Jon Moodie told GoAutoNews Premium in a special interview that interest rates are on the rise again and that interest rates in Australia were tracking up “pretty severely”.

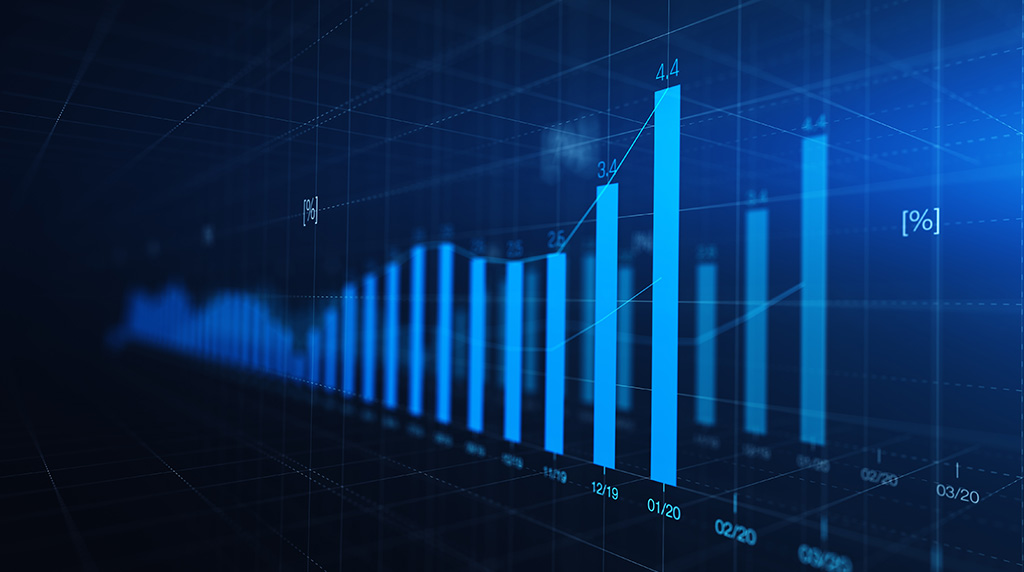

“If you look at the long-term swap rates, they have gone up probably a percent and a half over the past six months,” he said.

Mr Moodie said that in addition to the rate hikes, there is significant inflationary pressure in the car manufacturing nations of the Northern Hemisphere. This will place upward pressure on vehicle prices, which will gradually start eating into the strong margins currently being enjoyed by car retailers in Australia. “We’ve already seen several OEMs lift their prices and I expect this trend to broaden as the pressures overseas increase.”

“Many in the finance industry have moved rates up, not all. But you can bet your bottom dollar that if these fixed rates keep tracking upwards, these swap rates, then customer rates will start to follow up.

“We are seeing it on fixed mortgage rates already. People are scrambling to get out of their home loans and trying to fix their rate now before the rates go up too far. Westpac increased their fixed mortgage rates three times during the past three months.

“The issue is that if the variable mortgage rates start to increase the financial pressure on customers, the pressure increases overall as their food costs go up because inflation is driving up prices generally. Oil price spikes, we can see, are driving up the price of petrol at the pump and that feeds into the price of every product that requires transportation.

“So, you will eventually have customers with less money to spend coming into dealerships which are now asking more money for the cars, and then more money for the monthly repayments. You have to think it is going to dampen the market – which of course is the whole point. Central banks are trying to stop inflation from getting out of control. They have to put a lid on demand.”

Mr Moodie said that the rate that financiers have to pay for the long term money needed to organise cover the life of the loan on a car is going up.

“That’s the issue. It went up before Ukraine started. Inflation in the US is over 7 per cent. So, the US has already moved on interest rates and is moving again. New Zealand’s moved a couple of times. Our Reserve Bank was talking about not moving until 2023-2024. It is now almost certain to move this year more than once.”

Mr Moodie said that, with the heat of the market driven by the lack of stock, and the fact that buyers are showing a willingness to wait long periods for cars, the question is to what effect will inflation or interest rates across the community have on hosing-down demand; a little or a lot?

“You can just see it coming with the logistics and supply chain issues driving prices up, you’re going to have this double whammy of inflation driving both the price of the car up and the cost of the interest up. And if increases in real wages don’t follow it, and they have always been pretty soft, you’d have to expect that demand will be pinched in some way.

“When interest rates start to climb, and mortgage payments go up, people start to feel a little bit less confident,” he said. “On the upside, the gap between supply and demand right now in our industry is so wide, we can expect sales to hold up for quite a long time. I still expect a million new vehicle sales this year and we know how tight the used car supply is”

Mr Moodie said financiers look to the swap rate because that is what the market perceives the future interest rates will be.

He said the swap rate was established by traders around the world who look at what all the central banks are saying and doing. They look at inflation in the US, they study what’s happening in China and key nations then they try to make an educated guess.

“At the moment they are looking at interest rates going up because there’s so much upward pressure on oil and other inflationary factors that are hitting the market right now.

“They are predicting that central banks are going to want to dampen demand and put a lid on inflation. And the only tools they really have is to start moving their cash rates up. As a result, we’ve seen this pressure on the swap rate.

“With uncertainty in the market, credit becomes more expensive. Then, rates and margins start to climb, which is happening in the fixed rate market where all the car financiers are. Already we’ve seen the impact with the majority of dealer financiers move rates up to varying extents.

“As an industry, we have had ten years of not having to worry about interest rates because you’ve been in a downward rate market where, if anything, your margin gets sort of enlarged temporarily. And then you have to drop your rates to be competitive.

“But when you’re in an upward-rate environment, that takes a lot of discipline, you have to start moving up or your margin disappears.

“At the end of the day the indications are that supply will eventually start improving. This will see the gradual reduction in margins and demand may well be dampened down by the factors of inflation and interest rates and more pressure on household budgets than we have seen for a few years. Good quality, well-trained business managers will come into their own as they help customers navigate the financing process in more challenging times – we at Allied intend to help with training and other assistance where we can.

“It could be worth factoring into the business plans that the time of plenty is going to begin to be squeezed from both ends. As the cash rate rises, so will floorplan rates.” Mr Moodie said. “Low stock availability will keep a lid on floorplan interest costs, however dealers should be factoring in increasing stock levels leading to higher floorplan funding costs as the market normalises in 2023 and beyond. It’s just a matter of being prepared.”

Footnote: Another factor for dealers in a rising interest rate environment is the question of what the interest rate will be when it is time to activate the loan at the time of delivery in, say, 10 months, and how will the dealership handle the explanation of the increase to the customer?

Mr Moodie said: I think it’s fair to say that dealers and financiers will have to manage that challenge. Most finance companies can’t hold interest rates for approved loans beyond three to six months. Especially when such a high proportion of sales are build-to-order.

Dealers need to ensure the expectations of the buyers are set appropriately and that there is plenty of servicing capacity because the finance company may need to do a quick reassessment of the applicant if the delivery is several months after the finance approval.

By John Mellor

Read More: Related articles

Read More: Related articles