BUSINESS manager churn is perhaps the greatest challenge we come across in the network, and one that has only become worse in more recent years.

It’s not uncommon to see two or three business managers cycle through a dealership in a year, accounting for tens of thousands of dollars of lost revenue, scores of tainted customer experience surveys, and weeks of time and effort wasted in building culture and ‘upskilling’ the individuals to the role.

Churn, like any organisation and any role in any industry, occurs for a number of reasons.

When we are willing to have honest conversations about the reasons behind this churn, then we can begin to put in place tangible action plans to attract, grow, and retain high performing business managers in the dealership.

Angle Auto Finance’s ‘Angle Edge’ Program assists dealers with crucial elements of business manager retention. We have worked within several environments to come to an understanding that there are universals outside of remuneration and culture that all dealerships must consider when hiring for their next business manager or looking to retain existing BMs.

The two universals we’ll look to cover are capability and leadership as these are two areas in which we help to provide development and support within our network of dealers.

Understand the Capabilities Required

In a previous article, we discussed that there was a clear gap when it comes to the overall sales ability of the business manager network at large.

Quite often we find that in a rush to fill the vacancy, roles are filled with individuals who might have great credit, finance, or administration experience, but leave much to be desired in the sales department.

If you are to continue with this hiring practice, you must then focus on managing their expectations during the hiring process (that they are sales roles) and then upskill them with sales skills so they become great sales professionals.

Whether it’s having your used car or new car sales managers coach them around selling, or partnering with your financier to provide the fundamentals on how to sell finance, upskilling your business manager with sales skills will help to retain them as it will allow them to perform and succeed.

Like any role, the skills required will ultimately become balanced. In addition to great sales skill sets, business managers need also to understand the basics of financial principles and concepts.

How mortgages work, credit cards, and even how basic savings accounts work is something we see many newer business managers not understand. This is challenging because these are important conversations that can make or break an application.

Not understanding these basic life skills makes it harder to achieve great customer outcomes and positive buying experiences which ultimately impacts on the business manager’s performance.

Understanding the balance of skills required to be a high-performing business manager is one of the ways we can provide clarity to dealership leaders on how to foster development in their F&I department.

If your business managers can see a clear pathway to success based on skill sets and know that you can support their development journey, they are more likely to stay and reward you with performance and loyalty.

Leadership Matters

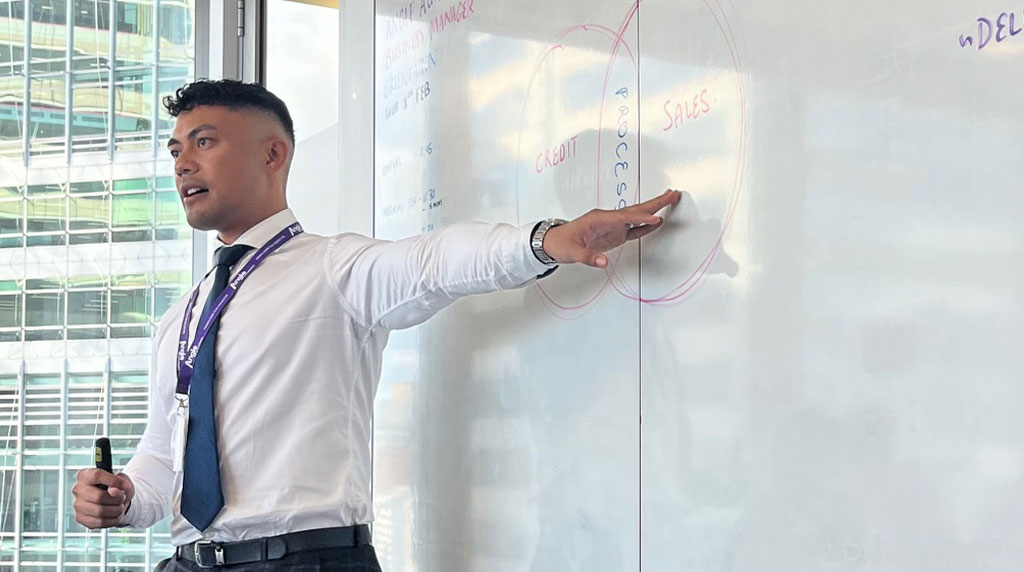

Leadership is the most crucial element to business manager retention and there are two lenses that can be applied. In the ecosystem of a dealership, it’s important to recognise the natural position of leadership a business manager holds.

They are managing an entire revenue stream and are a key pillar of dealership profitability.

Treating this role as a leader in the business is one way to help business managers maintain accountability of their results and performance.

We see this work best when they work alongside sales managers and are treated as managers of a department. It’s not uncommon that we see business managers treated as a sales consultant or an aftermarket specialist and while these roles are integral to the success of the business, they do not operate in the same manner a business manager would.

Where we see this occurring, we often find BMs disengaged as the complexity of the role is often under-appreciated and not managed in the way it should be managed.

Another lens of leadership that is important to consider is the cultural tone set by the greater leadership team on how they view an F&I department.

Where we see leadership teams working together and driving in the same direction, we often see high performance (and not just in the F&I department).

Specifically, new car managers and used car managers who not only understand the value a business manager can provide in the sale of the vehicle, but also promote that value to their teams, often see the greatest cut through in Finance Penetration and NPS outcomes.

Having a leadership team that promotes the value of F&I will allow business managers to feel supported and valued in the dealership. You may wish to check in with your leadership team and ensure there is alignment not just in the value F&I brings, but also the processes and expectations of how F&I should be executed in the dealership.

How Angle Edge helps with business manager retention

The Angle Edge program focuses on whole-of-dealership engagement and training.

One of the core tenets we talk about is how to effectively manage your F&I department and incorporate elements of how to manage stakeholders and referral channels or how to manage performance and dealership processes that are conducive to great finance outcomes.

We focus on developing business manager capability while also assisting in fostering an environment where a BM has a seat at the table so they can demonstrate their contribution to the dealership value chain.

Evange Epa is the national business performance manager of Angle Auto Finance

Read more articles by Evange:

Sales and Finance. Why working together wins

Business managers are salespeople too

Managing finance when stock is delayed

This is the fourth in a series of articles that investigates some of the auto finance sector’s challenges, trends, and innovations.

This series of management workshop articles prepared by automotive financier Angle Auto for GoAutoNews Premium draws on the expertise that resides in the financier’s Angle Edge dealer development program and other Angle Auto initiatives.

Angle says its workshops are designed to add value to its dealer clients and to the industry at large.

It is published to assist retailers to tackle challenges and embrace coming changes in auto showrooms.

By Evange Epa

Read More: Related articles

Read More: Related articles