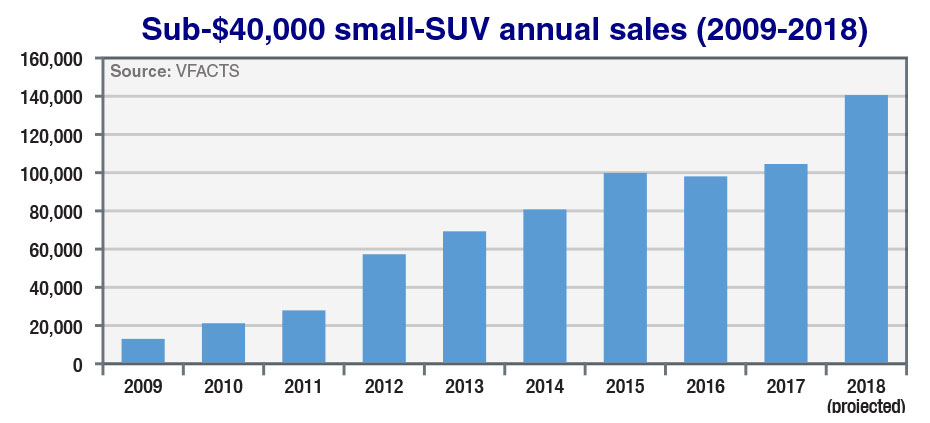

This segment’s year-to-date growth is the highest of any in 2018, bucking the negative trend of the overall market, which is down 0.2 per cent, although it does remain within striking distance of another annual sales record.

Significantly, it appears new-vehicle buyers are shunning light (-7.6% YTD) and small (-4.4%) cars in favour of small SUVs (+26.4%) , which have this year overtaken large SUVs (-5.5%) in popularity, by 3660 vehicles, after trailing them by 18,069 units during the same period in 2017.

While mid-size SUVs (124,106 sales, +9.8%) have supplanted small cars (123,569) as Australia’s vehicle of choice in 2018, small SUVs (82,156) will also mount a challenge if their current pace continues for another couple of years.

The dramatic growth of sub-$40,000 small SUVs – their largest since 2012 – is partly due to the launch of all-new models from Hyundai, Toyota, Mitsubishi and MG Motor; which have contributed incremental sales and boosted the segment’s bottom line.

Launched in October, the Hyundai Kona has quickly reached sixth position on its segment sales ladder, with 6874 units sold year to date, while the Toyota C-HR sits one spot behind with 5431 vehicles sold. It hit showrooms in February 2017.

Aloha: The Hyundai Kona has been a smash-hit since its launch in October, with 6874 examples sold to the end of July this year.

After lobbing in late-December, the Mitsubishi Eclipse Cross has claimed eighth place year to date, finding 3899 homes. Arriving Down Under in November, the MG ZS currently claims 13th position in 2018 with 789 sales.

Volkswagen and Kia are expected to also field small SUVs in the sub-$40,000 segment next year, with the T-Cross/T-Roc and a model based on the SP Concept respectively.

Freshly launched new-generation models have also lifted interest in the segment, with the second-generation Subaru XV lighting up the sales chart since its launch in June last year. It sits in fourth spot year to date with 8135 units sold (+83.9%).

The Jeep Compass occupies 11th place with 918 examples finding homes so far this year, after its second-generation model hit showrooms in January. During the same period in 2017, only five sales were made.

While the second-generation Suzuki Ignis has sold 866 units, its 12th-position effort is down 45.7 per cent, from 1596 vehicles. It lobbed in January 2017.

The best-selling Mitsubishi ASX (11,053 units YTD, +4.4%) was recently facelifted alongside the third-placed Nissan Qashqai (8418, +9.2%), fifth-placed Honda HR-V (7455, +3.5%) and ninth-placed Holden Trax (3491, -19.6%), as well as the 14th-placed Ford EcoSport (679, -22.8%), 16th-placed Renault Captur (256, +61.0%), 18th-placed Fiat 500X (154, -73.8%) and 20th-placed Peugeot 2008 (110, -55.8%).

This momentum looks set to continue as new or updated versions of the second-placed Mazda CX-3 (10,048 units YTD, -6.0%), 10th-placed Suzuki Vitara (2926, down 19.9%), 15th-placed Nissan Juke (416, -52.1%) and 21st-placed Suzuki Jimny (88, +11.4%) are set to launch in the next six months.

Other small SUVs still on sale include the 17th-placed Suzuki S-Cross (211 units YTD, -31.7%), 19th-placed Haval H2 (124, -31.9%), 20th-placed Jeep Renegade (110, -79.3%) and 22nd-placed Citroen C4 Cactus (60, +30.4%).

For reference, the $40,000-plus small-SUV segment has contributed 9618 sales year-to-date – a 23.3 per cent increase over the 7798 deliveries made in the first seven months of 2017.

By Justin Hilliard

Read More: Related articles

Read More: Related articles