It is the first OEM signing for YOUx which started operations under its name only a month ago (click here).

The company says it has already signed more than 400 dealerships and last month said it was targeting OEMs.

YOUx is now rolling out in-depth onboarding, training and activation across Chery dealership sales teams, F&I teams, websites and dealership spaces.

One of its first Chery franchises is Lennock Chery, part of the Lennock Motor Group. The group’s owner, George Miklas, said: “Lennock Motor Group is always seeking new ways to innovate, particularly when it makes the purchase journey easier for customers.

“The adoption of YOUx’s suite of products means that our dealer group will be able to respond to customers more efficiently, while at the same time making the entire process more economical for customers and our dealer team.

Mr Miklas said YOUx’s product range complemented his existing in-house finance offering which supports its preferred lenders while also providing tailored finance solutions to customers.

YOUx said it has a simple, hands-free dealer-focused product available 24/7 that generates leads while giving consumers ready access to loan options including comparative repayments and interest rates.

YOUx CEO and co-founder Simon Penhaligon told GoAutoNews Premium that the business was developed to increase finance penetration at the point of sale and to improve the quality of leads and expand finance opportunity data.

He said the partnership with Chery Australia would help the car-maker grow its local customer base while reducing wasted time and improving the quality of customer data, dealer profitability and customer care.

“The rise of millennials as the largest ever customer demographic, the most tech-enabled, with the highest propensity to settle finance and the most likely to research their choices online, makes it imperative that dealerships can offer not only finance choice, but also digital self-service opportunities,” Mr Penhaligon said.

“YOUx’s entire dealer product stack maintains compliance and serves finance pre-approvals to customer initiated and business managers initiated applications within minutes. Saving over an hour on every submitted finance application is a win for customers, business managers and business owners.”

YOUx offers four distinct products which integrate to deliver a class-leading finance experience starting with the dealership website to capture customer intent 24/7, to in-dealership activation, through to back-of-house finance fulfilment.

The four products are YOUxScan, YOUxApply, YOUxManage and YOUxLodge.

“These will be adopted and integrated across participating Chery dealerships to streamline the lending process for customers,” Mr Penhaligon said.

He said that to increase finance penetration at the point of sale, online and in-dealership, YOUx uses a range of customer, vehicle and third-party data bureau information to instantly give customers their personalised finance marketplace, including prioritised wholesale funding lines.

“A customer’s first interaction with the YOUx product stack is likely to be online during their initial vehicle and finance research,” he said.

