Developed over the past 12 months by Dealer Solutions, the platform borrows from the US-based vAuto used car intelligence system which was developed by well-known US used car guru, Dale Pollak, who toured Australia several years ago. vAuto is owned by Cox Automotive, and has 7000 customers.

Gillian Allen, product manager for AutoRadar told GoAutoNews Premium that the AutoRadar development team was able to gain insights from the vAuto system.

“One of the advantages of being part of Cox Automotive is that we get to share information with our international colleagues. It was great to be able to gain insights from the vAuto team and to demonstrate AutoRadar to them and apply their feedback,”

Ms Allen said the AutoRadar team has been working with a number of large dealer groups around Australia which have been using the system “to make sure we delivered the right features for the Australian market”.

More than 100 separate dealers have been trialing the product.

Michael Sommerton, CEO of Cox Automotive Australia Retail Solutions, told GoAutoNews Premium that dealers had been calling for competition in the used car valuations and stock management space.

“The feedback we are getting from dealers is that they absolutely welcome what we are doing and are excited there is a good quality product that established good competition in the marketplace.

“We developed AutoRadar because we wanted to give dealers a choice where, for example, they did not have to list on a particular online platform to get access to this kind of market insights data. They can now list anywhere they like and still get access to the data.”

Michael Sommerton

Mr Sommerton said that AutoRadar would be available to dealers at no cost for the first month and that dealers would be pleased with the very competitive price position AutoRadar has taken.

“We don’t underestimate the challenge but we are glad that now there is a challenger for dealers to move over to and particularly some choice,” he said.

Ms Allen said that because the core business of Dealer Solutions is managing the dealers’ online classified listings for all its dealer clients, it has access to the extensive data it needs to analyse used car activity across Australia.

Dealer Solutions has nearly 2,000 dealer clients and manages over 100,000 individual vehicle listings at any one time. It also has over 700 websites in their platform which provides valuable customer keyword search analysis.

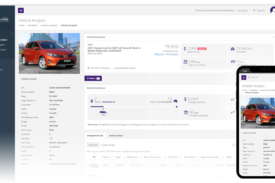

AutoRadar is also linked with Kelley Blue Book to provide market relevant vehicle valuations for used cars. Kelley Blue Book was recently launched in Australia and sources information on auction prices from Manheim and dealer asking prices from dealers’ classified listings.

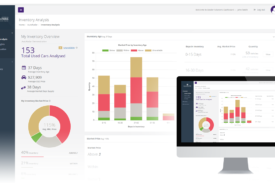

Core data includes make, model, variant, kilometers, listing price, price at time of delisting, days in inventory, market days supply and days to sell.

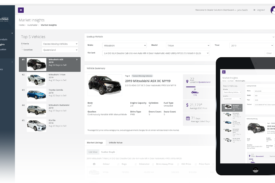

The AutoRadar system interrogates dealer’s used car stock listings and compares the data with other subscribing dealer used car activity in the same local market (or state or national).

By tracking when cars are first listed and the price, the number of days they remain listed and the final price, and then comparing the same data with other dealers, all sorts of market intelligence becomes available.

By seeing how many similar vehicles are in the market, their advertised prices and the time they have been listed, used car managers can make accurate judgements on buying a similar car into stock, setting a trade-in offer price or deciding to quit stock and the price they are likely to achieve.

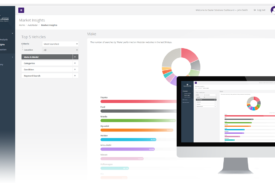

The days supply reports by make/model/variant take the number of a particular car in the market compared with the average days they are taking to sell. This shows which cars are moving quickly and those dragging their heels and identifies which models to pursue and which ones to avoid.

Dealers can also benchmark how they are travelling in efficient inventory management compared with others in their market. The system also develops reports showing which cars are the most popular with buyers making make-model searches on dealer websites. This buyer search demand shows what models people are currently looking for in the market.

Gillian Allen

One option includes looking back over the previous 60 days of cars that have been delisted (and presumably sold). It also details the price at which models were listed against the final listed price for each model across the market.

AutoRadar is flexible so that it can be used for single rooftops or across a dealer group. It provides a summary at the group level or can drill down to just one individual location.

Other tools include a list of the top five fastest-selling vehicles in a dealer’s market area, a list of the top five models with the lowest day’s supply as well as the most popular in terms of the highest sales volume.

Dealer Solutions, part of the Cox Automotive Group, is Australia’s largest independent data aggregator. It conducts inventory management and management of dealer websites, markets a fully functional dealer management system (DMS), conducts professional photography and has a digital advertising agency, Digipurple.

By John Mellor

Read More: Related articles

Read More: Related articles