WHY do European prestige car-makers continue to create niche variants?

This week Mercedes-Benz launched another SUV – its eighth for the Australian market – that appears no more than a styling exercise on an existing model.

The GLC Coupe is a derivative of the GLC, launched at the beginning of the year, which in turn is based on the platform, drivetrain and cabin components of the mid-size C-Class passenger-car range.

The latest GLC Coupe version encompasses a step up in cabin luxury and photocopies the performance of its sibling, but unlike the square-rigging of the GLC, the new model presents a slope-back silhouette to claim the “coupe” tag and a lower roof height to inspire a sense of sportiness.

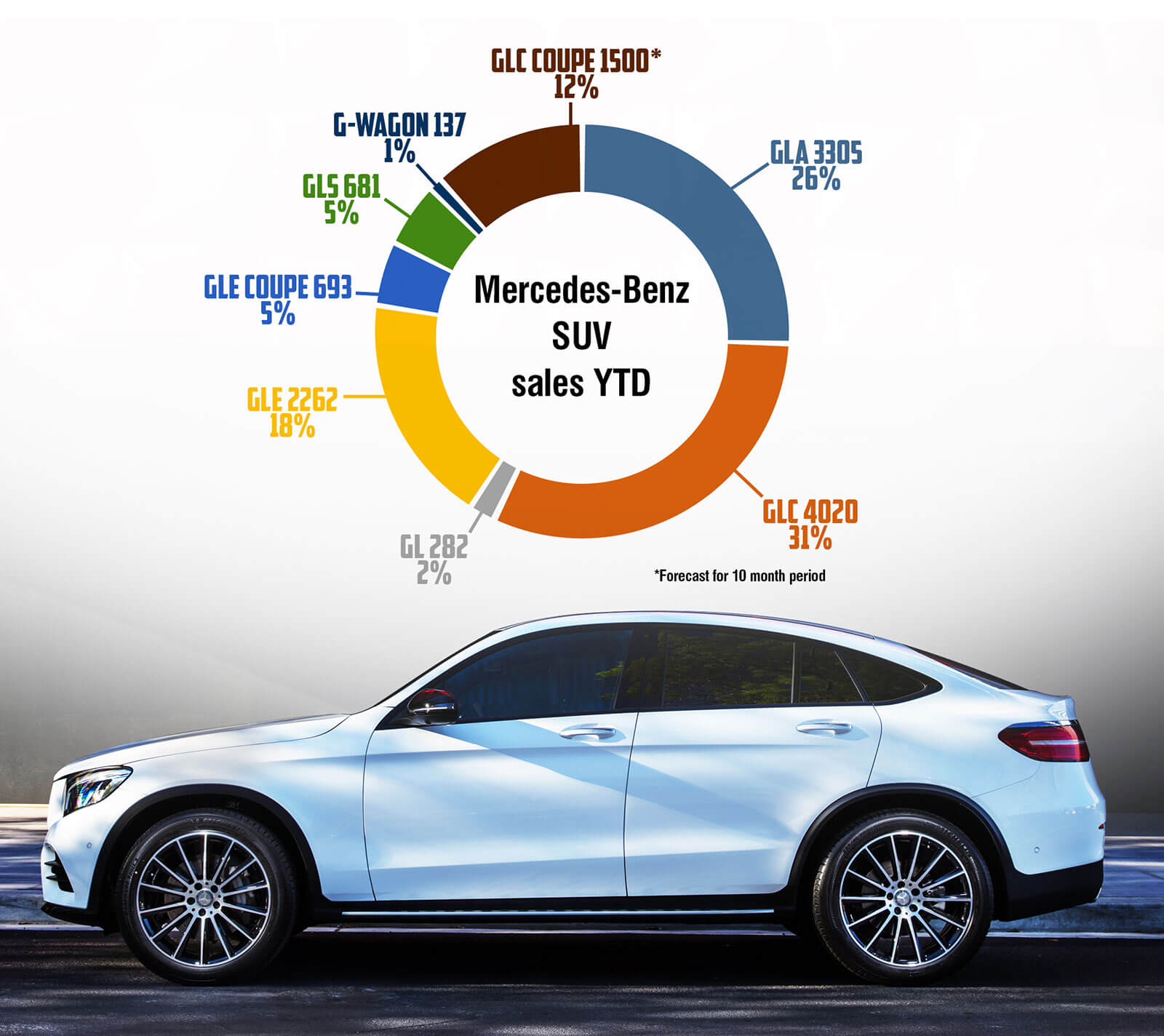

So why is it here? First, medium-size SUVs are becoming an unlikely power source for the once singularly luxury car-maker Mercedes-Benz.