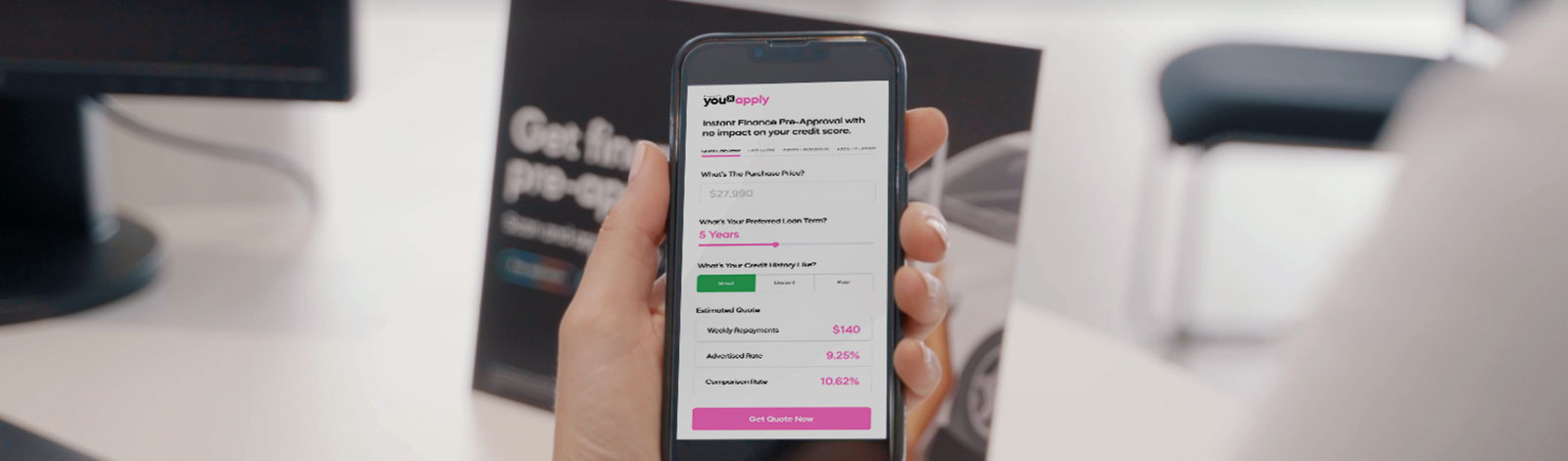

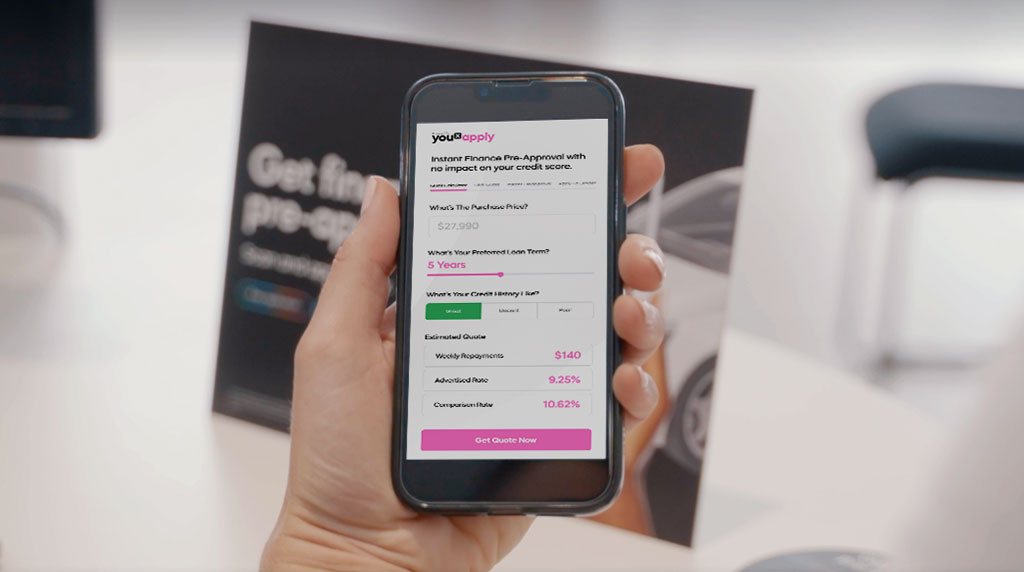

“Customers would encounter YOUxApply at the online point-of-sale of the dealership website, alongside dealer stock, within the finance page and elsewhere throughout the website.

“YOUxApply is a mobile-first web application which enables customers to easily self-serve vehicle finance, obtaining a conditionally pre-approved finance application in less than a minute.”

“Once qualified, customer submissions are immediately available to the dealer business manager via YOUxManage, where pre-approved customer applications then can be finalised by dealer staff.

“The YOUxManage platform allows for paperless applications, with increased accuracy and security of personal details and data; a single source for all applications, with real-time updates to dealership staff worklists and transparent KPI tracking; and face-to-face or over-the-phone customer applications in-platform.”

In the dealership, YOUxScan can create a self-service finance opportunity via a QR-Code that when scanned, launches on the customer’s mobile device.

This allows the customer to access finance options and progress through a finance application.

YOUx also gives dealerships access to the YOUxLodge Success Gurus, a team of asset finance and technology experts that train the dealership teams and offer finance scenario support and process dealership finance opportunity overflow.

“Available seven days a week, the YOUxLodge Success Gurus are available to fill in when dealership staff are ill, on leave, or trade is busy,” Mr Penhaligon said.

“This helps to improve finance conversion, reduce wait times for customers and remove dealer principal resource anxiety. When required, it also offers extra lending panel coverage for sites that require lending panel support.”

By Neil Dowling

Read More: Related articles

Read More: Related articles