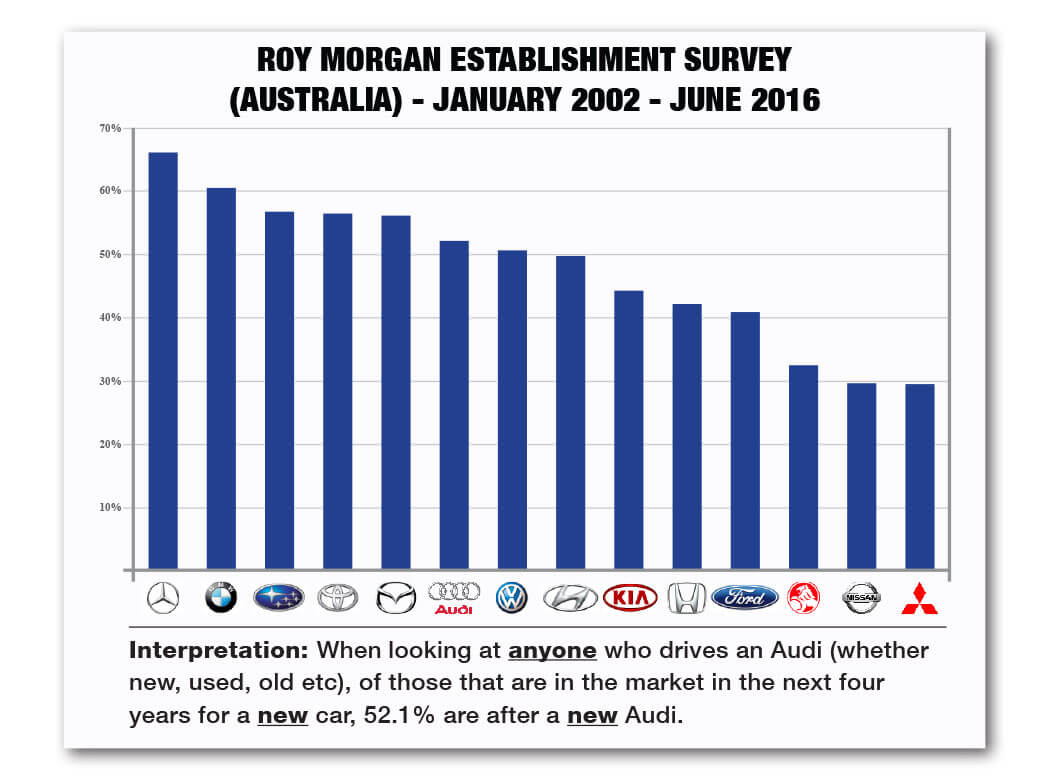

But dealers selling Subaru, Toyota and Mazda vehicles will be pleased to hear that research shows more than half of their owners say they will buy the same brand again and that only Mercedes and BMW are ahead of them.

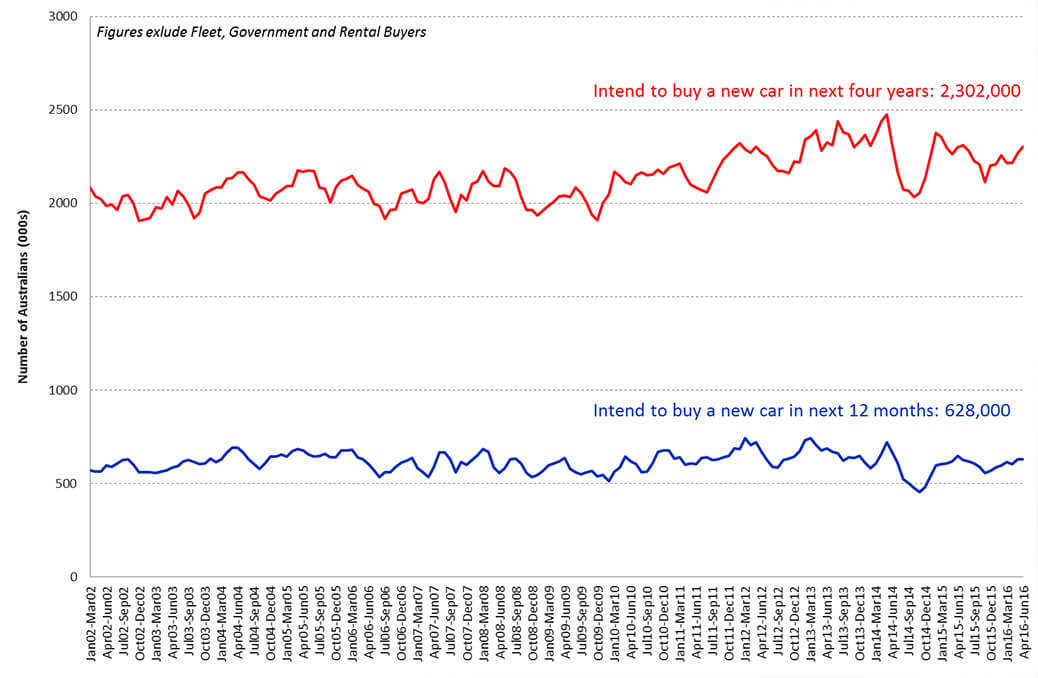

The finding is part of Roy Morgan’s research into buying trends that is headlined by the revelation that the number of Australians who are intending to buy a new car within the next four years has increased compared to last year (see table below).

