The growing preference towards organising car loans online was revealed in an F&I panel discussion held by Angle Auto Finance at the recent AADA Convention.

The research also revealed that an increasing number of buyers who intended to get a car loan from a bank or lender end up actually buying the loan at the dealership.

The panel, entitled: Achieving growth through an omni-channel buying and financing experience included Alex Farrugia, Angle Auto Finance; Anna Perera-Shaw, RFI Global; James Nipperess, Sime Darby Motors Australia; Evange Epa, Angle Auto Finance; and Toby Simmons, EKTO Advisory and Investment.

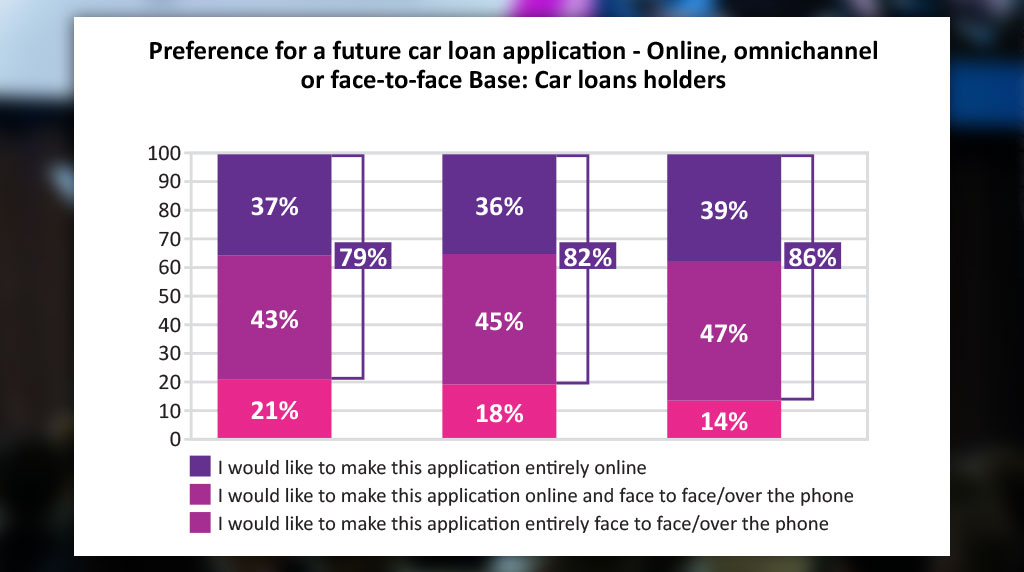

Panel member, Anna Perera-Shaw, of research firm RFI Global, told delegates that in the three years from 2020 to 2022, the number of buyers showing a preference for making a total application online or online followed by personal contact (i.e. face to face meeting or phone call) has increased from 79 per cent in 2020 to 86 per cent in 2022.

At the same time, the number of people who want to make the application entirely face-to-face has declined from 21 per cent to 14 per cent.

Ms Perera-Shaw said that in spite of the growing preference for online or omni-channel, “we can’t ignore the fact that some customers have a preference for face-to-face applications and that may be because they have always bought cars this way”.

“But it’s really worth thinking about. How do customers want to apply? What is their preference and how can you accommodate their preferences? Especially as we think about the online application.”

The research also showed that while the numbers of current loans holders who said they are already comfortable with buying a new car entirely online has risen from 35 per cent to 37 per cent, the number of current loan holders who said they were not comfortable with buying a new car entirely online has fallen from 42 per cent in 2020 to 25 per cent in 2022.

Asked by moderator Alex Farrugia, of Angle Auto Finance if the numbers for used cars were very different, Ms Perera-Shaw said: “We asked how comfortable would used car buyers be buying a used car entirely online and the comfort level right now is lower for used car buyers.

“Compared to the 37 per cent for new cars, it’s actually 30 per cent for used cars, which actually is quite high considering there are more steps and potentially more opportunities where customers would want to see the car, to really understand the detail about it.”

