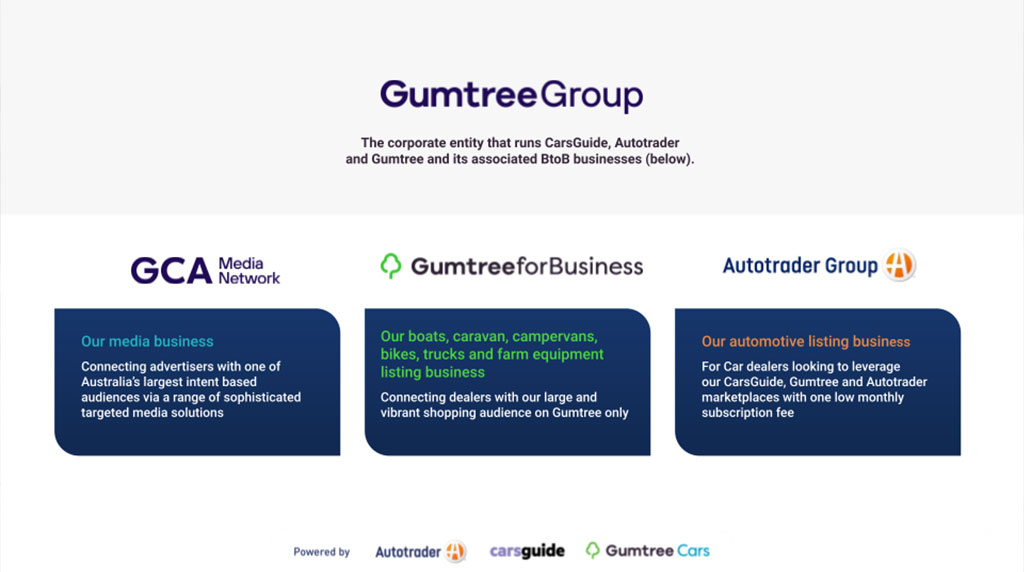

AMBITIOUS plans are afoot to take the Gumtree Group, including Gumtree Cars, CarsGuide and Autotrader, from the holding pattern that the auto sites have occupied in the past few years. Not just to restore what its owners think is its rightful place in the market but to move to the point where it is the first choice of dealers to advertise their cars.

Coupled with that target is a strategy to make the group’s three website brands the go-to places for car buyers, who are then directed to dealers’ cars for sale.

The company believes that the three-pronged online approach casts a superior catchment net than a single website can achieve, with car buyers being drawn into any one of the sites with different needs and from different directions.

Benn Sykes, who was recently appointed as director of motors within the Gumtree Group, told GoAutoNews Premium in an exclusive interview that, on the back of these diverse sources of traffic, Gumtree Group will be able to build an audience that more than challenges its competitors.

As it is, Nielsen data shows around half of the Autotrader Group’s 3+ million unique monthly visitors (deduplicated total of Gumtree Cars, CarsGuide and Autotrader) do not visit any other auto site in the same period, providing a large and exclusive car buying audience for dealers.

Meanwhile, Gumtree Group, in total, has more than two million live listings across all categories. Together with CarsGuide and Autotrader, it reaches more than six million Australians each month while generating over $3 billion in monthly gross listing volume.

To capitalise on this audience, the group is investing heavily in its dedicated Autotrader Group dealership classified advertising offering as part of ambitious growth plans for its dealership clients in 2024 and beyond.

Mr Sykes, a long-time sales executive in automotive media, including senior positions at CarAdvice, Drive, CarExpert, ACP Magazines and News Limited, said there would be a refreshed focus on strengthening existing dealership relationships with a fresh emphasis on collaborating with its dealer partners to provide advertising packages tailored to their specific needs.

He said that each of the three online destinations serves a purpose and, if the company consolidated those three brands into one, the one single brand would never achieve the traffic of those three brands individually.

“Our three brands offer different things for different people depending on their stage within the auto purchase journey. They offer different and unique opportunities for dealers as well, each with its own individual value proposition, he said.

“CarsGuide’s leading auto editorial platform helps guide and educate car buyers who are researching their next new car. They’re actively in the market but largely undecided on which make or model they’d prefer. Often they require a little bit of advice or content to push them down the funnel, compare their shopping list and ultimately make the decision of brand A over brand B.

“For us, our strength is our SEO proposition: best family SUV, best ute for towing, Toyota Hilux review, the Hyundai Kona review, or whatever it might be. So it is an editorially-led content-first approach – with classifieds second – focused on the burning questions new car buyers want and need to know about how the car will fit into their lifestyle,” Mr Sykes said.

“It is how we take those undecided consumers and help them make an informed purchase decision through education and content. “On the Gumtree side of things, that is a huge destination in its own right, and a brand that we will push to become even more of a destination for all of life’s major moments and milestones.

