The generic platform, that will be adaptable across all the OEMs and dealerships, will allow buyers of new and used cars to complete almost all the steps to secure a vehicle and can completely leapfrog a visit to the showroom.

But Carsales told GoAutoNews Premium that it has no plans to replace a dealership.

In conjunction with participating OEMs and used-car outlets, the concept will change the traditional processes of car buying but Carsales said it was hardly an unexpected shift.

The move is the outcome from a “white paper” written by Carsales’ head of strategy for Mediamotive, Henny Darvall, in conjunction with global, French-based, researcher Ipsos.

Ms Darvall was the lead author of the white paper – a guiding report that will become the launchpad for the online sales business. Mediamotive is Carsales’ advertising sales division.

“We believe it puts people closer to the dealer and gets the (sales) process completed quicker,” Ms Darvall said.

More buyers happy to purchase online

“The study found that 57 per cent of people aged 18-54 years can see digital used for car purchases and that 41 per cent have confidence in completing their entire car purchase journey online today.

“Only 20 per cent of car buyers are unsure about online-only purchases and the 23 per cent who lack confidence were more likely to be in the 55-plus age bracket.”

The Ipsos study also showed that since 2013, there has been a 70 per cent increase in online shopping in Australia and that visits to dealerships had halved.

It said that car owners made an average of 1.8 visits to dealerships in 2017 and took just 2.2 test drives before collecting their new car.

Working with ‘three or four’ OEMs

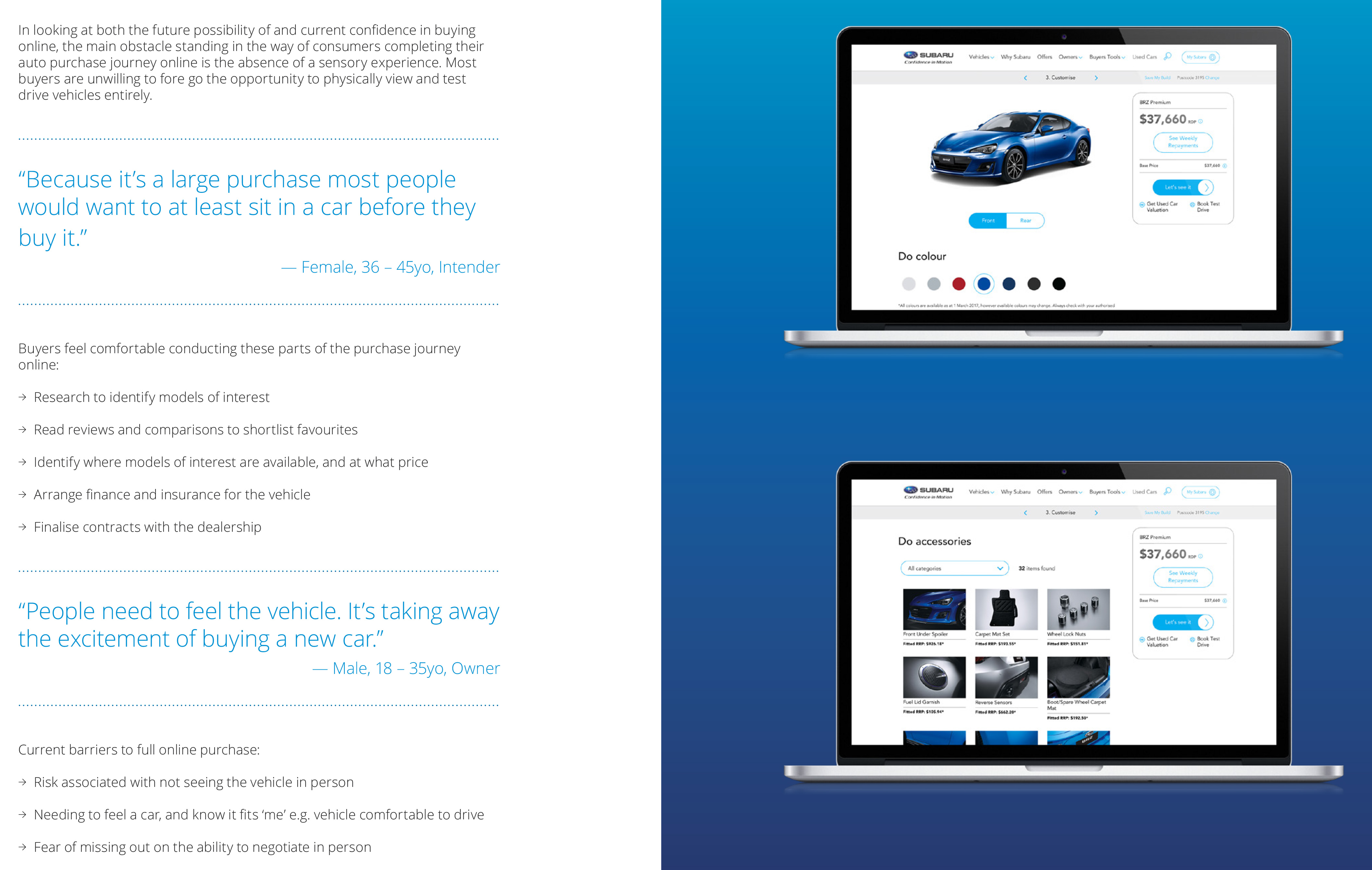

The move to digital sales isn’t new to Carsales. It has already built ‘buy online’ platforms with interest from several manufacturers.

