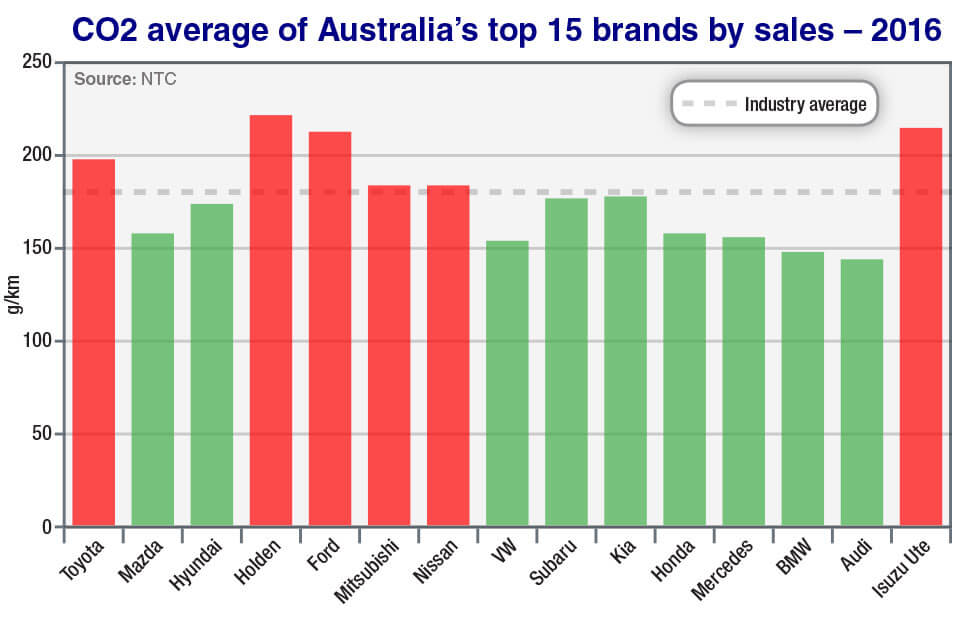

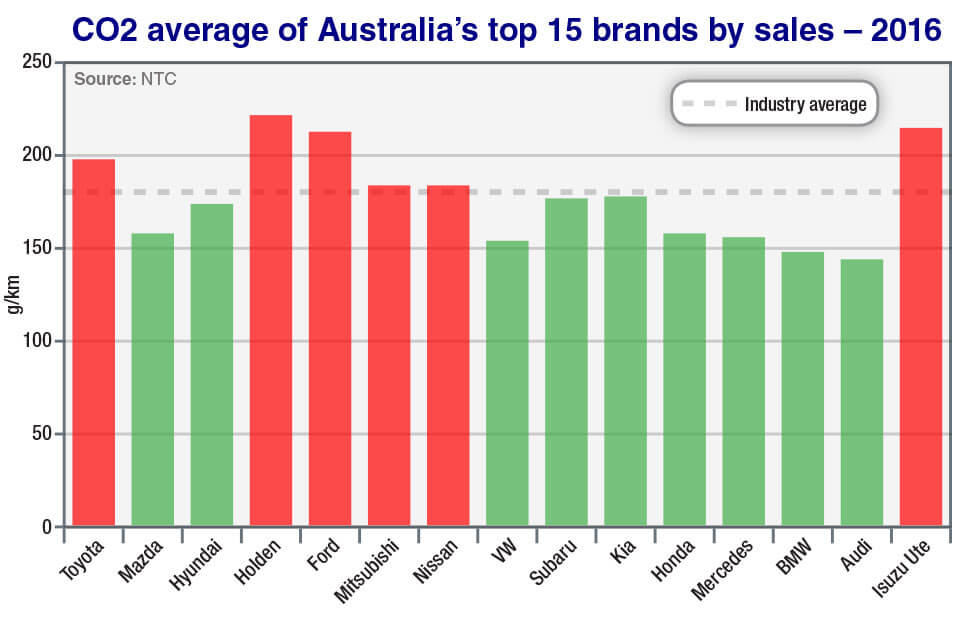

The result, which was among the findings in the National Transport Commission’s annual report on CO2 emissions for new light vehicles sold in Australia, now positions Audi as the undisputed low-carbon champion among the leading brands, lowering its average emissions intensity to 144g/km – 4g/km clear of BMW, in second place, which was on par with Audi in 2015 but improved only 0.9 per cent (1g/km) last year.

At the other end of the scale, Holden was the leading offender among a group of four brands to increase their average CO2 emissions last year, increasing 2.6 per cent (5g/km) to 222g/km which places it at the back of the field overall.