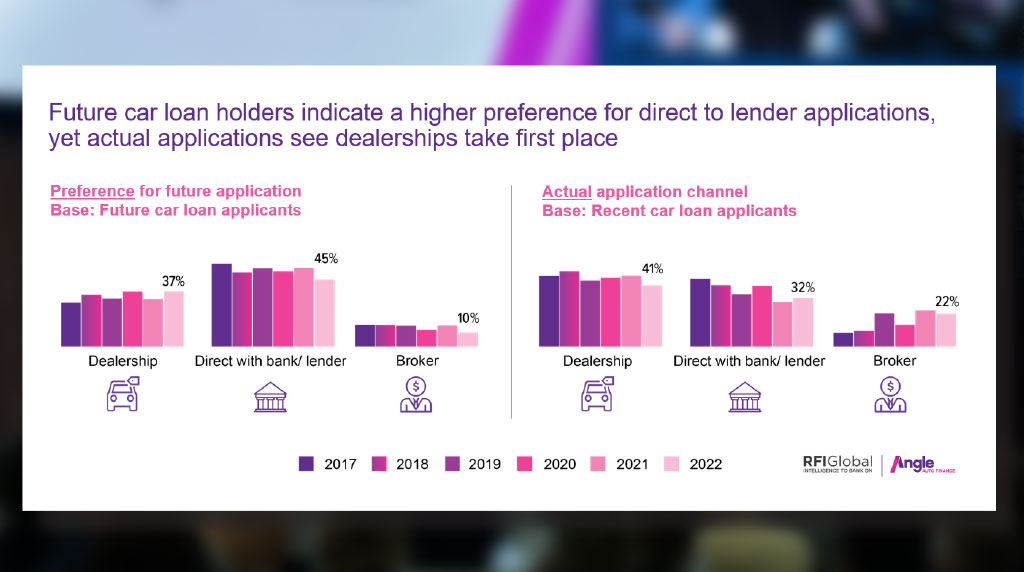

Ms Perera-Shaw said the research asked the cohort of future car loan applicants, customers who are in the market to buy a car and intending to use finance, how they prefer or what they are planning in terms of the future application channel; is it with a dealer, is it directly with a bank or lender, or is it a broker?

“Forty-five per cent of those prospective or future car loan applicants say they’re intending to go directly with a bank or lender. This could be driven by a main bank relationship, potentially customers who haven’t had finance before and they think they will go straight to their main bank, and maybe that’s a major bank, or a bank they have a legacy relationship with.

“Thirty-seven per cent intend to go to a dealership. But an interesting thing happens when you look at recent car loan applicants who have been approved for finance and bought a car in the last two years using finance.

“Forty-one per cent actually took out finance at the dealership and only one in three, or 32 per cent, ended up actually applying directly with a bank or lender.

“Essentially, there is something happening when customers are intending to go directly with their bank or lender, but they end up with a dealer. There is a compelling difference between that intention versus what customers actually end up doing,” Ms Perera-Shaw said.

“It could be due to the dealership knowledge and knowledge of the cars themselves and that expertise is potentially part of why we’re seeing that number being so high.”

James Nipperess, group general manager – sales & financial services at Sime Darby Motors Australia, which is partnering with Angle Auto Finance in building an omni channel experience for Sime Darby’s SD Motors website, told the panel: “I think it really underpins the role that the sales team and the business managers play in supporting the omni-channel online offer.

“Initially, 37 per cent of customers express their intention to utilise dealer finance when making a vehicle purchase. However, this figure increases to 41 per cent as customers become actively engaged in the dealership process.

“This data underscores the significance of business managers and sales consultants in integrating finance seamlessly into the sales process, thereby influencing the customer behaviour positively. It also highlights the fact that the average consumer tends to underestimate the value of dealership finance.

“We have significant responsibility in educating customers about the benefits of our financial offering. Additionally, we must have confidence in the products we offer within the dealership, ensuring they resonate with customers.” Mr Nipperess said.

Evange Epa, of Angle Auto Finance, who is training dealerships through an Angle Edge excellence program, said: “What we have experienced is when buyers go into the dealership, the high performing dealerships will do a very good job at demonstrating their immediate value from a product perspective, as well as from a service perspective. And then the customer embraces that value and goes with it.

“With the Angle Edge training and excellence program we share industry insights and best practice around what some of the best dealerships are doing to convert more finance customers.

“We spend a lot of time in data analytics and we spend a lot of time educating business managers, dealerships and sales teams to really demonstrate that value,” Mr Epa said.

By John Mellor

Read More: Related articles

Read More: Related articles