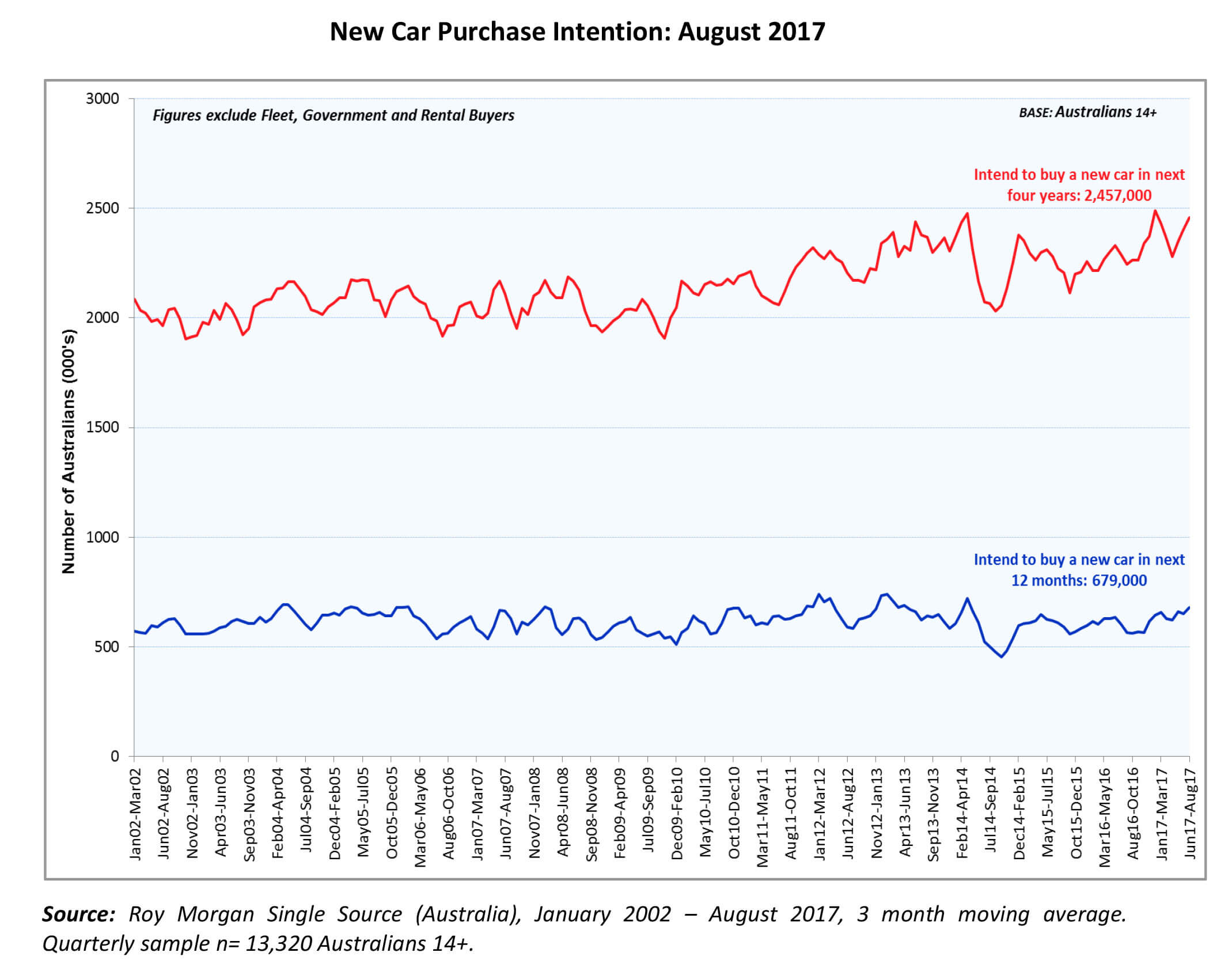

Roy Morgan Research shows Australia’s automotive industry will have “another good year” as its survey points to an increasing number of consumers reporting an intention to buy a new car in both the short and long term.

Roy Morgan Research industry communications director, Norman Morris, said 2.45 million Australians are in the market for a new car within four years, up 53,000 from a similar survey in July and just below the 15-year high record reported in February.

“Analysis using Roy Morgan’s Helix Personas segmentation has shown that the biggest gains have been among three diverse groups.”

These groups are the affluent Leading Lifestyles; Today’s Families; and Battlers.

“These three groups have very different brand and price preferences,” he said.

Roy Morgan’s definitions are:

- Leading Lifestyles are high income families who own their home and live in inner suburbs.

- Today’s Families are young families living in outer suburbs, have above-average incomes and are technology-savvy.

- Battlers reflect struggling young families, single mums and/or retirees. Many are welfare dependant.

Roy Morgan automotive analyst, Rob Heneghan, said it was not unusual that three very different groups were found to be seeking the same consumer choice.

“Battlers are often the second biggest group of people with new-car buying intentions,” he said.

“A lot in this group are retirees and while not necessarily affluent, they have funds available for purchases such as a car.

“In addition, this group tends to live in rural and semi-rural areas so they would need a car more than, say, someone in more near-city suburbs.”

Rising consumer confidence has been attributed to the growing interest in owning a new car. After a fall in confidence in July, Roy Morgan said consumers are now more assured about their finances.

“While intention may have gone down recently, the automotive industry remains in great shape,” the research said.

Mr Morris said the group that is intending to buy a new car had a much higher level of consumer confidence that the average of the Australian population.

“Over the August quarter, the consumer confidence level for all Australians was 113.1,” he said.

“But those people intending to purchase a new car in the next 12 months had a much higher confidence level with 125.2.”

Mr Morris said that though official VFACTS data shows that sales in the eight months to August are up only marginally on last year, “strong intention levels indicate that it is likely to be another good year for the industry”.

“The increase in new-vehicle intentions over the last three months has been driven primarily from the continued market trend to SUVs, with an increase of 84,000, coming mainly from medium SUVs,” he said.

“Light commercials were the other big mover, increasing by 41,000, while passenger vehicle intentions remained unchanged.”

Mr Morris said that the upward trend was not across the board.

“Not all brands shared in this rising market, with the major growth coming from Toyota up 45,000, Mitsubishi up 44,000, Kia up 35,000, VW up 22,000 and Skoda up 18,000,” he said.

Mr Heneghan said Kia had reported an exceptional period of growth and was very high on the list of brands that people wanted to buy.

Hyundai also remained strong but there was no significant upward trend in buyer growth.

The results are good news for dealers in the four-year term but the research also shows short-term sales are also on the rise.

“The number of Australians intending to purchase a new car in the next 12 months has now increased by 9.2 per cent over the last quarter to 679,000,” this week’s Roy Morgan Research survey said.

By Neil Dowling

Read More: Related articles

Read More: Related articles