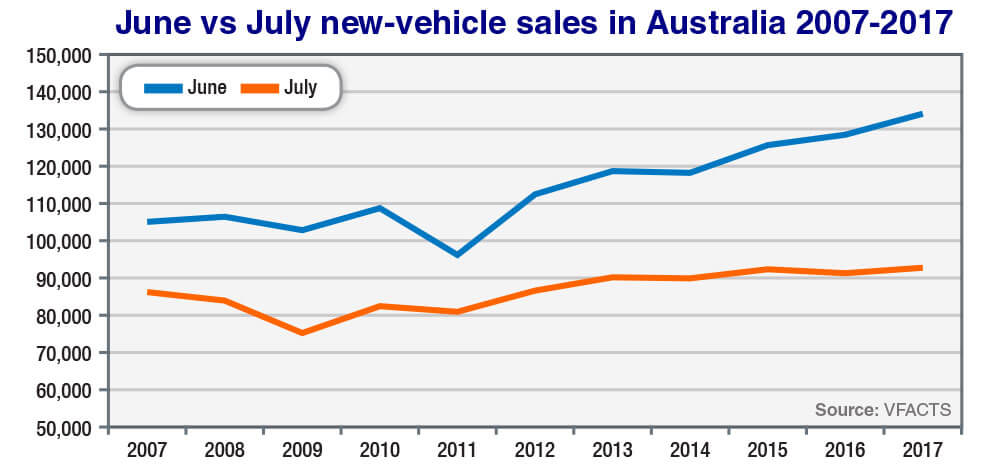

The frenzied activity at the end of the financial year always produces a surge in sales, followed by a significant fall in July as EOFY deals expire and the surrounding sales and marketing mayhem tapers off.

This year, the 134,171 new registrations in June was followed by 92,754 sales last month – a massive 30 per cent tail-off with 41,417 fewer vehicles which, if anything, shows the underlying strength of the market rather than any cause for concern.

While June was the industry’s highest monthly sales tally in history, the July result was the highest result ever for the seventh month of trading. May also produced a record for that month (102,901), as did March (105,410).

So for the past three months in a row, and in four of the past five months, the industry has pushed higher than it has ever been before on a monthly basis.

Since breaking through the ‘magic million’ sales mark in 2007, the Australian new-vehicle market – often described as “mature” or even “saturated” – has repeated the performance every year bar one.

The year in question was 2009, when the effects of the global financial crisis had permeated the sector, although the industry soon recovered on the back of government stimulus measures, low interest rates and improved consumer confidence.

Barring external shocks such as the GFC and the supply-crippling 2011 Japanese earthquake and tsunami, the sales discrepancy between frenetic June and cool July over the past ‘million-unit’ decade has, for the most part, been consistent, averaging about 26,000 units but certainly pushing higher into the 30,000s over the past couple of years as the industry recorded 1.155m sales in 2015 (up 3.8 per cent on the previous year) and then hit 1.178m units last year (+2.0%).

Post haste: There might have been 41,400 fewer buyers last month than in the frenzied EOFY month of June, but the industry still recorded a strong result, led by the Toyota HiLux on 3742 sales.

For the year to date, the market is sitting 0.4 per cent ahead of where it was last year on 692,306 units, with the standout performances in March and from May to July tempered by two months in which sales were down compared to the corresponding month last year – February (89,025, -7.7%) and April (83,135, -5.1%).

January was a steady start to the year with 84,910 units, lineball (+0.6%) with the opening stanza last year.

The Federal Chamber of Automotive Industries (FCAI) is anticipating another record year for the market, underscored by continued growth in the SUV and light and heavy commercial vehicle segments – up 5.6, 4.8 and 8.1 per cent respectively – which is compensating for the decline in passenger car sales (-6.7%).

There is also solid growth coming out of the business and rental markets, with a 15.2 per cent increase in sales of SUVs to the business sector last month – SUVs now being the most popular segment in the market for business sales, and for the year to date are up 10.3 per cent – while sales of SUVs to rental fleets rose 50 per cent last month to be up 36.3 per cent YTD.

Across all vehicle categories, rental fleet sales up are 12.6 per cent this year (to 34,982 units), while the higher-volume business sector sales are up 2.0 per cent YTD (277,907). Private owner sales are down 2.1 per cent but remain the single biggest buyer group at 336,468 units YTD, while government sales are also down 3.5 per cent (23,190).

Among the states, Victoria is the standout performer with sales up 4.2 per cent last month and 4.3 per cent for the year-to-date (to 194,912 sales), while the nation’s biggest-selling state, New South Wales, is on an even keel with last year, 1.3 per cent ahead last month to be 0.1 per cent in front for the year (to 233,037).

With an 8.7 per cent rise in sales last month, South Australia is now 1.5 per cent ahead YTD (41,835) and Tasmania is likewise holding its end up (10,290, +1.1% YTD), while Western Australia is continuing to struggle at 55,800 units YTD – down 7.2 per cent after an 8.0 per cent fall last month.

Queensland is also down 1.2 per cent this year (138,694) and the ACT has slipped 1.0 per cent (10,947), although the Northern Territory had a bumper month in July (+10%) to be 1.1 per cent ahead YTD (6791).

Overall, there is plenty to be optimistic about and every indication that the market will not only post its eighth consecutive year above one million sales, but will achieve its third consecutive record result.

The July “cooldown” is purely seasonal – and we are now anticipating a long, hot summer.

By Terry Martin

Read More: Related articles

Read More: Related articles