The report, called Manufacturing: A Moment of Opportunity which was made public last week by the Australia Institute’s Centre for Future Work, said currency strength combined with the shake down from the 2009 Global Financial Crisis (GFC) seriously affected the manufacturing sector.

It said that the “overvaluation of the currency was a key contributing factor in the decisions of many manufacturing firms to downsize or close their Australian operations (including the devastating decision of global vehicle manufacturing companies to leave Australia entirely)”.

But the report infers that the car-makers who have already closed or are closing their operations (Ford, Holden and Toyota) may have jumped too soon.

It said that the subsequent softening of the local currency had triggered a resurgence in manufacturing in this country.

Since 2011, the Australian dollar fell by 36 per cent – from around $US1.10 to $US0.70 cents for the past 18 months – which has had “an enormous impact on the relative cost competitiveness of Australian-made products in export markets, and on the business case for new capital investments in Australian facilities”.

“The combination of rising sales, especially to export markets, improved cost competitiveness, and rebounding employment, productivity, and profitability has together underpinned a significant and promising strengthening of general business attitudes in Australian manufacturing,” said the report of the current economic position.

The report is calling for a greater understanding of the importance of the manufacturing sector and wants to change community perceptions of the importance of this area of the economy.

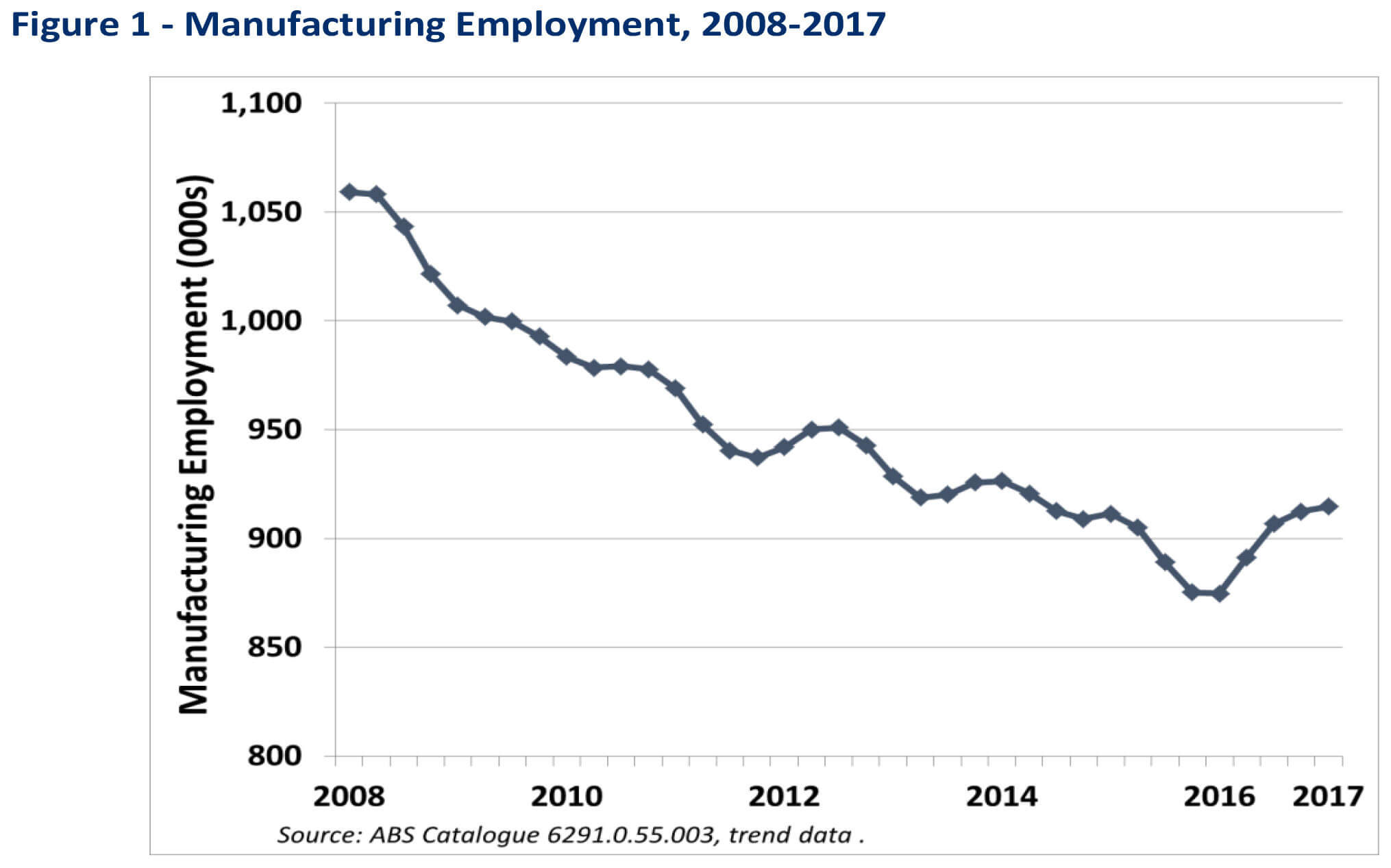

It said manufacturing currently employs 915,000 people in Australia, making it the sixth-largest employer of all industries and representing eight per cent of all employment.

