Cameron McIntyre

CARSALES.COM Ltd has announced that artificial intelligence (AI) has become a “key pillar” for future growth at the online car portal as it delivered its first half results for the 2017-2018 financial year that has seen revenue grow by 12 per cent.

The online automotive classified site’s CEO, Cameron McIntyre, said AI developments would improve fraud detection, automation, personalisation and recommendation engines and, for the future, “as yet unknown features that will significantly improve customer experiences”.

The move to heighten technology has also been adopted by Carsales.com’s enterprise resource management (ERP) and customer relationship management (CRM) platforms. It has announced it will move its entire international operations onto a standardised ERP and CRM with new Oracle and Salesforce systems.

The company indicated that the rollout of the platforms – to be completed in a few months – to all business zones would integrate its operations and support further expansion into offshore markets.

At the announcement of its half-yearly results, Mr McIntyre said: “We are making excellent progress advancing our international strategy”.

“Our focus is on attractive macroeconomic environments where we can achieve superior returns through deploying Carsales’ strategic, product and technology capabilities and IP.

“We see significant long-term opportunity in all our international markets and we are excited to increase our exposure in Korea and Mexico by taking 100 per cent control of these businesses.”

Carsales announced revenue for the six months to December 31, 2017 of $200.1 million, up 12 per cent on the corresponding period in 2016, and net profit of $60.9 million, a rise of 11 per cent.

Mr McIntyre termed it “an outstanding first half of the year”.

In its offshore businesses, SK Encar (South Korea) had revenue growth in the six months of 13 per cent and earnings (EBITDA) up six per cent; Webmotors (Brazil) had a 30 per cent revenue rise and a 122 per cent increase in earnings; while increases were also seen in its operations in Chile, Argentina and Mexico.

But there was no contribution from the South-East Asian operations under the iCar name. Carsales.com’s head of external communications, Will Clarke, told GoAutoNews Premium that the company has reduced its shareholding in iCar and resigned from its board.

“As such we do not account for iCar in our accounts – and didn’t for the full year of the 2017 financial year – though we still have a small shareholding in the business,” he said.

The domestic market also showed increases, with private business up 20 per cent; dealerships up seven per cent; display revenue up four per cent and its data, research and services division up seven per cent.

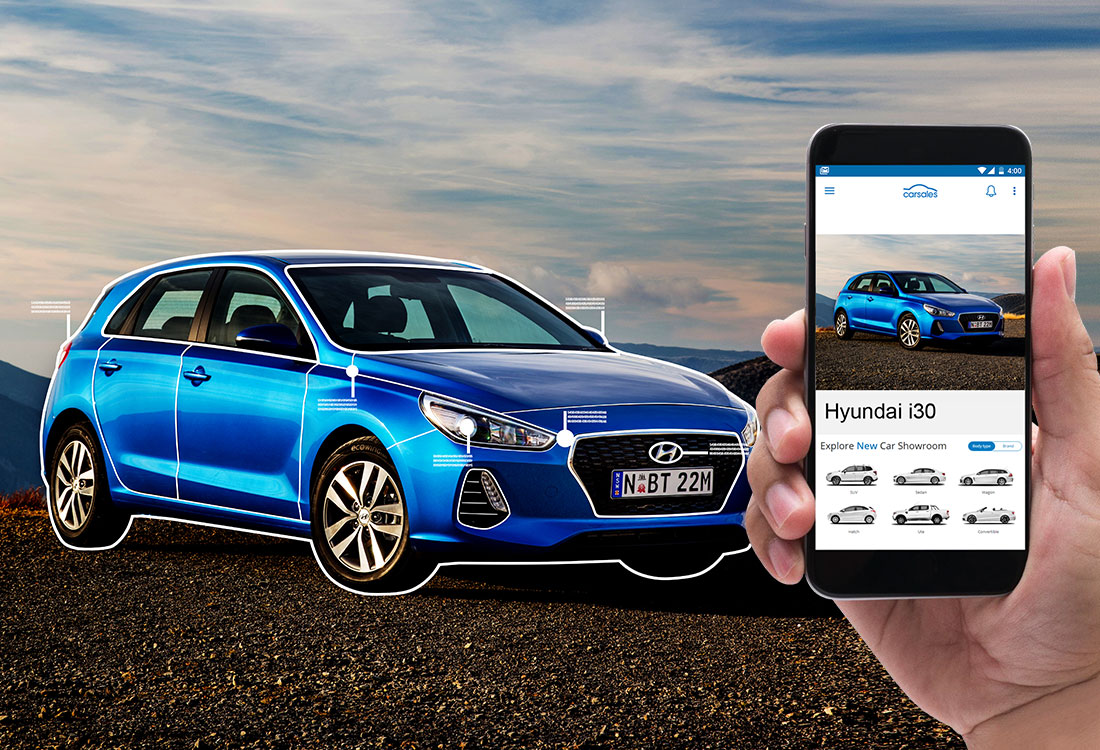

Income derived from these divisions was boosted in the second quarter of the financial half that was attributed to improved customer attitude to the site and new product enhancements, such as the improvements made to the mobile phone platform.

Carsales said it would continue to expand its mobile platforms to give better access to customers and dealers, and continue to roll out its online sponsored content for advertisers.

Mr McIntyre said the mobile business would be enhanced by new systems such as the Autogate app for dealers.

“There is plenty more to come with our investments in mobile technology, data science and artificial intelligence, ensuring we provide compelling personalised experiences for consumers and commercial customers,” he said.

In other areas, its 50 per cent-owned Stratton Finance has returned to positive revenue and earnings growth – its revenue lifted by 20 per cent to $24.8 million – which Mr McIntyre said came after “difficult structural issues over the past 12 to 18 months”.

For the future, Mr McIntyre said he expects a continuation of the strength of the first half results, noting that its finance and related services business, including Straton, would also remain solid.

“Assuming market conditions remain stable in Brazil, we anticipate continued strong local currency revenue and earnings growth in the second half of the 2018 financial year,” he said.

“In South Korea, we are expecting solid revenue growth and moderate earnings growth with revenue and earnings impacted by the Winter Olympics and incremental investment in the SK Encar business as part of the transition to 100 per cent ownership.”

Carsales bought the remaining 50.1 per cent of SK Encar on January 19, 2018, and has been included in group results from that date.

The company has announced an interim dividend of 20.5 cents a share, up 10 per cent on the previous corresponding period, to be paid on April 19, 2018.

Footnote: Carsales shares were initially sold to investors for 20 cents each. Shareholders who still have those initial investments are now receiving an interim dividend of 20 cents – the initial cost per share. So, apart from seeing their original share value grow around 70 times to $13.80, they now receive each year as an interim and final dividend twice what they paid for their initial shares – JOHN MELLOR

By Neil Dowling

Read More: Related articles

Read More: Related articles