The Car Buyer of the Future study, conducted by Autotrader.com – America’s largest auto website with 30 million unique visitors a month, asked 4002 car buyers if the current method of purchasing cars was the preferred experience, with only 17 saying yes.

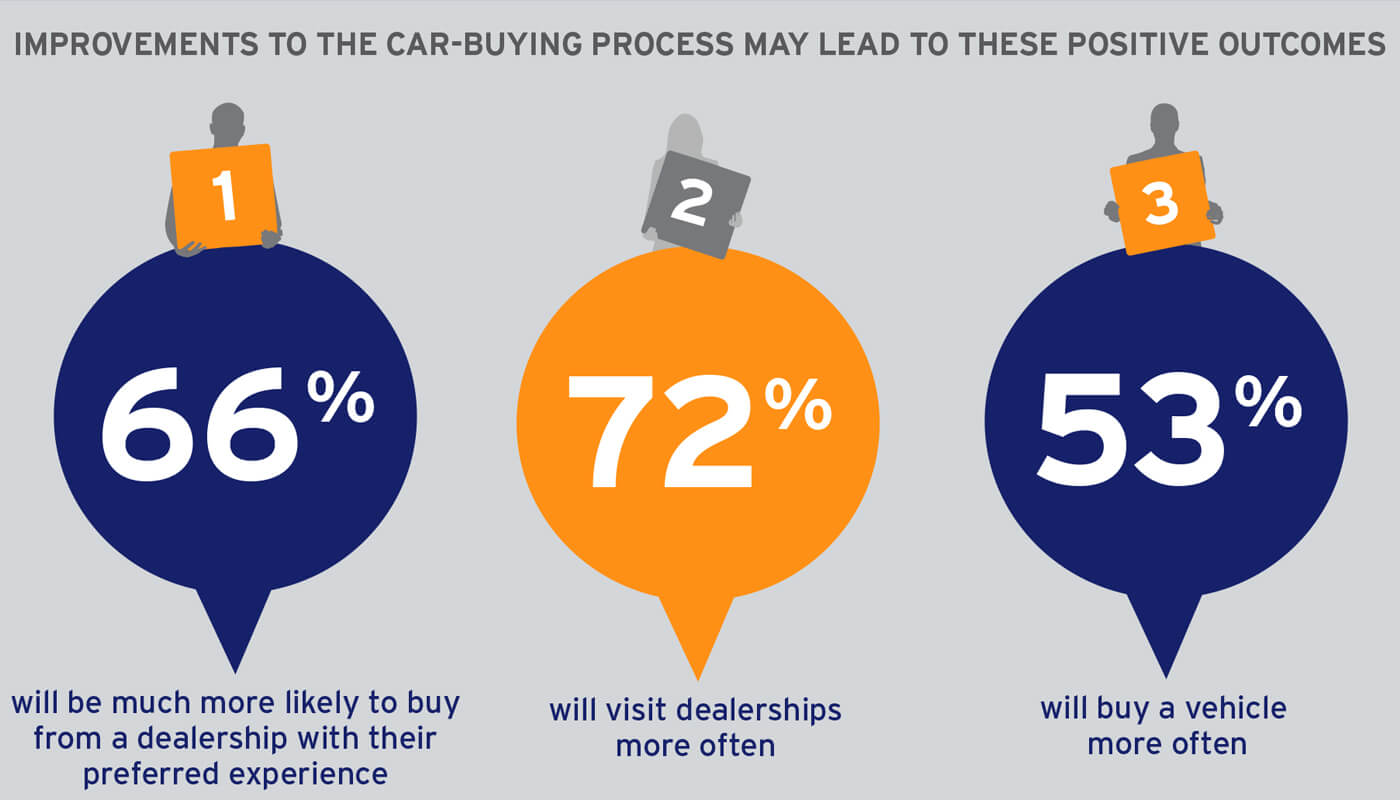

However, respondents also voiced that they would more willingly go to dealerships if the sales process was realigned to address their discomfort in showrooms.

For example, 66 per cent said they would seek out dealerships which sold cars in a way that aligned with their preferred experience and a whopping 72 per cent said they would visit dealerships more often.

More than half of those surveyed said that, if the experience was more aligned to that which they thought was ideal, they would actually buy a car more often.

