cent of the brand’s total volume (4760 units).

Skoda has averaged 199 sales a year of Octavia Scout since its first full year on sale (2009), while Yeti has managed 872 a year (on average) since 2012, having launched in October 2011. The Scout’s best annual return was 437 units in 2015, while Yeti rose only as high as 1129 in 2013 – having added incremental volume right from the start – but has been on a downward slide in recent years and is falling further in 2017.

VFACTS figures released this week show that only 107 Yetis have been sold to the end of May this year, down 55.4 per cent compared to the same period in 2016.

The all-new Karoq is a fraction smaller than the top-selling Mazda CX-5 but is a bona fide mid-size SUV, while Kodiaq is an all-new entrant that is not as big as the likes of the Mazda CX-9 but still qualifies as a large SUV. Both stand as a drawcard for Skoda in two of the most popular market segments in Australia.

More than 172,000 new mid-size SUVs were sold across all brands last year, and more than 142,000 large SUVs, leaving only small cars (at 224K) and light-commercial pick-ups/cab-chassis (at 190K) in front of them.

Skoda Australia senior management has refused to nominate a sales target for Kodiaq or the brand as a whole now that such an important new model has reached the marketplace.

On the face of it, Skoda sales have increased every year since the brand returned to Australia in 2007 after a 24-year hiatus, climbing from a low base of less than 1000 units and only a few models to 3500 by 2011 as new vehicles such as Superb, Fabia and Yeti arrived and its dealer network expanded.

It did, however, stagnate from 2011 to 2013, selling 3501, 3502 (yes, the record books will forever show this as another year of growth) and 3555 over that period, while the all-new Rapid and redesigned Octavia, the latter including lower-priced but higher-performance RS variants, helped push the brand up to 3853 units in 2014.

Skoda took another step forward in 2015 to 4750 units – a new-generation Fabia and Octavia Scout making an impact – while the brand was back to treading water last year, this time with 10 extra units to ensure another record result but with nothing much to write home to Mlada Boleslav about.

Fabia and Superb were the only two models in positive territory, with Octavia (-7.3 per cent), Octavia Scout (-22.0), Rapid (-18.1) and Yeti (-42.8) disrupting those gains.

This year, Skoda’s sales are lineball with 2016 – 1911 cars had left showrooms by the end of May, 38 more than at the same point last year – but, depending on supply, will certainly rise as the “unprecedented” level of interest in Kodiaq, including more than 4000 potential customers signing up for information via its website, translates into vehicle deliveries.

There should be no trouble passing the 5000-unit mark for the first time, but how much further the two new SUVs can take the Czech brand is another question entirely.

The migration of buyers to the Rapid small hatch, for example, which is planted in Australia’s most popular market segment, hasn’t been substantial – Skoda sold 367 last year – while 857 Fabia sales marked the light car’s best sales performance ever in Australia.

The brand’s biggest-selling model – Octavia – which has been the backbone of the Skoda range since the brand’s 2007 relaunch, had its best year in 2015 with 2128 units. This dropped back to 1973 units last year.

These are not big numbers for a brand that often receives high praise for its vehicles and, on paper, strikes an excellent balance in terms of price and specification. It also this year increased its standard warranty period to five years (or 150,000km).

Success will hinge on a variety of factors like overseas supply, marketing budgets, dealer representation, product renewals, new variants and more all-new models coming to the fore.

But unknown quantities also come into play, such as just how far the Skoda brand can reach into the psyche of Australian car buyers and switch off their deeply rooted preference for other brands, particularly the top Japanese marques.

Does anyone have a definitive answer for that?

By Terry Martin

Read More: Related articles

Read More: Related articles