THE Australian Automotive Dealer Association (AADA) has joined with automotive market intelligence provider AutoGrab to provide what is being described as a used car market equivalent to the monthly VFACTS new car data reports.

The move comes at a time when increasing OEM intrusion into the independence of dealers in their new car retailing operations is seeing leading dealers increasingly swing their attention to used cars because of the freedom used car operations give them in controlling their businesses and branding them in their local markets.

The used car sales opportunity for dealers is that for every million new cars sold in Australia each year, 2.5 million used cars are sold with 60 per cent of those sales in the hands of amateurs; i.e. private sellers.

Like VFACTS, the analysis reports from AutoGrab will be issued monthly. To be called Automotive Insights Report (AIR) one report will be an exclusive detailed analysis for AADA members only. A second more generic report will be made available to the public a day later

The data is taken from an analysis by AutoGrab of online classified used car advertising listings reinforced with actual sales results from used car wholesalers, dealers and auction houses.

The report for AADA member includes:

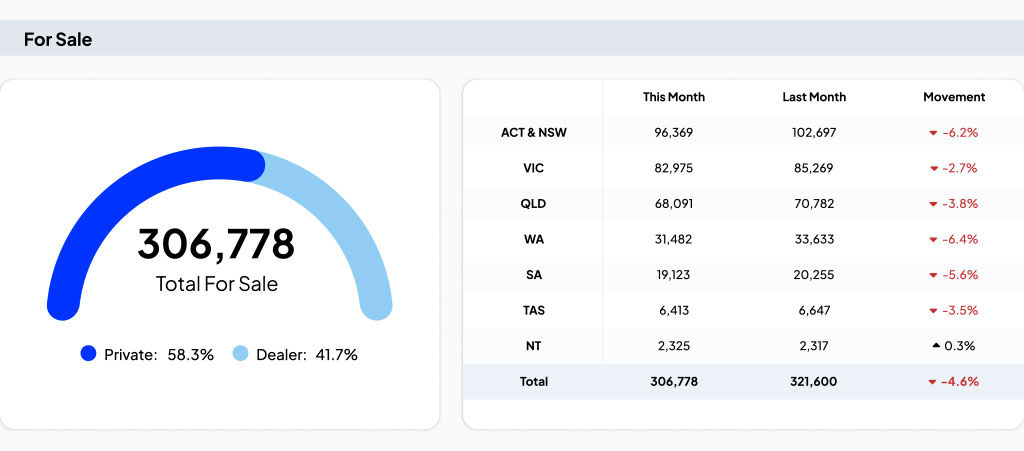

- Total used cars for sale including dealer vs private and state-by-state breakdown