The other brands to increase their emissions last year were Ford (+1.6% to 213g/km), Mercedes-Benz (+1.4% to 156g/km) and Mazda (+0.6% to 158g/km), which has kept the Blue Oval close to the lion brand at the rear end while Mercedes slips to fourth behind Audi, BMW and now Volkswagen (-0.9% to 154g/km), and Mazda holds onto fifth position.

Nissan, which has discontinued a number of models and has best-in-class status for CO2 emissions with its new diesel-powered Navara, continued its good form with another reduction last year (-3.4% to 184g/km), Mitsubishi made a significant improvement (-3.2% to 184g/km) and Kia and Hyundai – two leading brands found to have increased their emissions in 2015 by 1.1 and 2.0 per cent respectively – turned the tables last year with improvements of 2.5 per cent for Kia (now at 178g/km) and 2.1 per cent for Hyundai (at 174g/km).

Honda was the other notable improver (-2.1% to 158g/km) while sales market leader Toyota lowered its CO2 emissions 0.5 per cent to 198g/km – a position that maintains its position below 200g/km but keeps it toward the back of the field, and well above the overall industry average of 182g/km which is based on the full 51 light-vehicle brands in the marketplace.

Toyota’s commitment to hybrid cars is clearly not enough to put much of a dent in either its average emissions or the industry’s overall standing when its high-emitting vehicles are among the most popular among new-vehicle buyers. These are led by HiLux, the biggest-selling model across all segments in Australia last year, and others that top their class such as HiAce, LandCruiser and Prado.

Green is good: Audi has only one alternative-drivetrain model on sale in Australia, the A3 Sportback e-tron, but its entire range now has the lowest emissions intensity among the 15 top-selling brands.

For the record, Rolls-Royce continued to have the highest-polluting range last year at 330g/km – the same amount as 2015 – while Citroen, which is struggling for relevance in the marketplace and will be relaunched under new distributor Inchcape later this year, can claim to be the industry’s greenest brand with a 13.3 per cent reduction last year (19g/km) to 125g/km.

Isuzu Ute’s continued rise in popularity took it into the top 15 brands last year, but unsurprisingly it sits at the back of the field with its range comprising only two large vehicles – the MU-X SUV and D-Max utility – which offer a combined emissions intensity of 215g/km (a 0.4% improvement on 2015).

As we have noted previously, CO2 performance often reflects a brand’s representation in certain market segments, with the biggest-selling brands – the top 15 accounting for 90 per cent of all new-vehicle sales last year – typically covering large passenger car, SUV and commercial vehicle segments that generally attract higher emissions.

Emissions reductions also occur in conjunction with vehicle renewal, the timing of which varies according to model lifecycles and launch schedules, although the figures broadly reflect ongoing powertrain improvements, vehicle weight reductions, increasingly prevalent ancillary measures such as idle-stop and brake energy regeneration systems, engine downsizing, more hi-tech diesel options and the introduction of smaller vehicles to a brand’s portfolio.

That said, Australian consumer preference for large, heavier vehicles with bigger and more powerful engines, keeps our emissions intensity much higher than in other markets like Europe.

Take light-commercial vehicles out of the equation for a moment – a whopping 217,750 of which were sold in Australia last year – and Australia’s average emissions intensity for passenger vehicles (including SUVs) came in at 173g/km, which represents a 1.0 per cent (2g/km) improvement over 2015.

This keeps us a long distance behind the European Union, which according to provisional figures released recently by the European Environment Agency fell by 1.2 per cent (1.4gkm) to 118g/km.

This was the slowest annual rate of improvement since 2006, but the EU remains committed to reaching 95g/km by 2021. Australia, of course, has no such commitment in place.

With light-commercial vehicles, Australia’s emissions intensity fell 2.9 per cent (or 7g/km) to 222g/km last year.

Comparative data from the EU, where vast numbers of vans are sold compared to utilities/pick-ups in Australia, points to a 2.7 per cent (4.5g/km) improvement last year to 164g/km.

This places the EU 6.4 per cent below the 2017 target of 175g/km – a point reached as far back as 2013 – but further efficiency improvements are still required across the industry for member states to collectively reach the even tougher target of 147g/km set for 2020.

With Australia’s last remaining vehicle manufacturers – Toyota and Holden – pulling out this year, and with climate change currently a major item on the national agenda, the time is surely right for our own more stringent, and mandated, targets to be put in place.

By Terry Martin

Read More: Related articles

Read More: Related articles