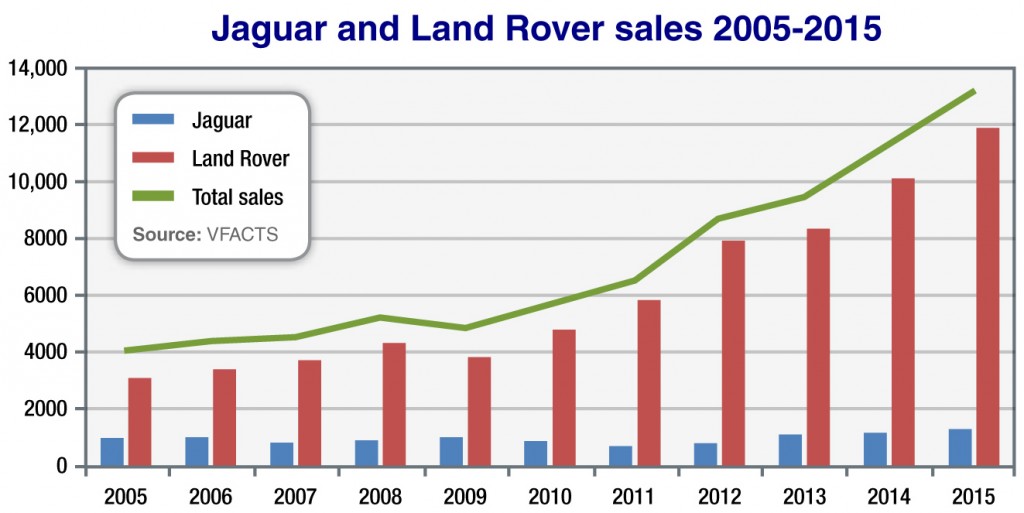

Despite record sales last year of 1292 units – up 10.7 per cent on 2014 and marking its fourth successive year of growth – Jaguar accounted for only 9.8 per cent of combined JLR sales, with Land Rover posting 11,885 new registrations.

Jaguar’s share was down from 10.4 per cent a year earlier, 11.7 per cent in 2013, and a long way from the 23 to 24 per cent share it held a decade ago, still with around 1000 units per annum.

This points to just how far Land Rover (and Range Rover) has come over that period – nine out of 10 years of sales growth, fuelled by significant new models such as Evoque – and how Jaguar has made only incremental gains after falling to a low of 693 units in 2011 once the XE’s predecessor, the Ford Mondeo-based X-Type, was discontinued.

A four-cylinder petrol version of the previous XF large sedan combined with the arrival of the all-new F-Type sportscar to bring Jaguar’s sales back up to the 1000-unit mark in 2013, but it was the XE – in showrooms since last September – which clearly denoted a new era for the cat brand.

VFACTS figures show that XE was responsible for 39 per cent of Jaguar’s volume in the final quarter of last year (and was at 91 per cent in January), while the brand overall was only 54 units shy of Land Rover’s fourth-quarter figure, accounting for 49.6 per cent of the total.

Pent-up demand for the new XE is a factor here, but the tide is clearly turning for Jaguar as it brings the new-generation XF to market this month, confirms a third-quarter launch for a brand-enhancing high-performance SVR version of the F-Type, and prepares for the launch of another sure-fire winner in the form of the F-Pace SUV, which arrives around the same time.

Do not expect the same proliferation of all-new models the three dominant German brands have created, but Jaguar is clearly on the same stretch of road when it comes to SUVs – an entire family is reportedly in the pipeline – and performance variants, with its newly established SVO division striving for the sort of success Mercedes-AMG and BMW M have long enjoyed.

Other body styles such as a coupe and estate version of the XE and new XF are also anticipated – the previous XF Sportbrake wagon never made it here, due to Australian Design Rule complications (child seat anchorage points) – which will flesh out the reborn Jaguar range and build sales volume further.

The company’s stated aim is 14,000 combined Jaguar and Land Rover sales in Australia this year – up from 13,177 in 2015 – while Jaguar’s annual share in the JLR stable over the next four years is expected to climb from around 10 per cent now to 30 to 35 per cent by 2020.

Unconfirmed reports have put JLR Australia’s internal targets for Jaguar at around 25 per cent of Mercedes-Benz’s sales passenger car/SUV volume once the full gamut of new-generation vehicles has reached the market, which, based on Mercedes’ record 31,750 sales in 2015, translates to around 8000 units.

On the Pace: Jaguar’s first SUV, the F-Pace, is sure to boost sales when it arrives in showrooms in the second half of the year, priced from $74,340 plus on-road costs.

Factor in ongoing prestige market segment growth and 10,000 is the round number that looks to be an obvious objective for Jaguar.

In comparison, Lexus achieved a record 8691 sales last year (up 24.2 per cent) and similarly remains committed to ongoing growth via new models and an expanding dealer network, while Volvo, which is also in a rebuilding phase and should experience solid growth in the coming years as new models arrive, edged up 5.3 per cent to 4943 units.

Infiniti is likewise expecting to move into higher gear, its 574 units last year marking a 30.2 per cent increase on 2014 and ongoing growth projected on the back of new models and the required business development in place behind it.

Remember that Jaguar’s annual sales were less than 700 units only five years ago.

Just as Evoque was almost singlehandedly responsible for taking Land Rover’s sales from less than 6000 in 2011 to around 8000 a year later, the F-Pace – which will be positioned as more of an on-road wagon to keep it separate from Range Rover – will be expected to produce an immediate return on investment for the resurgent Jaguar brand.

The SUV will test the market response to such a vehicle from the long-established brand – “the pushback from purists” – just as each of its new-generation models has had to convince Australians there is that so-called “fourth choice” in the marketplace and no lingering concerns about reliability, which has plagued Jaguar in the past.

The leaping cat looks different, now. Not mainstream, but more appealing to a broader audience and one that looks to have the models and momentum behind it to at least continue its double-digit sales growth and keep it in the right lane, even if the rate of acceleration is still to be clocked.

By Terry Martin

Read More: Related articles

Read More: Related articles