Under new managing director Ben Farlow, who took the steering wheel last September, Peugeot Citroen Australia (PCA) – which is part of Inchcape Australasia and has controlled the French PSA brands since 2017 – has just returned the mid-size Expert van to market in its new-generation guise after imports of the previous model, and the Partner small van, were halted in 2013.

This was at a time when former distributor Sime Darby had just added Citroen to its stable (taking over from Ateco Group) and was reconsidering the case for LCVs across both the Peugeot and Citroen brands, sticking with latter’s long-running Berlingo while working with the factory in France to have a tilt with the new Citroen Dispatch mid-sizer, which is a sister model to the Expert.

This never eventuated as Inchcape took over, and now the current team has a unique opportunity to mount a full-scale attack on the marketplace without a competing interest, as Ateco previously sold the Berlingo and Dispatch while Sime battled with Partner and Expert from 2008 to 2013.

Inchcape has no intention of limiting the sales potential of its LCVs by offering competing models in the same segment – or simply complicating the issue by offering a mix of vans across both brands – and has made the decision to reposition Citroen as primarily an SUV marque while Peugeot will have a “a more considered and understated” focus with entrants across all major segments: passenger car, SUV and LCV.

It must now attempt to hold onto Berlingo buyers when the new Partner arrives in the third quarter – no small feat, given Citroen’s compact van is a rarity in building up a loyal following over many years in a segment that is typically driven by price – while also drawing in new customers with the broader line-up that includes Expert and the forthcoming Boxer large van, which will launch around the same time as Partner.

With Expert, PCA expects to mount a strong challenge to the well-established leading brands in the ultra-competitive 2.5-3.5t mid-size van segment, which is worth 20,000-plus sales a year overall and is dominated by the soon-to-be-overhauled Toyota HiAce, Hyundai’s iLoad and a number of strong European-bred lines including the Volkswagen Transporter, Renault Trafic, Mercedes-Benz Vito and Ford Transit Custom.

It must also contend at the entry level with the fast-growing G10 van from Chinese brand LDV, which is handled by the highly experienced Ateco.

Numbers? Not surprisingly, PCA is keeping its sales forecasts out of the public domain for now, but its success will hinge on striking significant fleet contracts, attracting a wide range of businesses and ensuring its dealer network can effectively switch from a heavy retail focus on privately owned passenger cars and SUVs to corporate deals on highly price-sensitive LCVs.

Hard yakka: Peugeot is aiming to at least match the sales of its European rivals with the Expert mid-size van now on sale in Australia, despite a failed previous attempt under a different distributor.

The company has waited until it can offer specifications that will appeal to the Australian market – top of the list being a conventional automatic transmission – but, as always, sales will also depend on a host of other factors such as the marketing resources thrown at the models, delivery times, trade fit-out options, servicing and repair costs, and so on.

