A SURVEY by the Australian Automotive Dealer Association (AADA), primarily to track trends in electric vehicle buyer intentions, has separately revealed that franchises that are strong on SUVs will benefit as buyers say they are going to swing even more than they have into owning sport utility vehicles.

And dealers are likely to see buyers sooner than originally indicated.

But the news is not good on the passenger car front. The research shows the swing against buying passenger cars, which is already well established by the sales numbers from the past few years, is set to accelerate.

Researchers asked 2000 car owners what type of car they had in their households currently and then asked what type of cars they were likely to buy when they replaced those household vehicles.

Currently, the survey showed, 42 per cent of first, second and tertiary cars in the household were SUVs.

But, the survey revealed, the preference for SUVs in terms of replacing all those household vehicles grew to 56 per cent suggesting that well over half the market for household vehicles moving forward is going to be SUVs. This is a big shift by any standards.

But with passenger cars, which are currently one in two of all the household vehicles surveyed, the number of passenger cars in households based on replacement vehicle preference is heading for just one in five.

This has significant implications for used vehicle values. It suggests increased demand for used SUVs and a glut of used passenger cars.

(Note this data was gathered before the announcement of the NVES and was not likely to be influenced by fallout from that scheme which could affect the numbers as the NVES plays out).

Within the SUV category, medium SUVs are predicted to rise from 25 per cent of household vehicles at present to 32 per cent after replacement. Small SUVs are predicted to rise from 10 per cent to 13 per cent and large SUVs are predicted to rise from 7 per cent to 11 per cent.

On the passenger side, small cars are predicted to fall from 25 per cent of household vehicles to 15 per cent – a massive 10 percentage point drop – and medium cars are predicted to fall from 19 per cent of household vehicles to 14 per cent. Large cars will fall from 4 per cent to 3 per cent.

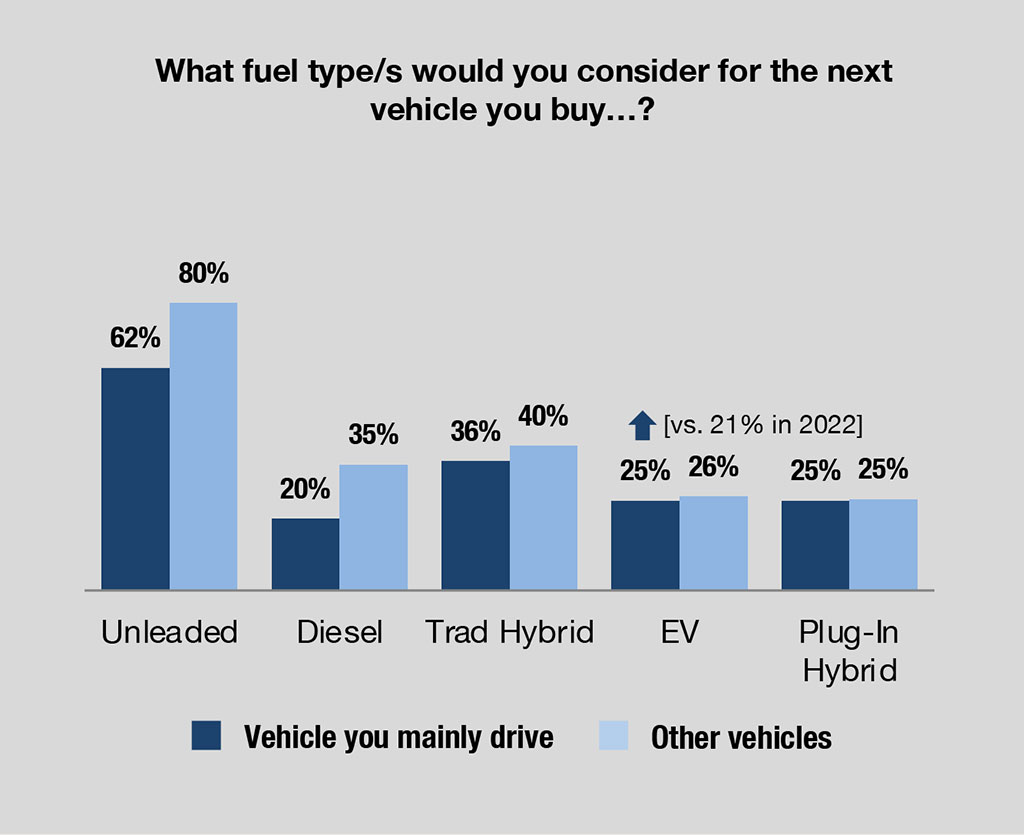

Referring to the type of fuel type buyers might chose to replace their current vehicles, the survey said: “The headline remains that unleaded engines are most likely to be the expected ‘next vehicle’ for both the main vehicle driven (62 per cent) and other vehicles to be replaced in the household (80 per cent).

