But the good news is that car owners will touch remaining dealerships far more often with recurring transactions during the time they have their car.

The bulk of the 2018 KPMG Global Automotive Executive Survey responses – from 907 people who occupy the position of chief executive, president, chairman or executive – said the reason they expect up to 50 per cent of traditional showrooms to shut was a shift to online purchases.

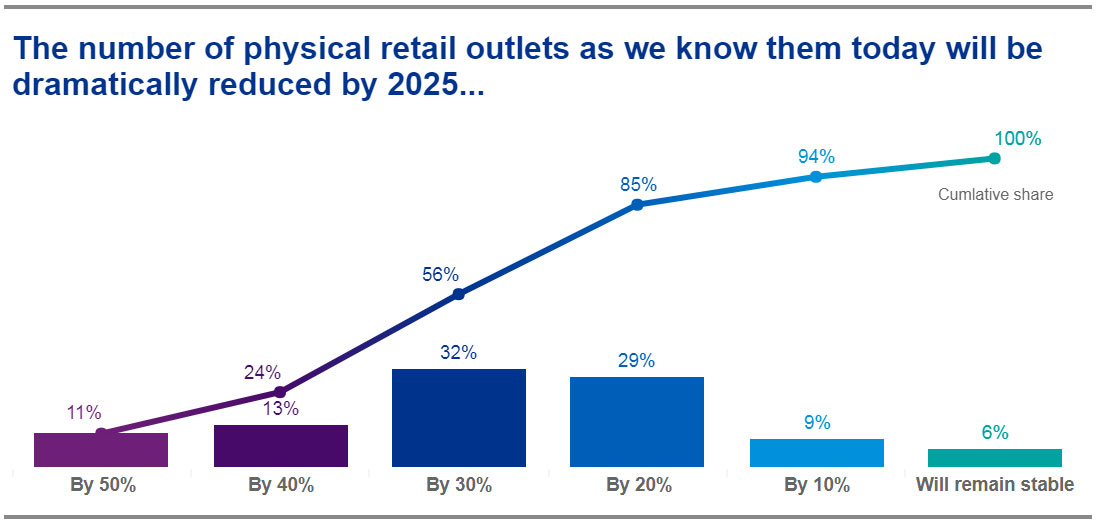

“Over half of all execs (56 per cent) are highly confident that the number of physical retail outlets as we know them today will be reduced by 30 to 50 per cent already by 2025,” the survey, published this week, said.

“Mobility patterns are changing and if customers request more and more intelligent mobility solutions instead of owning a private car, we will see a shift from a one-off transaction towards TCO (total cost of ownership) recurring transactions throughout the entire customer lifecycle.”

In delivering the survey, KPMG’s UK head of automotive Justin Benson said: “In the UK, our findings are clear on one thing – there are more significant disruptors to the automotive sector than Brexit.

“Electric vehicles, autonomous vehicles and Mobility as a Service (MaaS) are going to drive change in the automotive sector for the foreseeable future,” he said.

“New business structures and new economic models are on the horizon, driven by these disruptors and the associated new technology.

“It’s an exciting but uncertain time for the industry. Whilst our report highlights concerns in some of its conclusions, it also helps chart a path to future success.”

The survey said the retail landscape was undergoing a transformation phase that requires re-thinking current retail concepts and business models.

“There are two reasons for the reduced number of retail outlets,” it said.

“The obvious fact is that an increasing number of customers can purchase their new private car online, but the second reason seems more striking and fundamental.

“Mobility patterns are changing and if customers request more and more intelligent mobility solutions instead of owning a private car, we will see a shift from a one-off transaction towards TCO-driven recurring transactions throughout the entire customer lifecycle.

“These transactions will probably be made on an online platform with multiple mobility solutions for traveling from A to B.

“In this world, product profitability alone has become outdated and will be transformed to measuring customer value over the lifetime.”

