STOCK delay. If we all had a dollar for every time someone mentioned this, the cost-of-living crisis would be far more bearable.

It’s no secret that the industry is currently littered with stock delays. This article isn’t going to focus on the delays themselves, but more-so the challenges that arise regarding finance when there are vehicle stock availability issues.

Whether it’s a global pandemic, international conflict, or supply chain challenges, it is important to recognise that stock availability challenges will always happen and that the ability to sell finance not just ‘in the now,’ but also to an order bank is a skill that will remain relevant for the foreseeable future.

Selling finance to vehicles on order is a key challenge we see in the current environment.

This is playing out in the data we capture, more specifically around conversion rates and finance penetration between new cars and used cars (the latter being greater in both instances).

We then hear anecdotal evidence from our network around the new car finance conversation being more difficult, which can be grouped into three themes:

- Customers have more time to research and shop around, which is posing a challenge when trying to sell the finance at the point of sale

- Sales teams are not viewing finance as relevant given the waiting period and are focusing entirely on the metal and not a ‘five-star’ sales approach; or

- There is genuine reluctance to entertain the finance conversation from the business manager, mostly driven by their perception of what the customer might be thinking and feeling in the moment.

These themes play out in many dealer visitations and have led us to question, how do we manage this environment? Or perhaps more importantly, what can we do to support our network to overcome these challenges?

Selling to the ‘Now’ and Selling to the ‘Order Bank’ is the key to longevity

It is tempting to think that selling to the order bank is a skill that will be put on the backburner in the coming months or years; but the reality is we live in an incredibly volatile time.

COVID, recent international conflicts, and parts shortages have proven that it only takes a moment of volatility to impact stock availability. The takeaway from this is that the best business managers and F&I departments in the industry know how to sell to the now, as well as to the order bank.

So, what does successfully ‘selling to the order bank’ entail? There is no one right way or answer, however there are certain processes and fundamentals that if employed 100 per cent of the time with 100 per cent of your customers, can achieve greater finance conversion with your order bank and in turn increase your finance penetration outcome.

Through our Angle Edge Training, we help business managers leverage these processes by equipping them with the knowledge to:

- Overcome delay objections at the point of sale

- Identify key points of contact for opportunity calls in an order bank

- Demonstrate value at all points of the customer journey to retain finance sales

- Influence sales teams on how finance will bolster sales within a stock delay environment

- Ensure you have the right follow up process with customers.

Many of the elements covered in our approach to managing finance conversion in stock delay environments also naturally apply to the sale of the metal. When you’re looking to increase your order bank finance conversions think about:

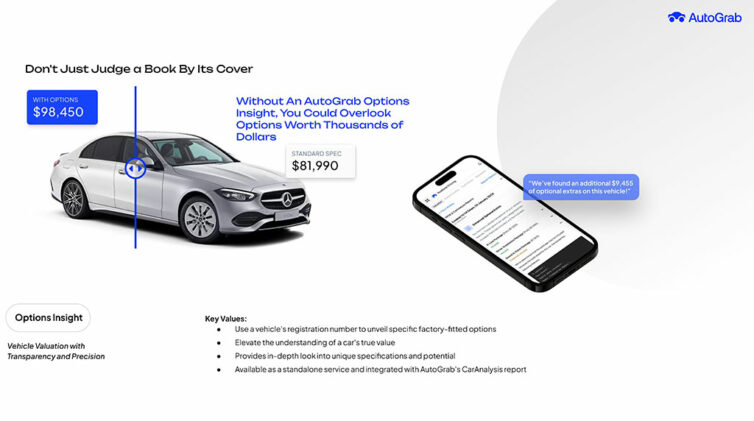

- Truly understanding what your customers see in their product research so that you’re well positioned to have a well-informed conversation at the point of sale

- Demonstrating your differentiation and value immediately so that when customers inevitably shop around, they are including your service excellence as a part of that comparison

- Curating the right contact moments and touchpoints to maximise your chances of finance conversion

- Assessing the interdepartmental processes available to ensure you have a consistent follow up journey with every customer, every time.

Managing and maintaining an order bank is no easy feat. Throw in the finance element and it’s easy to see why many dealerships and business managers have difficulty increasing finance penetration in this environment. Through our Angle Edge program, we aim to support our network of dealers by discussing tangible strategies, processes, and upskilling people to achieve a consistent and strong finance performance even with the current market challenges.

Evange Epa is the national business performance manager of Angle Auto Finance

Read more articles by Evange:

This is the third of a series of articles that investigates some of the auto finance sector’s challenges, trends, and innovations.

This series of management workshop articles prepared by automotive financier Angle Auto for GoAutoNews Premium draws on the expertise that resides in the financier’s Angle Edge dealer development program and other Angle Auto initiatives.

Angle says its workshops are designed to add value to its dealer clients and to the industry at large.

It is published to assist retailers to tackle challenges and embrace coming changes in auto showrooms.

By Evange Epa

Read More: Related articles

Read More: Related articles