The shaky future for EV production does not augur well for Australia as it begins its EV journey and could lead to reduced model choices.

Car-makers already claim EVs are expensive to produce and have tiny profit margins compared with existing internal-combustion-engine (ICE) vehicles.

At the pointy end of the push to EVs are the European and US governments demanding reduced CO2 emissions. But now car-makers – hit by flagging sales, ballooning EV development costs and production and logistics headaches caused by new European fuel mandates, quarantine issues such as shipborne brown stink bugs and now the coronavirus – want a delay in the CO2 rules.

The European Union’s CO2 timeline wants car-makers to make vehicles far more fuel efficient and open the way to expand EVs in their fleets.

The EU wants an average fleet fuel consumption of 4.1 litres per 100km in 2020/21, a tightening from the previous mandate of 5.6L/100km in 2015.

Then it plans a further fuel consumption cut of 15 per cent in 2025 to around 3L/100km before demanding a fleet average of 2.55L/100km by 2030. That compares with current US draft legislation wanting an average of 5.8L/100km by 2030.

The harsh draft requirements are seen as coming into play when European car-makers are temporarily closing plants because of coronavirus and expects demand to fall by up to 20 per cent this year.

In addition, car-makers are finding it hard to abide by the fuel economy proposals on the back of consumer demand for large SUVs and the plunge in demand for the more efficient diesel-engined vehicles.

Forbes magazine reported that car-makers are investing huge funds in the research and development of EVs while having to curtail production of big-profit SUVs and luxury sedans to meet ever-stringent fuel consumption figures.

At the same time, the car-makers are being forced to build fuel-efficient small cars which have negligible profit just to attempt to meet the same fuel mandates.

Volkswagen is on record as saying it will be “impossibly expensive” for it to make cheap cars like the Up and Polo by 2030.

This is likely to be common across the industry and will make it difficult for average wage earners across Europe to afford new, cheap cars, and will push them away from car ownership into public transport or car-share or the second-hand market.

Forbes quoted Norddeutsche Landesbank Girozentrale analyst Frank Schwope who said the rules have to be revised.

“The coronavirus crisis poses unprecedented problems for automobile manufacturers and suppliers with production and sales largely paralysed for at least four weeks,” he said.

“The European CO2 targets or the fines (manufacturers) face may be softened or postponed, so that companies are not at risk of financial burdens.”

The IndustriAll-European Trade Union’s economic advisor, Guido Nelissen, said sales are already down eight per cent in Europe in the first two months.

“There will be a dramatic drop in sales this year, making it impossible to introduce electric and hybrid cars,” he said.

“I think we have to ask (the EU Commission) for a delay for, say, one year. It makes no sense to levy heavy fines in tough economic times,” he told Forbes.

The German auto industry currently has 830,000 employees, according to the Center for Automotive Research.

German car-makers in 2019 built 4.7 million sedans and SUVs, nine per cent down on the previous year and the lowest since 1997. Of that total, 3.5 million were exported.

Mr Nelissen said the coronavirus emergency comes at an inopportune time for the automotive industry, already in the throes of an existential threatening upheaval.

“There are plenty of companies in the supply chain that will go bust and it depends on what governments can do to keep afloat ailing companies,” he told Forbes.

“There are too many things happening at the same time, with electrification, the move to connected cars, autonomous cars, the business model is changing from producing vehicles to selling mobility services and this virus on top will make it very hard for the industry to cope.”

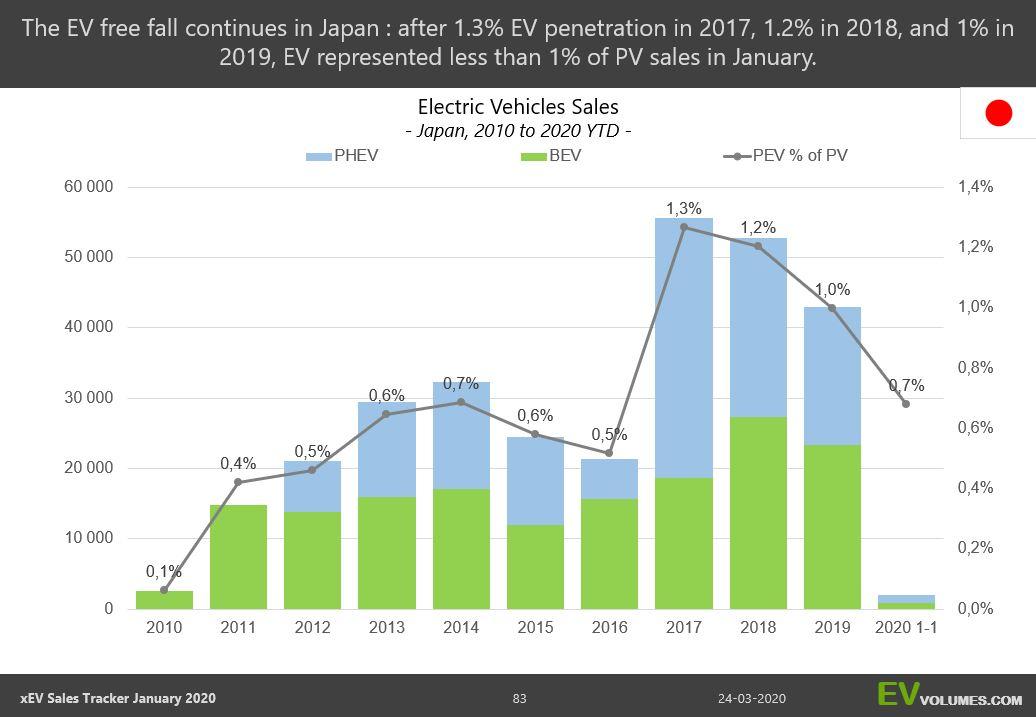

Meanwhile, Japan’s EV appeal has diminished despite the country having one of the biggest fast-charge networks in the world.

Sales of EVs in Japan fell 17 per cent in 2019 to 43,867 units compared with the previous year, which followed a seven per cent year-on-year decline in 2018.

This represented a market share of only 0.8 per cent, down from 1.0 per cent in 2018 and 1.1 per cent in 2017.

The top-selling EV/PHEV in Japan last year was the Nissan leaf with 19,789 sales. It was followed by the Toyota Prius Prime (9569) and Mitsubishi Outlander PHEV (5286).

In Australia, the EV market share was 0.6 per cent in 2019, with sales of about 5020 units.

Tesla made up the bulk with an estimated 3500 sales – Tesla does not list registration figures by country and does not participate in the VFACTS national vehicle database – with Hyundai Kona, Nissan Leaf and Hyundai Ioniq following.

The combined EV and plug-in hybrid electric vehicle (PHEV) Australian market for 2019 was about 12,500 units (9216 on VFACTS, 3500 from Tesla), representing 1.2 per cent of the vehicle market.

By Neil Dowling

Read More: Related articles

Read More: Related articles