Incredibly, the implication is that the fear of entering a car dealership under the current system is limiting the sale of cars.

The survey revealed that:

- Dealers must make sure their business is represented online across all devices

- Buyers want more control over the negotiations and thought this could best be achieved online

- Buyers would prefer the initial stages of discussions be anonymous

- The test drive should not include sales staff

- Buyers would like test-drive centres across multiple makes and models

- The sales process was too long, especially if finance and insurance is involved

- Paperwork is frustrating to buyers

- Buyers would purchase more aftermarket products if they learned about them earlier

Negotiating the price

More than half (56 per cent) said they prefer to negotiate because, under the current system, it was the only way they could get the best price, but they also said the whole process was a serious point of frustration.

The survey said dealers should make greater use of wholesale and trade-in market guides to validate the discussions they are having with buyers.

A further surprise in the data (because it is not what dealers have come to expect) was that more than half of buyers (54 per cent) would prefer to buy from a dealership, if it sold cars in the way buyer’s preferred, rather than buy a car from the lowest-priced dealer who sold in the traditional way.

Asked about driving further away from home to a dealership, 65 per cent said they would drive further for the lowest price and 73 per cent said they would drive further to deal with a “great salesperson”. More than 40 per cent of people said they go to dealerships to learn about cars.

While 84 per cent of respondents said they preferred to buy the car in person in order to gain more control in the price discussion, a third of the respondents said they would would like the deal to be negotiated online and more than half (56 per cent) of those asked said they would like to begin the negotiation online before arriving at the dealership because “they wanted the negotiations to start on their terms”.

In fact, such was the trepidation of the process in the showroom, 45 per cent of those asked went so far as to say they would like to be “anonymous to the dealer” until after the deal was locked in.

Autotrader said this online negotiation process would use software tools that would allow buyers to engage with dealers online and start structuring the terms of the purchase. The survey suggested that by connecting with dealers online on a commercial basis this would preserve and maintain the important role of dealers in the car purchase process.

For this process to work, dealers would need to train sales staff to help them understand the online negotiation process and to avoid any pressure to come to the dealership, which could likely lead to breaking the process and a lost sale.