“It is where Australians go and buy their caravans, it is where they go and buy their boats. And it is where they go and buy their cars. And we want it to be a bigger home to all of those things.

“For us it is the destination classified website and it is much more of a direct competitor to Carsales. Now, traditionally, it has been where you got a cheaper car. But that has changed.

“We removed the ability to list your car for free and we’ve seen the average car listing price increase to more than $32,000 with considerable growth in the $40,000-plus segment.

“Currently Gumtree Cars make up about 40 percent of the leads we deliver which surprises almost all dealers when I tell them,” he said.

“We need to give Gumtree a much more premium look-and-feel and that’s happening and will continue to happen over the next 18 months. It’s just in need of a renovation to improve the overall customer experience.

“Gumtree is incredibly important to this business and our story moving forward. Fortunately for us, everyone knows Gumtree and it still holds a place in most people’s hearts and minds. Everybody has a Gumtree story. Everybody has bought, sold, searched or transacted on Gumtree.

“As we rebuild the look-and-feel of Gumtree Cars and then extend that look-and-feel into caravans and marine and bikes and so on, all on the one site that is visited by millions of Australians every month, suddenly, Gumtree’s value proposition is much higher and much better than what it currently is.”

“Then you have Autotrader. Autotrader, for us, is our technology brand delivering a great online car buying experience. It has access to a global market-leading platform while the local site has been purpose-built in collaboration with our dealer partners and optimised for delivering quality leads.”

Mr Sykes said the new look-and-feel of the listing’s environment on CarsGuide is powered by the learnings of what works on Autotrader. If we didn’t have the Autotrader brand, we wouldn’t be able to do that.” Mr Sykes said.

“So that’s why we have all three.”

Mr Sykes said that dealer listings and billings are run under the Autotrader Group brand as a single touchpoint for dealers and that classified advertising is sent to each of the three sites and displayed to their respective audiences to capture car buyer demand via a wide net.

“So when a dealer gets our lead, they get one single lead from the Autotrader Group. When they get reporting, it’s from the Autotrader Group.”

The group prides itself on not charging dealers for leads or for clicks. It runs a subscription model where dealers buy packs of 100 or 200 cars priced on the number of advertised vehicles per pack. The pack not only displays dealer cars but generates walk-in showroom traffic by displaying the name, location and contact details of the dealership as well.

More recently, the company has been more flexible to meet the changing used car market.

“It is taking dealers a little longer to sell cars at the moment,” Mr Sykes said. “Dealers are also getting more trades than previously because they have more new car stock and they are getting stock faster.

“As a result a dealer who might have previously had 70 cars on the lot might now have 110 or 120 while we were offering a 100 pack or a 200 pack. That didn’t cut it. So we are working with all of them, creating greater flexibility in those packs that are tailor-made to the dealerships themselves.

“Just because we don’t have a suitable pack size shouldn’t be their problem. It should be ours. If a dealer is telling me: ‘Hey, I’ve got more stock just sitting on the lot at the moment, you don’t have a pack size that fits the bill’. Great. We change it, those are the sorts of things that we need to do. More of that needs to happen across this business as we go.”

Mr Sykes said the group is encouraging all dealers “to list their vehicles with us first, if not exclusively. Let us sell it for you. We’re not out there to gouge you per lead, especially when a lot of those leads are for a car already under consideration or a quick price check from outside their PMA”.

“So let us do the heavy lifting for you. We know we are not going to give you the same amount of volume. But we know that the lead-to-sale ratio with us is just as good, if not better, for many dealers.

“This has allowed us to free up the conversation around dealers giving us all their listings.”

Mr Sykes said he “spent an awful lot of time and money in the past working for businesses that have always wanted to get into the position that this business is in now and that is being the consumers’ choice to the other place”.

“As far as the consumer is concerned, we have always been that choice and with the additions of Autotrader and CarsGuide, as well as the changes to Gumtree, that’s only increased.

“We now need to capitalise more on that audience and provide dealers with more flexibility and a true alternative.

“So, for me, it becomes about value. I’m never going to be able to offer dealers the same volume of leads as the other place. That’s not what we are built to do. We don’t charge per lead and I’m not going to go down that rabbit warren with dealers.

“We are focused on helping our dealers with more ways to be able to sell cars and achieve greater value as a result.

“Part of that is sending people into their dealerships absolutely free of charge because we know the dealers will convert about 40 per cent of them. Part of that is also utilising resources like we have with CarsGuide, using news, reviews and content to better inform and close the deal both in-store and post-visit.”

Footnote: Gumtree Group is a wholly-owned by ASX-listed The Market Herald, a Perth-based business publisher.

Read more:

Read More: Related articles

Read More: Related articles