Carsales head of strategy, with responsibility for the commercial side of the business including OEMs, is Agostino Giramondo. He said the company taken these learnings and best practices from around the world. “ I admire what BMW, Hyundai and GM have done overseas. We want to lead the way in Australia to offer dealers and manufacturers greater flexibility”.

“We are working with three or four other OEMs at the moment but they are in different levels, from car configurators to e-commerce platforms and even moving a US platform across to Australia to integrate it here.”

He said that there was even an opportunity for Carsales to licence the platforms and sell that to the OEMs.

“The new platform will happen in the first half of next year. We are creating one that any company can use, so on Carsales it won’t just be for one brand,” he said.

All OEMs can participate

“We may be talking to OEMs to put their cars on it but it doesn’t mean it is exclusive to that OEM.”

Mr Giramondo said that buying a car online is an extension of the uptake of the online shopping trend and related to the huge volume of information about cars online.

“We are using what is happening already in the digital space – with research and vehicle comparisons – and giving buyers the opportunity to use the same method to secure a car,” he said.

“It may take some time before some people are ready to commit to buying a car entirely online. We have to test the points along the way from deposit through to pick up.

“But it means that using our online platform means a consumer has made a commitment to have a relationship with the dealer who has advertised the car.”

Mr Giramondo said the steps to buying a car using the platform were research, shortlist, select and purchase. The digital platform can cater for each, or all, steps.

The plan has significant ramifications for dealers

“We think we can change the whole buying procedure and make the dealers more comfortable adjusting their business models,” he said.

“This includes the type of staff they have, changing the emphasis from selling to greeting so the process is more tailored to what the consumer wants.

“The dealerships could become ‘experience centres’ and the staff become more like concierges. There’s a general trend now to call consumer engagement anything but sales.

“If I can walk into a dealership, having done all the hard work of research and comparing and then selecting a car and knowing what options and accessories I want, a dealer should love it.

“My journey as a consumer has been quite pleasant and for the dealer, it has been efficient.”

Platform gives consumer choice and ‘helps dealers’

Mr Giramondo said dealerships would continue to be involved but that it was at the discretion of the dealer and the customer.

“There are things that some customers want,” he said. “For some it’s seeing a new car on the showroom floor. For others it’s conversing with dealer staff or about how the car is to be delivered.

“Car delivery will depend on the dealer and consumer. Some may want to get the consumer into the showroom so they need the real estate that they want the consumer to experience.

“Others will say they just want efficiencies and use the digital process to save time and that may include home delivery.

“Giving consumers a choice is important and at the same time I am really optimistic that the platform will help the dealer.”

Providing personal details online still a work in progress

One of the issues facing prospective customers has been online disclosure of personal financial information.

Mr Giramondo said: “If we can create an environment where the consumer knows the finances are safe, then that will speed up the mindset. That will also extinguish any gender or age differences.

“In private to private sales, we are seeing transactions valued at more than $50,000 being done on Carsales because consumers feel comfortable with our secure system called PayProtect.”

The role of Stratton Finance

Carsales, which owns a majority stake in Stratton Finance, dismissed a suggestion that this relationship may compromise the financial products offered by a dealership.

“We only allow Stratton to pitch for finance on private to private sales,” said Carsales spokesman Will Clarke.

“So if a consumer was buying a private car, Stratton could do the finance online. This process would be integrated into our site for a frictionless experience.

“For dealer cars, we offer opportunities for dealers and other third parties to sell the finance on the vehicles.

“So in theory we could integrate the dealer finance into the online purchase to streamline the process, but it would take a little more work.”

A few surprises in the market research

In researching the market and examining the results of the Ipsos survey, Ms Darvall said there were some surprises.

“We assumed women would prefer to buy online,” she said.

“But it actually came back to us that women were more reluctant to do the purchase journey online while men were more open to the opportunity of buying online. It challenged the stereotypes.”

But there were no big surprises about the reaction from different age groups.

“The acceptance was definitely skewed to 18-54 years, with 57 per cent saying they would buy online.,” she said.

“Most of the 54-plus group said they couldn’t see a future where they would use an online buying service for a car.”

By Neil Dowling

Read More: Related articles

Read More: Related articles