The study said 84 per cent of consumers want to drive themselves – even in an autonomous car – compared with 16 per cent who said they prefer the car to drive itself.

This is not how the autonomy script was supposed to play out.

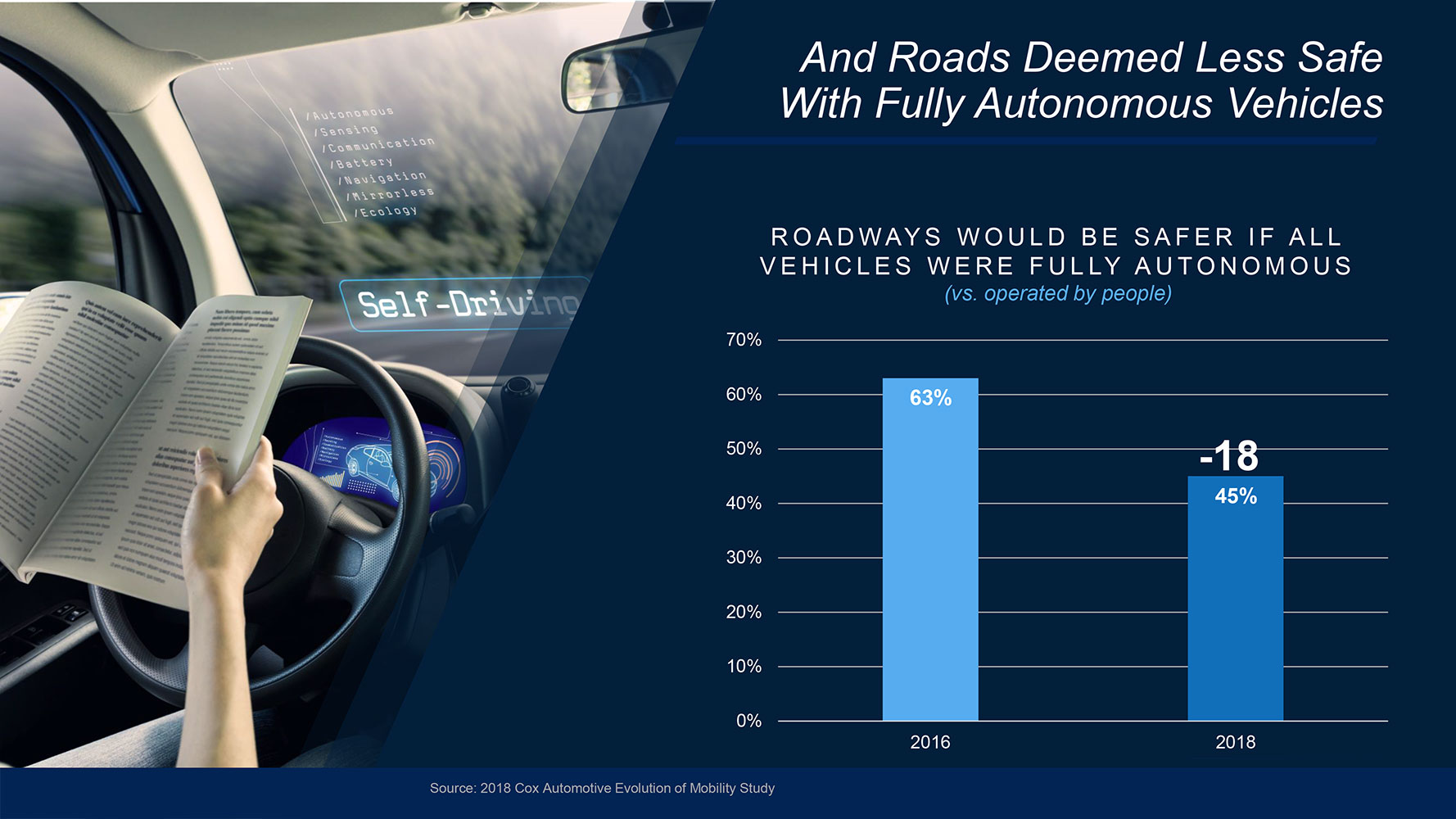

The survey also revealed that there has been a shift in attitude by people about road safety in the past two years. Now 18 per cent more people believe the roads would be safer with cars driven by people compared with fully autonomous vehicles.

In the question in 2016, “Roadways would be safer if all cars were autonomous”, 63 per cent of respondents agreed. But this year, in the latest survey, only 45 per cent agreed.

Cox Automotive’s executive publisher of Autotrader and Kelley Blue Book Karl Brauer said “we’re seeing some dramatic shifts in consumer sentiment” as awareness increases about autonomous technology.

“People now have a deeper understanding of the complexities involved when creating a self-driving car and that has them reconsidering their comfort level when it comes to handing over control,” he said.

The Society of Automotive Engineers (SAE) currently recognizes five levels of vehicle autonomy, ranging from Level 0 (human-only control) to Level 5 (no human control). Most new cars are rated at Level 2.

Cox’s Kelley Blue Book study of 2016 found that respondents found Level 4 autonomy was the “sweet spot”.

They said it provided all the benefits of full vehicle autonomy without stripping away the option of driver control.

The latest 2018 survey finds that attitudes around self-driving technology have reversed and nearly half of consumers responding said they would never buy a Level 5 vehicle (49 per cent, up from 30 per cent in 2016).

Generation Z (aged 12-22 years) and Millennials (aged 23-36 years) were shown to be less hesitant at 48 and 39 per cent respectively.

Cox Automotive said that the change was partially attributed to recent accidents involving autonomous vehicles.

“But the accidents may only be slightly to blame for a change in consumer sentiment,” Cox said.

“Those unaware of the autonomous incidents – like the self-driving fatality in March 2018 – are just as likely as those aware of the incident to believe roadways would be safer if all vehicles were operated by people as opposed to autonomous vehicles.

“Three-quarters of consumers say fully autonomous vehicles need real world testing to be perfected, but 54 per cent prefer this testing take place in a different town or city from where they live.”

The survey said that despite some negative media coverage, consumers want – and expect – semi-autonomous features, particularly those centered around safety. These could include autonomous emergency braking, lane-change assist, blind-spot monitoring and rear cross-traffic alert.

“This signals a disconnect between consumer perception of safety technology features versus fully autonomous vehicles,” the report said.

“In fact, 54 per cent of respondents agree that semi-autonomous features make people better drivers.”

The top-ranked safety features that are considered must-have features in the next car purchase by respondents are collision warning alert systems and collision avoidance systems.

Cox Automotive Mobility Solutions Group president Joe George said: “There is a major opportunity, and a real need, for automakers and mobility providers to help educate consumers and further guide autonomous vehicles in their development.

“Autonomous safety feature adoption will be critical in creating future autonomous technology advocates,” he said.

The Cox Automotive study was conducted by Vital Findings and included 1250 consumers in the US who participated in an online survey during May 2018.

By Neil Dowling

Read More: Related articles

Read More: Related articles