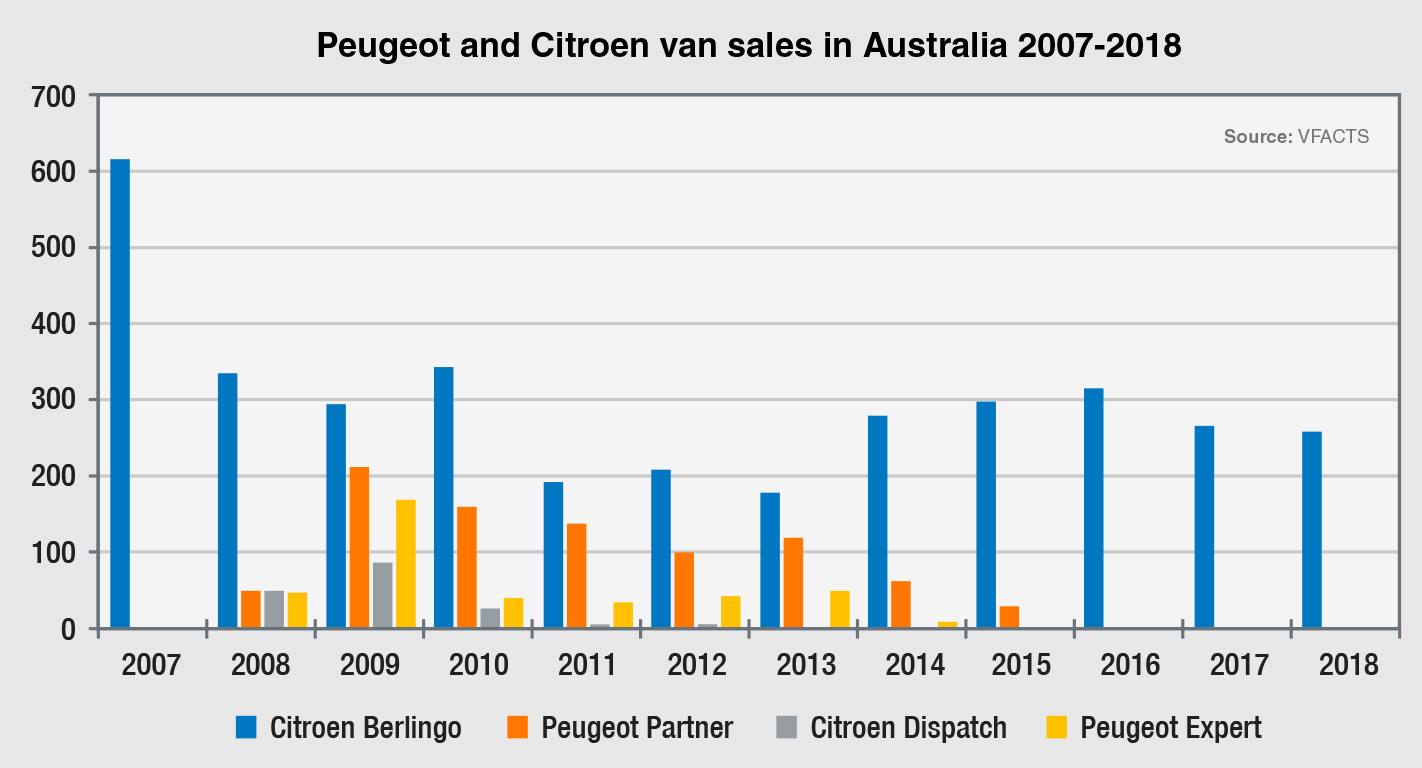

Under Sime, the Expert peaked at an untenable 169 sales in 2009 and otherwise only managed between 35 and 51 units between 2010 and 2013. At the same time, Ateco likewise peaked at a paltry 87 sales of Dispatch in that GFC-ravaged 2009 market, dropping off to 27 units the following year and just a handful from then on as stocks ran dry.

The only way is up for PCA, with its first assignment to at least match its French rival Renault, which has spent the past seven years doing exactly what Inchcape is attempting now – establishing a solid presence in the marketplace with its light-commercial van range.

The Trafic recorded 1922 sales last year, down slightly on the 2037 units it recorded in 2017 but providing ample demonstration of what is possible after building from the 100-200 mark at the early part of this decade to more than 1100 by 2013 and, with the third generation launched in 2015, finding further incremental growth despite the lack of an automatic transmission.

Volkswagen similarly manages around 2000 sales a year with Transporter – a major update for which is due early next year – while Hyundai shifts about 5000 units of iLoad. HiAce, which enters a new generation mid-year, is king with around 7000 sales a year.

Ford’s Transit Custom also posted almost 1900 sales last year, while Mercedes’ Vito and the LDV G10 both pushed past 1300 units. All were in positive territory as the segment slipped 6.6 per cent overall, and although this year is proving tough for all-comers, Transit Custom is continuing to buck the trend with 27 per cent growth after the first quarter.

In the segment below (-2.5t), the Sime-run Partner peaked at 212 sales in 2009, only to fall 24 per cent the following year, 14 per cent in 2011 and 28 per cent in 2012, sending it below 100 units. It climbed back to 120 in 2013 as the decision was taken run the model out and focus on Berlingo, which has been a remarkably consistent performer over the past decade, averaging 270 units from 2008 to 2018.

Berlingo’s best year when running head-to-head with Partner was 343 sales in 2010, twice as many as the Peugeot managed that year, but we are also mindful that Berlingo comfortably racked up more than 600 sales in 2007 when there was no such competition.

With the untested Boxer on-board, Peugeot’s three-tiered LCV range will emulate that of Renault with its Kangoo, Trafic and Master – and which last year posted a combined 4467 sales, marking 45 per cent of the brand’s overall sales and 1629 units more than the Peugeot brand’s entire tally (2838).

PCA clearly has a hard slog ahead of it, but at least there is an air of optimism surrounding its new direction and no obvious reason why Peugeot cannot at least match the volume of its European rivals in the van segments – if it all goes according to plan.

By Terry Martin

Read More: Related articles

Read More: Related articles