In Australia, KPMG’s national leader of Motor Industry Services, Wayne Pearson, said the views of the executives in the survey were controversial but because electric vehicles were being legislated around the world “it really does follow a fairly logical conclusion”.

“The dealer distribution model was really established to provide comfort and convenience to the customers with regular service requirements around the complex mechanics of the internal-combustion engine over the ownership cycle,” he told GoAutoNews Premium.

“There are about 10,000 moving parts in a typical internal-combustion engined vehicle. With an EV, that falls to about 50. At the same time, service intervals are moving from 10,000km to an EV’s 100,000km.

“Because of this, most customers will probably never service their EV so the traditional distribution model will require refinement.

“That said, dealerships will change to become experience centres and personalisation hubs as cars become more software-driven and more connected to the driver.

“So dealerships will become more about fun for the customer and with this, I see the potential to have a resurgence in traffic flow.”

The survey’s results are already being seen in global retail changes. As reported in last week’s GoAutoNews Premium, UK shopping centre retailer Rockar has expanded its footprint into placing cars within one Next store. The retailer has more than 500 outlets and it is possible Rockar could have a presence in each.

The founder of Rockar, Simon Dixon, said that the cost of property for both car retailers and high street retail operators had meant that such partnerships could become more prevalent in the years to come.

KPMG said that this vision “may still be in a distant but we shouldn’t forget that we cannot jump into completely new retail concepts without remembering where we come from”.

“There will never be the one single retail model of the future, instead retail will undergo transformation and a variety of retail concepts will co-exist,” it said.

“This includes the optimisation and industrialisation of current retail outlets (for example with quality, customer experience, response time, etc.), enhancement using digital services and, in the long-run, the creation of an entirely new retail platform where customers can log-on in their own ecosystem with their individual identification.

“This will certainly require completely new structures, sales channels, customer touchpoints and mindsets.”

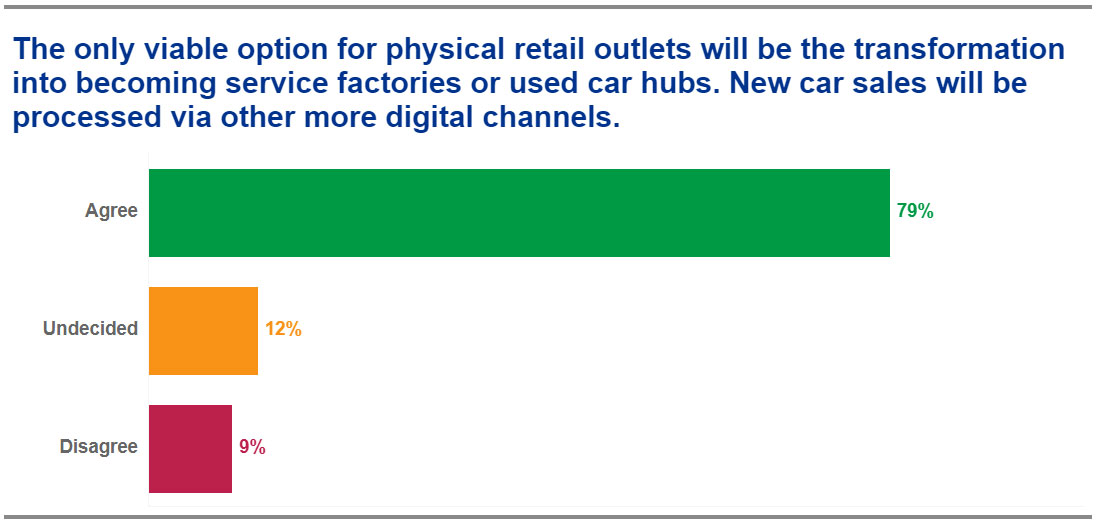

So what happens to the showrooms? KPMG said that the only viable option for physical retail outlets will be business transformation into service factories or used-car hubs.

Of the executives surveyed, 79 per cent believed that this transformation would occur and that new-car sales will be processed via other increasingly digital channels.