So why is it here? First, medium-size SUVs are becoming an unlikely power source for the once singularly luxury car-maker Mercedes-Benz.

The market is about demand and supply. Both buyers and manufacturers create niches and fill them with variants. Some become popular, others fade from the showroom.

Mercedes-Benz Australia/Pacific (MBAP) senior manager of public relations, product and corporate communications David McCarthy said it is a complex process.

We have to ensure that sales don’t fall below 100 units a year, otherwise the whole exercise becomes hard to sustain. – David McCarthy

“We have to attract buyers with distinctive vehicles but then have to ensure that sales don’t fall below 100 units a year, otherwise the whole exercise becomes hard to sustain,” he said.

“We have to attract buyers with distinctive vehicles but then have to ensure that sales don’t fall below 100 units a year, otherwise the whole exercise becomes hard to sustain,” he said.

“The coupe styling on what is seen as an SUV surprised us. We didn’t expect the demand. SUVs tend to be all about ride height and carrying capacity and some off-road ability.

“The coupe niche is more about styling first. Yes, it can carry almost as much as an SUV and have the tall ride height but it is more urban and there’s less focus on going away from bitumen roads.”

Mercedes is pitching the GLC Coupe mainly at cashed-up families with one or two children.

It is an urban vehicle and not intended for off-road work.

“We don’t see this as appealing to people who want to go on weekend adventures away from the bitumen,” Mr McCarthy said.

“It is also for a slightly different buyer than one who drives a GLC. The Coupe is more a style vehicle, while the GLC buyers are possibly more pragmatic.”

The GLC Coupe comes from solid foundations. The C-Class range of wagons and sedans outsells most European rivals. Its sales are twice that of the mainstream Mazda6, for example.

The C-Class is also significantly more popular than the bigger E-Class.

“GLC volume has been 4020 this year at about 350-400 a month,” Mr McCarthy said.

“This (Coupe) won’t do the same volumes. We expect 150-200 a month, and 2000 sales a year would be good.”

“This (Coupe) won’t do the same volumes. We expect 150-200 a month, and 2000 sales a year would be good.”

Mr McCarthy said that these were low volumes when compared with top-selling models in the volume market that achieve several thousand sales a month.

“There will be some buyer crossover from GLC and the Coupe and even the C-Class Estate. But since the GLC launch, we have not seen any slowdown in C-Class Estate sales. It remains a very popular car.”

But Mr McCarthy said people tended to choose a brand first. “Most do not cross shop brands,” he said. “They will buy the same brand but a different model.”

“C-Class used to be on the same volume as the Mazda 6 – but not anymore. We have sold about 5500 C-class sedans and wagons this year compared with 3600 Mazda6 sales.”

“C-Class used to be on the same volume as the Mazda 6 – but not anymore. We have sold about 5500 C-class sedans and wagons this year compared with 3600 Mazda6 sales.”

Mercedes said the mix from petrol to diesel would be about 50:50. Both engine types are economical and powerful and the nine-speed automatic as standard is a market advantage against many rivals with six- or seven-speed automatics.

Mercedes will market three models initially – the 220d, 250 (petrol) and 250d. It will add the AMG GLC43 Coupe (petrol) at the end of the year and then an AMG GLC63 (petrol) model early in 2017.

The GLC Coupe has a slightly higher level of equipment than the GLC version adding a premium of about $8000.

The GLC Coupe has a slightly higher level of equipment than the GLC version adding a premium of about $8000.

MBAP changed the specification inventory on the previous C-Class, asking for a higher equipment level from the factory and then packaging the most popular options.

“We can get a better price for the car from the factory if the additional equipment is fitted during production,” Mr McCarthy said.

“We can then bundle some popular options into packages. It’s about reducing complexity at the point of manufacture and at the point of sale, but still give buyers plenty of choice.”

Prices start at $77,100 plus on-road costs for the 220d diesel; $80,100 for the petrol 250; and $82,100 for the diesel 250d. The GLC 43 version, with a 3.0-litre V6 bi-turbo petrol engine, will cost $108,900. No price has yet been announced for the AMG variant.

Its rivals include the BMW X4 and the Audi Q5, and for the future, a coupe styled Q5 that could be called the Q4. There is also the Range Rover Evoque, Volvo XC60 and Lexus NX.

By Neil Dowling

Read More: Related articles

Read More: Related articles