- Total used car sales including dealer vs private and state-by-state breakdown

- Total used cars for sale by segment

- Total used cars sold by segment

- Total used cars for sale by fuel type

- Total used cars sold by fuel type

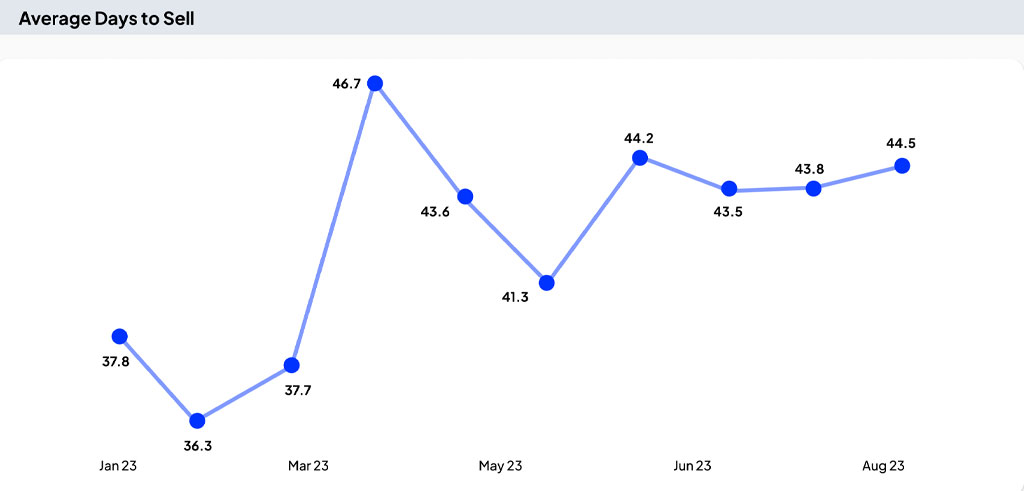

- Average days to sell

- Average residual value (2-4 years old)

- Total sales – top 10 makes less than 8 years old

- Dealer velocity – Top 10 lowest days in stock

- Dealer market days supply – Top 10 lowest

- Dealer market days supply – Top 10 highest

- Dealer sales – Top 30 makes/models sold in previous month

The CEO of the AADA, James Voortman, told GoAutoNews Premium: “We have always focused on the new car data we get from VFACTS but with so many more used cars sold than new cars we have been ignoring a very large part of the market for quite a long time.

“As dealers go into this new automotive landscape, they need to try and maximise every potential opportunity. We have always said used cars are an area where a lot of dealers can improve their performance,” he said.

The service will be released by the AADA and co-branded with AutoGrab.

Mr Voortman said: “The report will have some important stats on the number of vehicles for sale in a given month and also the number of vehicles that have been sold.

“There’ll be information on which segments are selling relative to others; the fuel type, which will be a very interesting story in the coming years with the immaturity of the battery electric used car market at the moment.

“Residuals are important coming off this period where resale values have performed outstandingly well and we will be in a position to monitor those at an aggregated level and also at a segment level, for instance.

“Looking at the data, it’s clear that the used Utes and used SUVs are holding up better than passenger vehicles, for example.

“There will be a top 10 makes and models that we can explore. And then also things like which vehicles are moving the quickest and which ones are taking the longest to move.”

Mr Voortman said the AADA exclusive member reports will be more tailored to dealers, looking at vehicles at the age that dealers are likely to be interested in. “Dealers are probably only interested in vehicles eight years or younger, for example. There will be a bit more detail on some of the makes and models, and so forth.”

“We have had dependable new car sales data in Australia for some time, but the industry has been lacking a regular reliable source of truth for used cars. Our partnership with AutoGrab and their unrivalled wealth of data on the used car market will complement the existing new car dataset, giving dealers a holistic picture of the Australian automotive landscape.”

Daniel Werzberger the CEO and founder of AutoGrab said the company was pleased to have been able to secure support for the data service from so many dealership groups, financiers, insurers and now the AADA.

“Due to our aggregation power, we have incredible visibility over the entire marketplace community and are able to detect when there is critical movement between one marketplace and another, including fraud,” he said.

“We have a competitive proposition on publicly-available and proprietary data aggregation that is unique to the market, driving strong demand and growth. AutoGrab is clearly excited to be partnering with the AADA to drive more dealership value.”

Henry Pedersen, COO of AutoGrab, said that car dealers continue to adapt and evolve in the face of unprecedented disruption and that, as the peak body representing franchised car dealerships, the AADA invests significantly in ensuring its members are at the front of the disruption.

“This focus was at the forefront of why this partnership with the AADA was a perfect fit for both organisations,” Mr Pedersen said.

He said that the joint AADA-AutoGrab monthly data service “incorporated never before distributed market data into the automotive discourse and provides dealers with a crucial instrument for navigating the increasingly challenging industry.

He said that without such data, “discerning between market fluctuations and operational challenges remains an intricate task. With this indispensable tool, dealers gain the clarity needed to align strategies effectively and identify opportunities for growth.”

By John Mellor

Read More: Related articles

Read More: Related articles