It said revenue also jumped, with a 69 per cent increase to $880,000 while the size of the fleet or owned and financed vehicles expanded by 116 per cent.

During the first six months, Carly said it maintained a vehicle utilisation rate of 87 per cent while increasing overall fleet size.

It also reduced the customer acquisition cost by 80 per cent, down to $201 from $1012 in the previous corresponding period.

Carly CEO and director Chris Noone said the company grew its fleet and subscriber base despite encountering vehicle supply restrictions caused by COVID issues and microchip shortages.

He said that during the first half, it added a further 64 vehicles to its owned and financed fleet representing growth of 116 per cent over the similar period in 2021. As at December 31, 2022, it had a fleet of 267 vehicles.

He said that Hyundai has also contributed to the fleet via “asset light” deliveries of Ioniq 5 EV’s which will be “a crucial growth area once supply bottlenecks have diminished.”

In its report to the ASX, Carly said that unlike previous years when it relied exclusively on an asset light model by accessing under-utilised vehicles owned by automotive dealers, manufacturers and fleet managers, “Carly has continued to finance the acquisition of vehicles to gain more control over fleet size and composition in a tight supply environment.”

It said that, by having a greater level of control over the fleet, it has been able to tighten its cost control.

“Excluding the impact of depreciation, corporate and administrative expenses have only increased by 8.2 per cent over the period compared to H1 FY22, while at the same time Carly has been able to grow its revenue by 68.9 per cent,” it said.

“Carly has not increased its staff levels over the period, however, as Carly invests in new vehicles and increases the size of the fleet, investment will be made in customer facing roles for the management of vehicle handovers.

“Perhaps most significant has been the move to a higher level of vehicle ownership which allows the company to capture more of the margin.”

In its outlook, Carly said it will go into the second half of the current financial year with a continued focus on the growth of the car subscription revenue stream “with a major emphasis on the acquisition and supply of vehicles from multiple sources to meet the level of demand from consumers and businesses.”

“The securing of additional debt facilities to continue growth of the vehicle fleet is a major priority for the business,” it said.

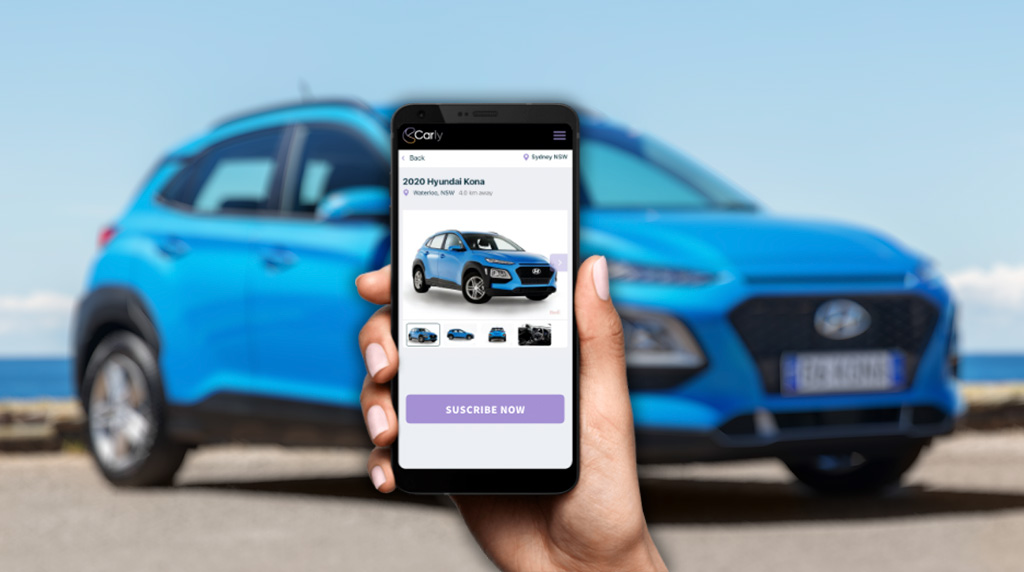

Carly started its vehicle subscription business in March 2019, leveraging its existing DriveMyCar operations and technology.

Car subscription allows business and retail customers to pay a single monthly fee to access a car for 30 days or more and is an alternative to purchasing or financing a vehicle.

Carly has attracted larger automotive industry businesses as shareholders with a model that facilitates sales volumes of new vehicles and delivers a new recurring revenue stream for automotive manufacturers and dealers.

The company has developed the model on similar lines to business launches in Europe and proved over the past three years that the model works in Australia.

It is now ramping up fleet size through vehicle purchases and leases.

The company said that the latest results show “continued cost discipline, strong operational results with fleet size increasing as forecast and utilisation rate maintained.”

“The interim accounts presentation highlights continued improvement in returns per subscriber and per vehicle.

“Fleet expansion is delivering enhanced returns via high utilisation and stringent cost and process control,” the company said.

By Neil Dowling

Read More: Related articles

Read More: Related articles