“However, the importance of manufacturing jobs appears to be widely underappreciated among Australians, perhaps because of the steady stream of negative headlines that have dominated most news about the sector in recent years,” it said.

“To test the gap between impression and reality, we presented respondents with a list of six major industries, and asked them to select which one was the largest employer in Australia. (see attached table)

“Compared with the other polled industries, manufacturing employs: 10 per cent more workers than public administration and safety (including defence and law enforcement); twice as many workers as the broad finance and insurance sector; over three times as many workers as agriculture or wholesale trade; and nearly four times as many workers as mining.

“Yet when presented with these industries, only 10 per cent of respondents correctly identified manufacturing as the largest employer.

“As well as being a large employer, the manufacturing sector is also a major exporter and investor in research and development (R&D) in Australia.

“While the mining industry is widely known as Australia’s largest exporter ($157 billion in 2015-16) it is not well known that manufacturing constitutes the second largest ($68.7 billion) source of national exports. It is followed by agriculture ($40 billion) and tourism ($20.9 billion).”

Though the report indicates the future is optimistic for manufacturing in Australia, it said it was too early to know whether this encouraging rebound in employment marks the beginning of a longer recovery.

“The continuing decommissioning of Australia’s motor vehicle assembly sector will certainly exert a negative impact on these numbers in coming months,” it said.

“But last year’s job-creation nevertheless marks the largest and most lasting improvement in employment conditions in manufacturing in the last decade, and is welcome respite after a decade of downsizing.”

