Sales of full-electric models and plug-in hybrid electric vehicles (PHEVs) are slowly building momentum in line with new model launches across various brands, bolstered by early recharging-infrastructure announcements and a growing awareness among the general public that electric cars are becoming an undeniable part of our lives, whether we own one or not.

Traditional fleets and new mobility services such as ride-sharing operators will gravitate towards the mass-market EVs in particular, while an ever-increasing cohort of private buyers – especially millennials and the generations following, who see them as one small but obvious way in which to combat climate change – are targeting EVs as an aspirational purchase, especially with home ownership increasingly out of reach.

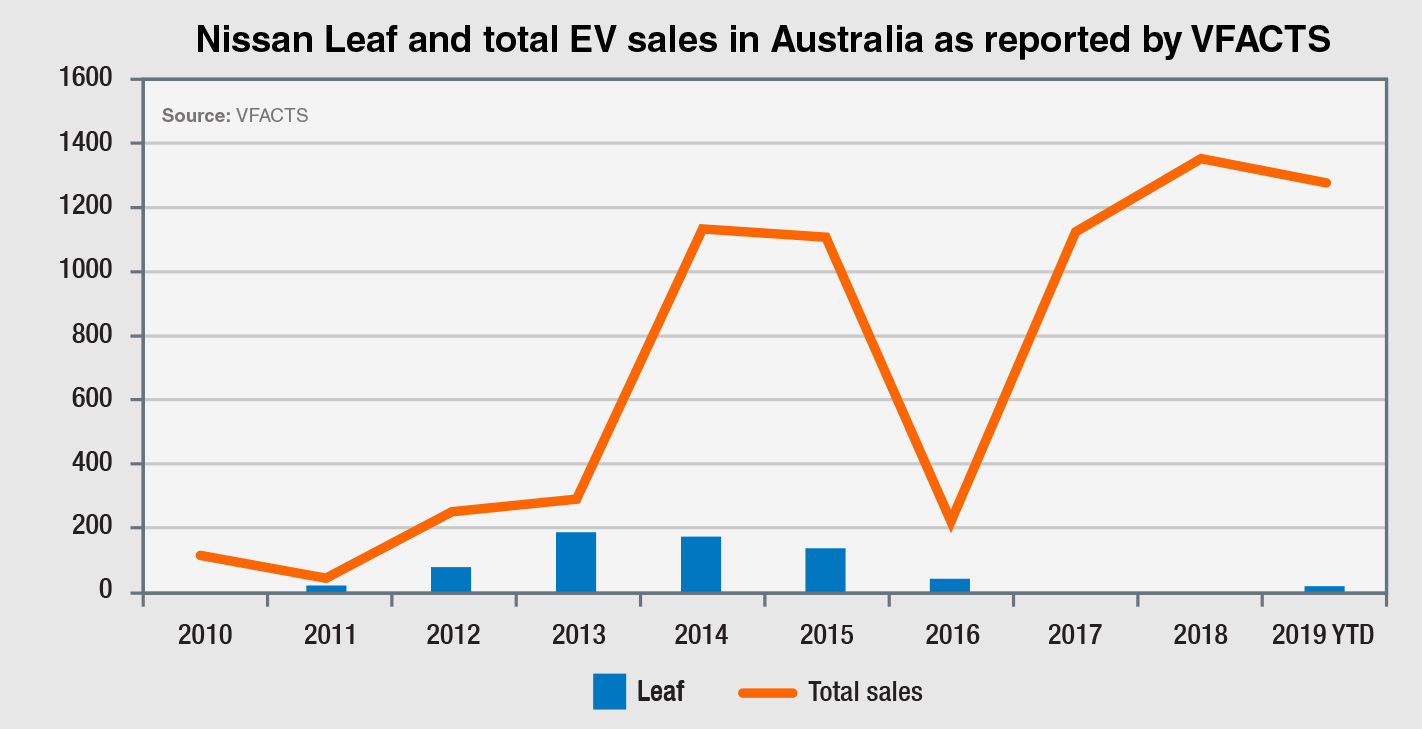

Nissan’s first attempt with Leaf, from 2012 to 2016, secured only 635 sales over that period, despite the Japanese brand building awareness of the model and dropping pricing along the way to less than $40K driveaway for private buyers.

Once businesses made their green purchases, and early adopters took the plunge, there was simply no ongoing appetite for the Leaf, or any other plug-in models at that time, when the sticker price was twice as high as that on equivalent cars with a conventional combustion engine and none of the inherent drawbacks such as limited driving range and a dearth of refuelling/recharging outlets.

Three years later, Nissan is back, and with hundreds of deposits already laid and high expectations on the back of 500 or so customers making enquiries at dealerships and 12,500 showing a degree of interest online, the company should have no trouble pushing relatively quickly beyond 635 new registrations.

This is despite the fact that its pricing, at $49,990 plus on-road costs, is still very high for a small hatchback.

The overall picture is very different now compared to the early-to-mid-2000s.

New start: Nissan sold only 635 examples of its first-generation Leaf over its four-year lifespan in Australia but will easily eclipse this figure, in far less time, with the new model now on sale.

The latest figures, which albeit do not include brands such as Tesla that fail to subscribe to the VFACTS reporting service, show that 1277 EV/PHEVs have been sold in the first half of this year, up 90.6 per cent (607 units) on the same period last year and just 75 units shy of the total number for the entire 2018 calendar year (1352).

To a degree, this flies in the face of the current industry contraction – total new-vehicle sales are down 8.4 per cent at the halfway point of the year – and soft general economic conditions that are prompting buyers to withhold purchases and, for those who are still in the market, carefully consider the value equation of EV versus ICE (internal combustion engine).

In stark contrast, 2016 coughed up only 219 EV/PHEV sales across the industry, 42 of which were the last examples of the first-generation Leaf.

As we have previously reported, this was a low-point for the fledgling EV sector, which opened up in mid-2010 when Mitsubishi arrived with the i-MiEV city car, and other brands – most notably Holden with its short-lived Volt range-extending plug-in hybrid – similarly jumped the gun early.

Only 706 total EV sales were recorded between 2010 and 2013, while Mitsubishi’s more appealing Outlander PHEV SUV had an immediate impact in 2014, helping push up the segment to 1135 units that year and 1108 in 2015.

Along the way, Leaf managed 19 pre-registrations in 2011, 77 in the 2012 launch year and 188 in 2013 – its highest mark, before slipping to 173 and 136 in 2014 and 2015 respectively, and petering out the following year.

Prestige brands have played a key role in rebuilding some momentum in the category, with overall EV sales as reported by VFACTS back up to 1124 in 2017 and pushing higher ever since.

This year, a healthy 40.3 per cent (515 units) of all EV/PHEV sales have gone to private buyers, who are, surprisingly, leading the way in terms of outright sales of electric passenger cars (163 versus 153).

It comes as no shock that SUVs are the most popular sub-segment, attracting 74.7 per cent (954 units) of all EV/PHEV purchases, with business buyers dominating (602 vs 352).

The overall figures also include seven examples of electric light-commercial vehicles, namely the Renault Kangoo ZE.

As was the case with the original Leaf, Nissan is launching its new EV without the benefit of government incentives, but the market is different this time around and the company has every reason to be optimistic based on the early response.

The real test will come after the initial demand is sated and Nissan’s sales force, which has no other small hatchback to offer, is tasked with convincing undecided buyers to flick the switch.

By Terry Martin

Read More: Related articles

Read More: Related articles