In its latest Market Insight, Cox reports that recovery is being seen in the industry following the outbreak of COVID-19 and, although the effects of the pandemic are still being felt, Australia has appeared to have weathered the crisis much better than most other markets.

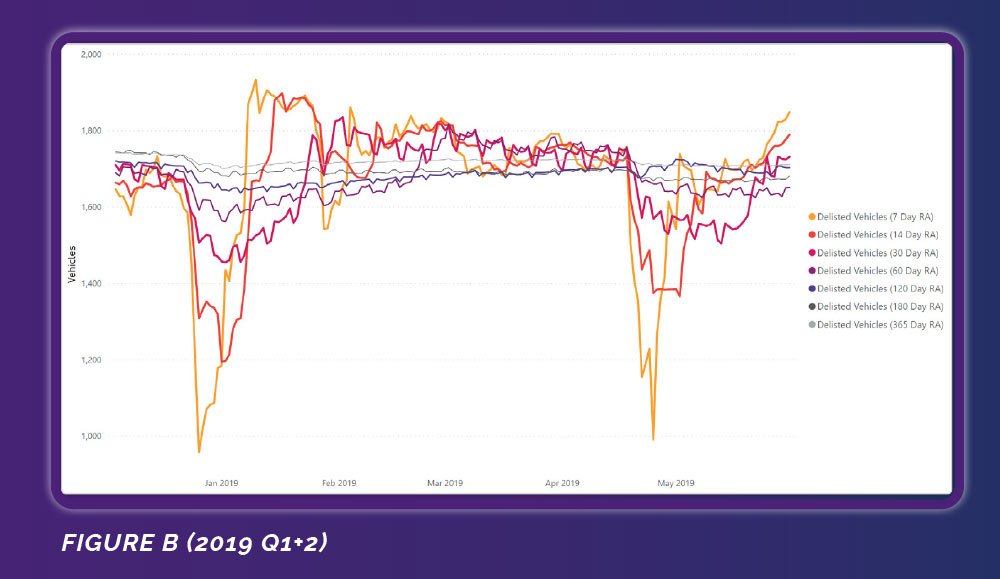

The report said there was a decline in sales of used vehicles after the COVID-19 lockdown and moves to social distancing in late March. But, since the start of May, there has been “a positive turnaround” and “strong upward trends exceeding previous highs”.

“From mid-April, despite long-term uncertainty over COVID-19, the market recovered by the first week in May to normal levels as it did in 2019 post-Easter,” the Market Insight report said.

“We are seeing a continued demand for vehicles pushing the seven, 14 and 30-day rolling averages beyond the usual rebound,” Cox said.

The report gave three possible reasons for the strong trend:

- Discounted prices dealers have offered to reduce growing stock levels

- Buyers holding back sales since February

- The availability of cash from early superannuation access under COVID-19 legislation.

The report was compiled by Cox’s business units of Dealer Solutions, online marketing agency Digipurple and Kelley Blue Book valuations.

It showed that the average used vehicle list price in March 2020 was $26,268. By May, that average price grew to $27,620 which, compared with the May 2019 average of $26,930, was a gain of $690.

The average sale price in May 2020 was $23,639, down on May 2019 at $24,804 (a reduction of $1165) because of the discounting as dealers quit stock. However, the May 2020 figure was up on this year’s months of March ($23,424) and April ($22,545).

Data shows the average discounting from the active listing to the actual sale price has fallen in May (averaging $3983) from $4424 in April, though well up on the more stable economic environment of May 2019 when the difference was only $1586.

Cox’s report also found there was an increase in unique users visiting dealer websites, in line with the social distancing triggered by COVID-19.

“Despite the sharp drop in April compared with March, the recovery in May 2020 has been impressive, reporting a 59.9 per cent increase in unique visitors across the Cox websites compared with April,” the report said.

In April, the study showed unique visitors to websites plunged by 24.7 per cent over the previous month.

The boost to the website visits was reflected in total leads. These were up 35.7 per cent in May after dropping 14.29 per cent in April compared with March.

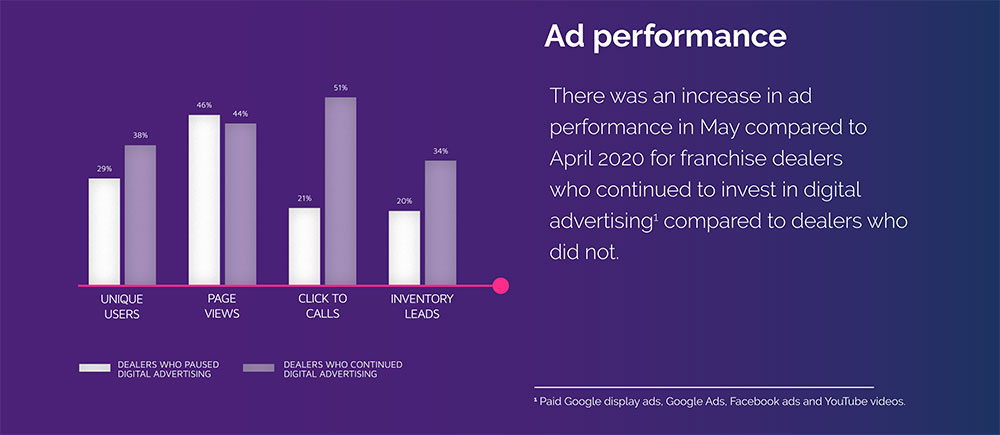

Advertising performance was another winner, as franchise dealers who continued to invest in digital advertising and promotion lifted the number of website visits and inventory leads above those who did not.

The report showed inventory leads by dealers who continued advertising was up 34 per cent in May over April, compared with dealers who paused their ads and only had a 20 per cent increase.

Looking at “click to calls” in the period, Cox found a 51 per cent increase for dealers who advertised while those who did not only saw a 21 per cent rise.

Cox also looked at the leads that were followed up within two hours of submission by dealership staff.

“Analysing website chat and form leads from a group of new-car franchise websites, we found that these leads converted to sales on average at 34 per cent,” the report said.

“We believe buyers were more ready to purchase compared with those who were window shopping because car buying pent-up demand was prevalent.”

By Neil Dowling

Read More: Related articles

Read More: Related articles