As a result of monthly payments much higher than what they are used to, owners are falling behind on their repayments and defaults on car loans are rising rapidly.

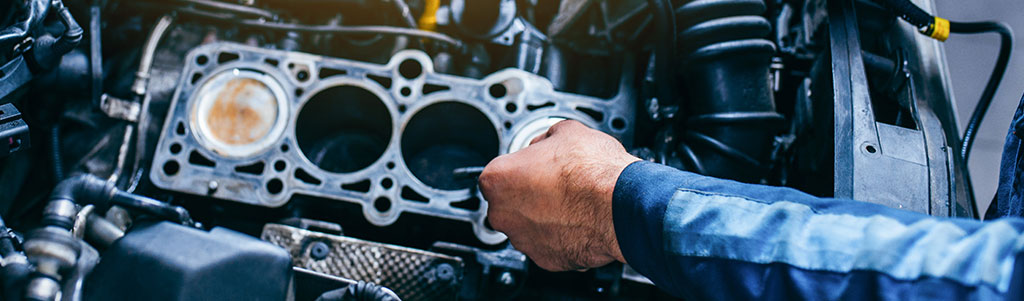

To make matters worse, because of the shortage of stock, many buyers were forced into much older cars than they would have normally bought and these cars are now breaking down; leaving owners without a car because they cannot afford the repairs.

The paper reported that the number of used cars registered between the age of eight and 11 years old has risen from 15 per cent in 2018 to 19 per cent in 2022. The number of vehicles retired from the roads each year has fallen from 16 million in 2020 to nearly 12 million in 2021.

On top of this, the cost of repairs is rising. According to US data, the cost of repairing cars has risen between two per cent and three per cent in each of the 15 years to 2020. But it rose by 10 per cent in 2021 and by 15 per cent in 2022. The jump in 2021 was the largest since 1975.

The WSJ said that many car buyers are already struggling to pay the large car loans they took out when prices surged in 2021 but having to meet high breakdown or repair costs to keep their cars on the road is forcing them to delay repayments or stop them altogether.

The newspaper reported that some 9.3 per cent of auto loans made with people with low credit scores were 30 days or more behind on the payments, the worst since 2010 according to Moody’s Analytics.

The high prices charged for cars during the pandemic meant people stretched themselves to meet the higher prices and loan terms. This left them with very little elbow room as they are now additionally hit with the rising cost of other household necessities as inflation took off.

Lenders are saying they are seeing a lot more older, high mileage vehicles. Buyers who cannot afford repairs are handing their vehicle back to lenders who are finding the balance of the loan is far higher than the value of the vehicle.

According to the US Manheim Used Vehicle Index, which tracks wholesale vehicle prices, used car prices jumped 47 per cent in 2021 then fell 15 per cent last year; thus sending hundreds of thousands of US used car owners under water on their car loans.

The report said that if a car breaks down soon after it was purchased, financiers try to get the selling dealership to:

- Buy it back

- Repair it or

- Swap it out for a lower-priced car.

If the car is repossessed, the owners have to pay the difference between the value realised at auction and the amount owed. This effectively excludes them from the car market for years.

The paper cites one owner of a 2011 Ford Flex who was laid off from his software job and while searching for new work fell behind on his car payments, rent and started running up credit card debt. He has found temporary relief through payments totalling $10,000 made to him on the go fund me website.

The WSJ also gave an example of a used 2013 BMW owner who found she needed a new engine at the cost of $19,000 – around the same as she paid when she bought the car. The 25-year-old struggled to get to her job, missed shifts and was fired. She then fell behind on the car payments and may have it repossessed.

Another example was a 2015 Mazda with an engine that failed and an Infiniti with a gearbox failure after just 73,000 miles. Both owners had made just two payments before their cars stopped running.

In response, some lenders are putting a ceiling of eight years and 120,000 miles on vehicles they will finance and 140,000 miles on trucks.

Damian Chadwick director AWN and CEO of Sovereign told GoAutoNews Premium: “The alarming reports coming out of the US market should act as a warning of what we will see in Australia as the market continues to harden.

“Our regulatory environment will limit the extent of the impacts seen in the US, however we will not be insulated from consumer distress as the government continues to apply strategies to slow the economy and reduce inflation.

“With an uncertain landscape ahead, the AWN group is working with strategic partners to release a range of products specifically designed to mitigate consumer hardship.

“To date, we have released MVI Excess and a complementary gap program. However, the upcoming release of our used car Guaranteed Buyback program is going to set the foundation for a paradigm shift.

“GFV is not a new concept. However, putting the power of that product in the hands of the average “mum and dad” used car buyer is a milestone we are proud to establish,” he said.

By John Mellor

Read More: Related articles

Read More: Related articles