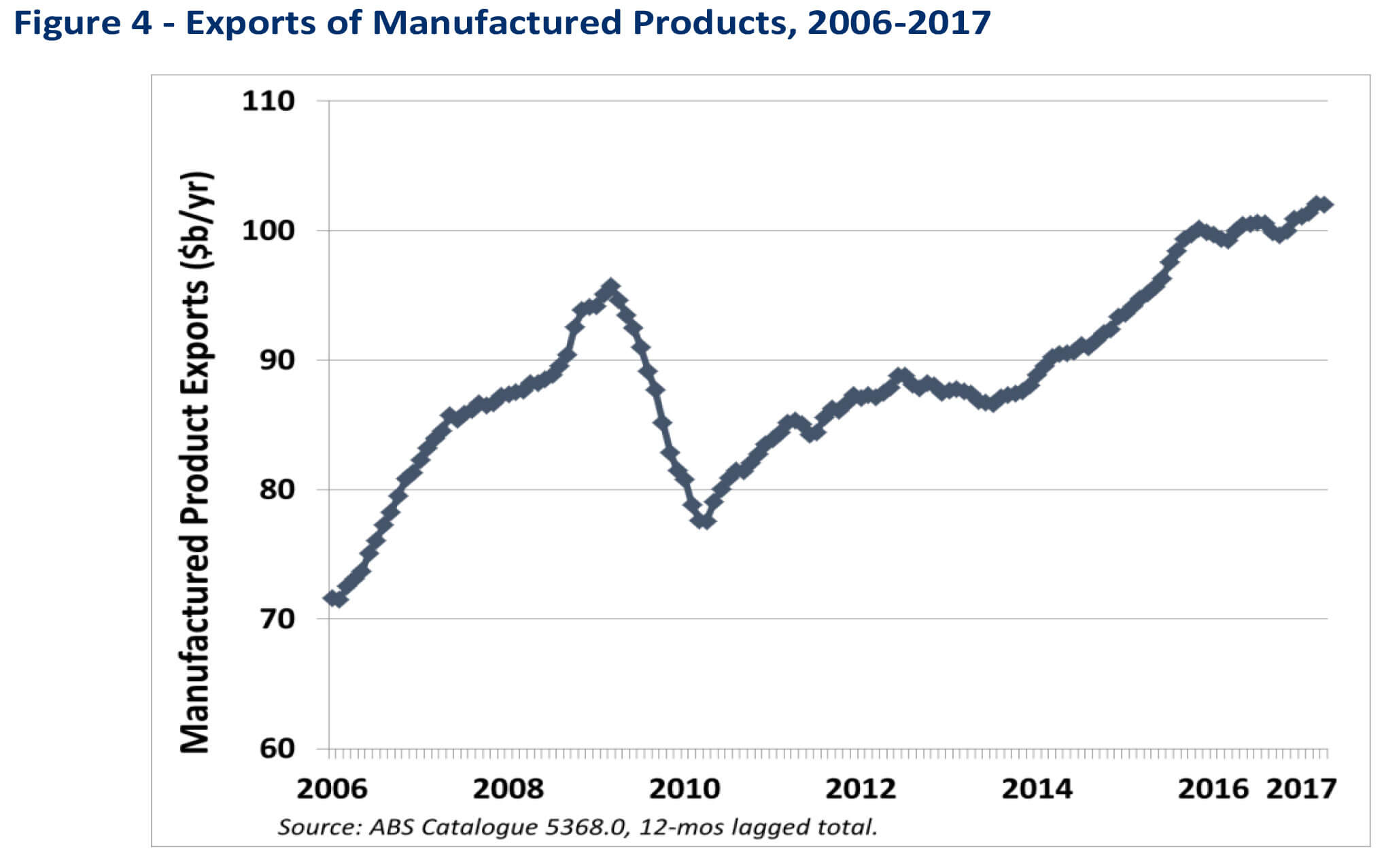

In terms of revenue from manufacturing, the report said the soaring currency exchange rate reduced the value of exports during the GFC and again in 2012.

“Since 2014, however, profits have begun to regain some of the lost ground, as companies adjust capacity to output, attain greater utilisation, and enjoy greater export revenues,” it said.

“Quarterly gross operating profits in manufacturing reached close to $8 billion in the March 2017 quarter, the highest in several years.

“Recovering profits could enable future increases in capital spending, and encourage more hiring.”

Manufacturing exports have risen from a low of $80 billion in 2009 by 25 per cent to reach a record of more than $100 billion in the most recent 12 months.

The report did not examine the position of the manufacturing sector if the three car-makers had stayed – indicating it was too late for a reversal – and rather looked at the future in a positive light.

Amongst the optimism for the future of manufacturing, the report said ongoing developments in technology could have significant impacts on the location decisions of manufacturers.

“In particular, technologies which allow for the decentralisation of production, and the undertaking of smaller, more customised production runs (such as 3D printing techniques and others), could enhance the potential for smaller, higher-cost regions such as Australia to sustain their production footprint and reduce the extent to which production migrates to lower-cost jurisdictions,” it said.

New technologies such as those under the headings of the “internet of things” and so-called “Industry 4.0” are also seen as opening new opportunities for innovation-intensive manufacturing. These could reduce the relative importance of production costs and further expanding scope for customised, niche production.

“Another positive sign for Australian manufacturing is the expansion of capital spending by governments at both the commonwealth and state levels, responding to pressing needs for infrastructure improvements,” it said.

“This ramped-up capital program carries substantial implications for domestic manufacturing.

“Huge investment programs in defence and shipbuilding, public transportation and railways, energy infrastructure, and more will stimulate significant purchases of manufactured products – with positive spillovers into Australian production.

“The stereotypical assumption that Australia cannot successfully participate in international manufactures trade (but instead should focus on a “comparative advantage” rooted in natural resources) is increasingly questioned.

“There are clear opportunities to improve Australia’s export promotion effort, targeting Australian participation in supply chains, stronger export engagement by SMEs, and more.”

By Neil Dowling

Read More: Related articles

Read More: Related articles