Roy Morgan Research data released this month shows that owners and drivers of European cars show a greater inclination to stay with the same brand when they buy a new car – although Roy Morgan Research’s automotive industry director Jordan Pakes said this trend was subject to the manufacturer having a vehicle suitable for the buyer.

The data was distilled from questioning a large sample of car owners and drivers, then asking if they intended to buy a new car within four years, and which model or brand they were intending to purchase. Those respondents who were in the market for a new car and looking to purchase the same brand they currently drive now were classified as “brand loyal”.

For example, of the 133,000 Audi drivers Australia-wide, 28 per cent indicated they were in the market to buy a new car within four years, and then, of that sample, 52.1 per cent said they were looking to buy a new Audi.

Roy Morgan Research supplied GoAutoNews Premium with the data for 14 brands and showed the results of their owners willingness to buy the same model.

Mr Pakes said the results – based on people who own a new or old, or a purchased second-hand model – showed Mercedes-Benz owners were more likely to stay with the brand when buying a replacement vehicle.

Mercedes-Benz scored the highest at 66.1 per cent, with BMW having 60.5 per cent of drivers keen to remain with the brand.

The third, fourth and fifth most loyal owners were separated by a mere 0.6 percentage point. Subaru was third with 56.7 per cent, followed by Toyota (56.4 per cent) and Mazda (56.1 per cent).

Roy Morgan Research finds that Audi owners are four times more likely to buy a new car within four years as the survey average. It also reports that less Audi drivers would buy the brand again compared with BMW and Mercedes-Benz.

The figures of these Japanese makes reflect their sales successes.

But it did not extend to Nissan and Mitsubishi, who recorded the lowest figures of the sample with 29.5 per cent and 29.4 per cent respectively. Again, Roy Morgan said owners of these makes may be looking at a new model that may not be available from Nissan or Mitsubishi (as they reduce model diversity).

Holden’s 32.4 per cent may be attributed to current owners unable to return to the Commodore model after it ends production next year, and the company’s current departure to field more upmarket models from Europe.

Ford came in with a better result than Holden, with 40.8 per cent of owners saying they would buy the brand again, while Honda scored 42.1 per cent.

Koreans Hyundai and Kia fared well with 49.7 per cent and 44.2 per cent respectively, while Volkswagen scored 50.6 per cent and brand-related Audi came in with 52.1 per cent, well down from rivals BMW and Mercedes-Benz.

And, while Audi was down in loyalty stakes compared with its prestige European rivals, Roy Morgan also notes that Audi drivers are, more than any other brand, keen to replace their cars.

Of the Audi drivers surveyed, 28 per cent intend to buy a new car (regardless of make) in the next four years – a rate more than double the norm of 13 per cent of all current drivers.

“Audi has the highest proportion of current drivers in the market for a new car, with more than one in four Audi drivers looking to buy a new vehicle before 2020,” Mr Pakes said.

“VGA stablemates VW and Skoda also have high proportions of potential buyers, on 23 per cent and 21 per cent respectively – equating to around 120,000 people behind the wheel of a VW or Skoda looking to purchase over the next four years.”

Mr Pakes said 2015 was a record sales year in the automotive industry.

“Brands and dealer groups spent around $1 billion on advertising in an effort to persuade potential buyers to visit their showrooms and purchase a vehicle from their range, he said.

“When it comes to looking for new prospects in 2016 and beyond, some brands are better position than others to start by looking at their existing owner base.

“When it comes to future purchase intentions, automotive brands need to know just how many of their existing drivers intend to buy the same make again.

“With a substantial portion of each maker’s future sales potentially coming from current drivers, trending loyalty (and understanding loyalists, switchers, and opportunities for conquest from other brands) is vital.”

Mr Pakes said that overall, the future is bright for the car industry.

He said that buyers in 2016 will outpace those in 2015 when it comes to future buying plans, presenting a strong market for dealers.

Roy Morgan said that the number of Australians who intend to buy a new car within the next four years has been steadily climbing over the past six months, with a total of 100,000 more car buyers now in the market than there were at the end of 2015.

“Near-term intention has also risen, adding 60,000 more Australians on the look out for a new car in the next 12 months compared with six months ago,” it said.

“With sales over the first six months of 2016 hitting another all-time record and with private short-term purchase intentions also on the rise, it looks like 2016 is on track to eclipse the 2015 sales record of 1,155,408 according to VFACTS,” Mr Pakes said.

“When looking at those consumers after a new car before the end of 2016, overall brand consideration for Toyota remains on top – with 74,000 potential private buyers considering a new Toyota.

“This is only marginally ahead of second place Mazda on 70,000, with both brands comfortable ahead of Ford, Hyundai and Holden battling it out for third, fourth and fifth place.

“Another brand looking to have a strong finish to 2016 is Honda – with 26,000 potential buyers considering a new Honda, up from 19,000 12 months ago.

“Much of Honda’s recent gains can be attributed to the recently launched all new Civic small car.”

By Neil Dowling

Read More: Related articles

Read More: Related articles