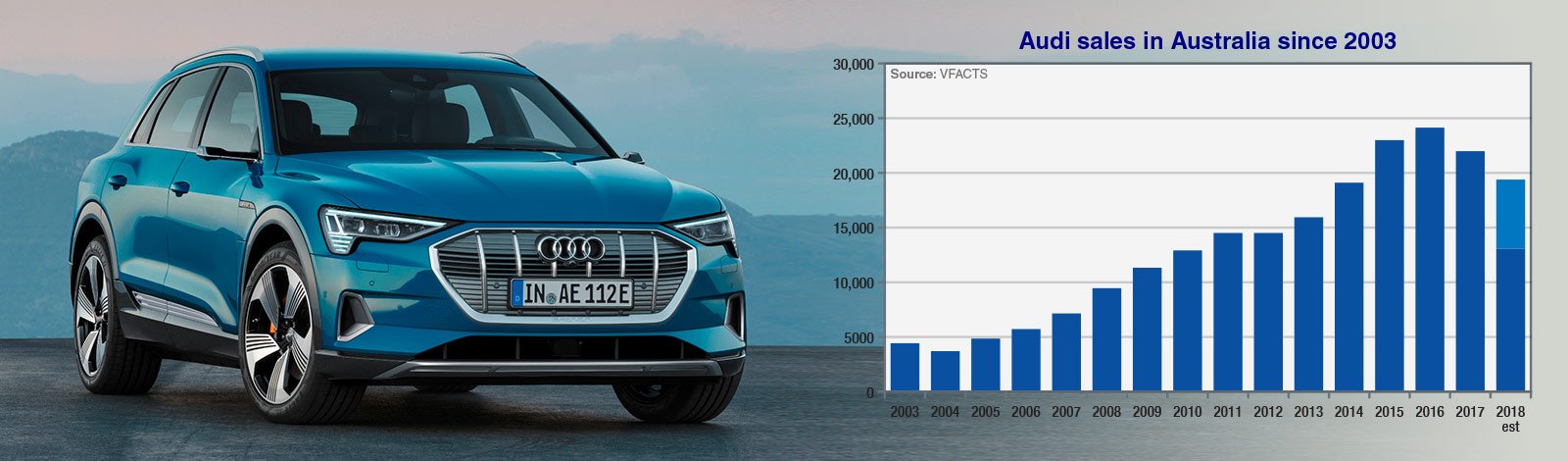

Year to date, Audi Australia has amassed 13,043 new registrations, an 8.5 per cent dip over the first eight months last year, which projects to a circa-19,500 year-end tally.

Last year Audi Australia sold 22,011 new vehicles, a 9.3 per cent drop over its high water mark of 24,258 in 2016.

Speaking to GoAuto, Audi Australia corporate communications manager Shaun Cleary said this year has been about consolidation for the brand as just three vehicles – the RS4 Avant, R8 RWS and new-generation A8 – have been launched to date.

“We haven’t had a lot of product launches this year, which is unlike recent years we had, but we know what’s coming,” he said.

“In the next 12-to-18 months, it’s going to be an incredible product offensive … We’ve really come to a great patch of new product.”

On the horizon for Audi Australia is the second-generation A7 that will land in local showrooms in November, while the mechanically related A6 is also expected to follow some time thereafter.

The A6 and A7 models have hit 86 and 188 sales year to date respectively, a 34.4 per cent increase and 20.7 per cent decrease, but new versions are expected to have a positive impact.

Early next year will also see the arrival of the brand’s new Q8 SUV flagship to take on the likes of the BMW X6 and Mercedes-Benz GLE Coupe, with the second-generation Q3 small crossover landing around mid-2019.

With a 1610 tally year to date, the Q3 is currently the brand’s third-best selling model behind the A3 range (2972, -18.8 per cent) and Q5 (2458, +47.5 per cent), but the new-generation version should reverse its 27.5 per cent sales slump.

Ringmaster: Nearly half of Audi’s models will be refreshed by the end of 2019, while two all new models will also launch in the form of the Q8 large SUV (below) and all-electric e-tron.

The new-generation A1 micro hatchback is also earmarked for a first half 2019 local launch, as is the facelifted A4 mid-sizer.

A1 sales have hit 758 units this year, a 7.0 per cent drop, while the A4 has slumped 33.9 per cent to 1065 units.

Not to be outdone, Audi’s sportscar line-up will also receive a refresh next year with the new-look TT planned and the yet-to-be-revealed updated R8 – which has been spied testing overseas – that could land in Australia before the end of 2019.

However, the updated R8 and TT are expected to contribute little to Audi’s bottom line. So far this year they have amassed 29 and 141 units each, a 14.7 and 7.2 per cent drop off last year’s pace.

Finally, Audi’s first all-electric model, the e-tron SUV, will charge up midway through 2019 to take the fight to the Tesla Model X and Jaguar I-Pace.

Mr Cleary described some of the fresh product as “significant models” that are expected to reverse its sales downturn and could lift Audi’s bottom line for the first time since 2016.

“We know what’s coming, we’re making sure our business and network is well positioned to really capitalise on that fantastic product that we have in the next 12-to-18 months,” he said.

As for the rest of Audi’s model range, the A5 and A5 Sportback have accrued a combined total of 940 units to the end of August, a 33.5 per cent lift over last year, which is expected to continue climbing after the launch of the flagship RS5 Sportback in February.

Meanwhile, the A8 passenger car flagship – which launched in new-generation form in July – has hit 20 sales this year, 9.8 per cent or two units off the pace of last year.

The Q2 continues its upward trajectory this year with 1274 sales, an 11.8 per cent lift, while the Q7 large SUV has slipped 22.1 per cent to 1502 units.

Overall, Audi’s Q models account for 6844 or 52.5 per cent of the brand’s sales, which reflects Australia’s shift in preference to high riders.

Mr Cleary said Audi is posed to capitalise on the market’s new predilection and hinted that there could be room for another SUV – possibly a Q6 – in its line-up.

“We know that there is a diverse customer market out there, our model range is arguably one of the most diverse in the entire market,” he said.

“The market has been clearly moving in the SUV direction, we’ve been launching more SUVs, we launched the Q2 last year as an all-new model, we’re launching the Q8 early next year as a new model, potentially there is more to come.

“We’re very comfortable with the fact that the Audi Q SUV range is increasingly popular, and we’re also launching other niche models as well … to compliment.

“I think the fact that our very first electric car is an SUV, probably gives you the impression of the importance we place on the Q family within the Audi brand.”

Audi is not the only premium brand to struggle to grow its market share this year with compatriot brands BMW and Mercedes-Benz also slipping 3.8 and 7.5 per cent to 16,352 and 23,013 year to date respectively.

By Tung Nguyen

Read More: Related articles

Read More: Related articles