It indicates greater openness to alternative fuel types when it comes to the main household vehicle than for secondary/tertiary vehicles (which may be of a lower value).

“Around two in five are open to traditional hybrid vehicles for their next main vehicle (36 per cent), while just one-in-four (25 per cent) are open to a plug-in hybrid.

“Consideration of EVs for their next main vehicle is at 25 per cent of the market, which is up significantly from the last wave of research (21 per cent). This figure is now above consideration of diesel engines (20 per cent). It indicates that consideration of EVs – while still behind hybrid and unleaded – is on an upward trajectory.

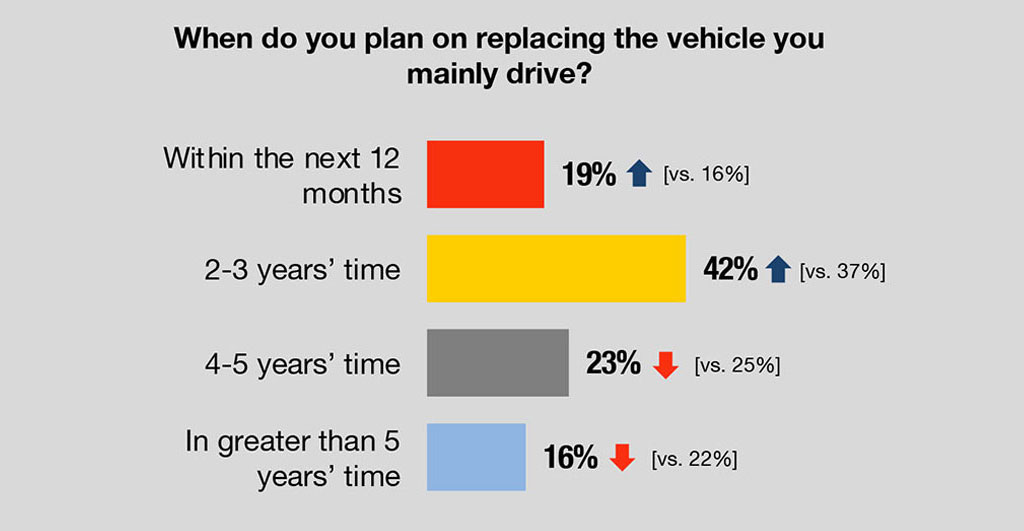

The research also contained good news for dealers in that, compared to results obtained in 2022, the timeline for vehicle replacement has shifted significantly closer.In the 2024 data, 61 per cent of respondents are planning on replacing their main vehicle within the next three years (up from 53 per cent).

“This does vary by the age of the driver’s current main vehicle:

- 63 per cent of those with vehicles more than 10 years old are more likely to update their vehicle in the next 0-3 years

- 60 per cent among those with a vehicle 5-10 years old

- 52 per cent among those with a vehicle aged 1-3 years.

Most commonly, main vehicles are notionally going to be replaced with a brand new (rather than used) vehicle (69 per cent new / 31 per cent used), up slightly on 2022 results (67 per cent intended new). It suggests that in spite of cost of living pressures being noted across Australia, there’s an ongoing desire and need to replace vehicles.”

Meanwhile, here are some of the headline findings of the research concerning electric vehicle purchasing attitudes:

- Three in five say that they are less open to paying more for EVs due to cost of living pressures.

- Respondents open to buying an EV for their main vehicle has grown from 21 per cent in 2022 to 25 per cent in 2024.

- The price premium consumers are willing to pay for an EV over a traditional fuel type is

8 per cent up from 6 per cent.

- More than two-thirds believe governments should be incentivising more customers to transition to EVs.

- 57 per cent are not open to an EV due to perception that EVs cost too much, but this is down from 62 per cent.

By John Mellor

Read More: Related articles

Read More: Related articles