“Most likely, the respective data points for a connected car will need to be collected centrally and will not primarily be made available to independent dealer groups, where it is first necessary to identify which data will even be available and at which point in future,” KPMG said.

“The difference between new cars and the already existing car fleet has to be made here, as it is certain that the current vehicle stock will require management.”

The survey found that distribution costs no longer match retail sales, “and we believe that for traditional retail outlets to survive, they must secure their role in the ecosystem and ensure efficiency by becoming universal service factories”.

“Alternatively, another scenario could be the conversion into used-car hubs.

“The margin potential in the used-car business is lost if OEMs don’t manage to step into the business by restructuring their physical retail outlets, which will invariably become obsolete in the long-run.”

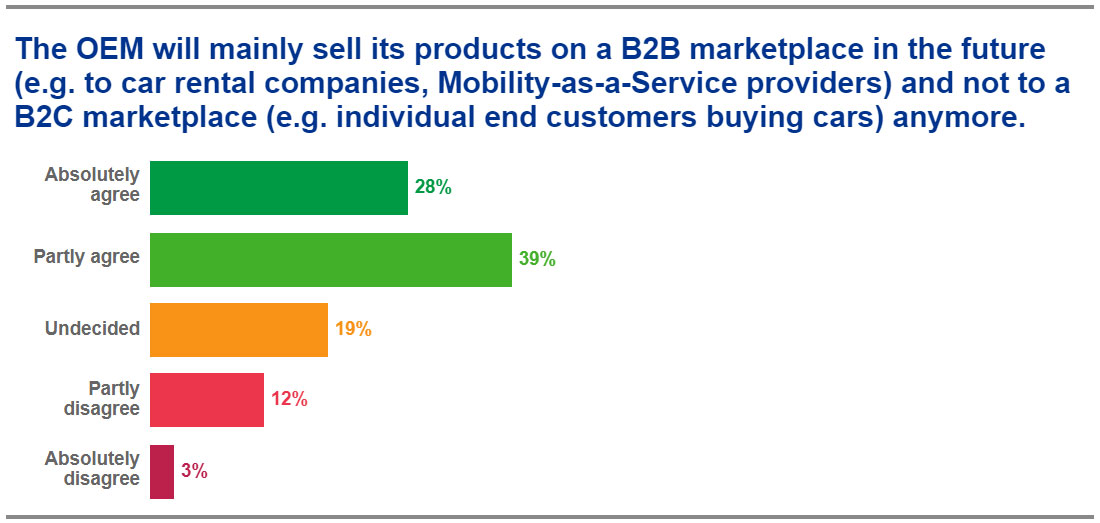

There is another major change, KPMG said. Currently, OEMs establish their strategy, sales channels, distribution models and prices for a pure B2C (business to customer) market environment, in which cars were sold to individual customers.

“However, with the increasing vital demand for new and innovative mobility concepts especially in cities, we must question whether this will still be the case in the future,” it said.

“Executives surveyed show a clear opinion – already today the majority (67 per cent) agrees that OEMs will need to say goodbye to a mainly B2C marketplace and will need to sympathise with a B2B (business to business) market environment in the future.

“This is an interesting challenge, as manufacturers would need to prepare themselves to sell entire fleets to mobility service providers and more importantly they could consequently run the risk of giving away the direct customer relationship.”

KPMG said in other retail-related points of the survey:

- 41 per cent of executives believe a trusted brand to be the key success factor for a sharing economy, followed by communities sharing the same values (24 per cent).

- 43 per cent of the surveyed respondents show confidence that half of the car owners they know today will no longer want to own a personal vehicle by 2025. This is based on changes to living circumstances (32 per cent) and total cost of ownership (23 per cent).

- 43 per cent of vehicle manufacturer executives believe that living circumstances and the resulting urbanisation are the most important reason.

By Neil Dowling

Read More: Related articles

Read More: Related articles