Finance and insurance (F&I) online as well

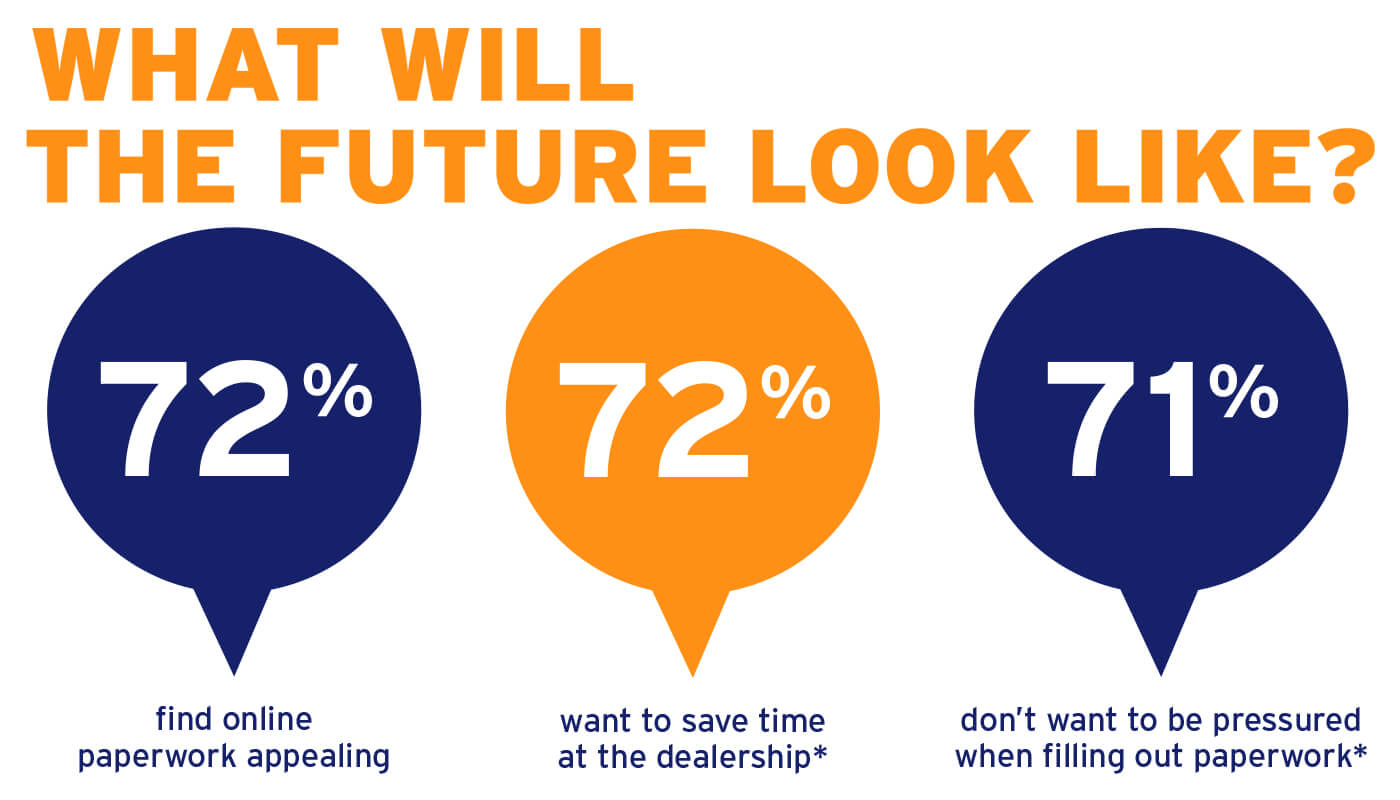

The same preference for online negotiations was also applied to finance and insurance (F&I) sales with 70 per cent of the respondents saying they want to start the process online because “it will cut the time taken in the dealership to complete the sales process”.

The survey found that customer satisfaction is highest in the first 90 minutes spent at the dealership and, as the time spent at the dealership increases, that level of satisfaction falls.

The survey revealed that with online research, online deal-building and online F&I negotiations becoming the standard, aftermarket pitches need to come earlier in the process and be made online as well because buyers told Autotrader they would have bought more aftermarket and F&I items if they had been told about them earlier in the price discussions.

Overall, 72 per cent of buyers found online paperwork appealing and the same percentage of those said they wanted online processing to save time in the dealership. A similar number said they wanted online processing because they did not like the pressure of filling out paperwork.

Research on multiple devices

The research showed there was a need for dealers to make sure their dealerships were well-represented on multiple devices in order to capture buyers in their research phase.

The data confirmed the well-known fact that more than 80 per cent of buyers research online. It highlighted that 42 per cent of this research was now conducted on multiple devices – especially smartphones – but also said there was a rapid swing to buyers researching “on an arsenal of devices” and that this figure would be north of 80 per cent by 2020.

The research said that investment by dealers in smartphone delivery of research data was therefore a necessity and that “dealers should focus on robust online merchandising that is easily accessible across all devices”.

The report said: “Strong, relevant content creates a better shopping experience across multiple screens opening up more opportunities for dealers to drive influence and preference for their dealership and brand.”

Test drives

Test drives remain a fundamental part of the buying process with 88 per cent of those surveyed saying they would never buy a car without test driving it first. Having said that, 81 per cent do not like the current structure of the accompanied test drive and of those, 67 per cent cited feeling pressured while test driving.

Respondents also said they wanted test drives to be more convenient. They preferred home test drives and they wanted to test drive cars without sales people with them.

Respondents in focus groups associated with the research also explored possible test drive alternatives.

One of these was test driving centres where buyers could drive a wide range of different makes and models without engaging with a dealership but with the choice of engaging a dealer when they were ready to buy. This would allow buyers to assess a variety of potential choices first hand and in their own time without the pressure of a sale.

The research said that dealers which satisfied these buyer aspirations in the test drive process were more likely to earn a car buyer’s business and would also earn higher customer satisfaction scores.

Service

Almost all the respondents (92 per cent) said they wanted more service location options and to to be able to service their car at any of the brand’s service centres even if they did not purchase their car there and 83 per cent said they wanted their cars serviced locally.

By John Mellor

Read More: Related articles

Read More: Related articles