DEALERS in the United Kingdom, which has a used car market very similar in structure to Australia, are being told that approaching challenges in the used car market will require the use of incisive data analysis of stock management and pricing, the curating of a following within the local market and building a differentiation built around unique customer experiences.

In the most recent article from the insight and strategy director at Cox Automotive Europe, Philip Nothard summarised the nature of the UK used car market for 2024:

- Cox Automotive anticipates challenges in the 2024 used car market, including realigned vehicle values, supply shortages, economic uncertainties, and EV sector volatility

- Data and insights will play a crucial role in navigating the complexities of the evolving landscape

- The EV market is poised for continued volatility despite rapid growth in used vehicle volumes due to persistently low consumer demand

- Differentiation, superior customer experiences and localised retention strategies are emphasised for dealers and manufacturers to thrive in the competitive market

- A surge in demand is expected, prompting retailers to replenish stock rapidly for a strong start in 2024

- The market exhibits a division between retailers and vendors, with dealers strategically managing a mix of old and newly priced stock

- The fleet and leasing sector continues de-fleeting with residual values set before the pandemic bounce

Mr Nothard said that data, differentiation, and precision will drive success in 2024’s used market:

- Attention to used market shifts will be crucial in the year ahead

- Navigating the coming year means a deepening use of data and insights

- EV sector set for continued volatility

“Vigilance in the face of used market complexities will be key to success for industry players in 2024,” the Cox Automotive analyst for Europe said.

“Several continuing trends, including the realignment of vehicle values, supply shortages, economic uncertainty, and continuing EV market volatility, are likely to underpin those complexities.”

Mr Nothard was writing in Cox Automotive’s Insight Report, in which he said dealers and manufacturers needed to evolve to weatherproof their businesses in the year ahead.

“The used market remains in a delicate transition, as we have seen over the past few years.

“Inconsistency persists in many areas, including where vehicle values and production shortages are concerned. The latter continues to have a marked impact on the number of vehicles entering the used arena.

“In 2024, navigating the changing landscape requires all concerned to have a steadfast connection to data and insights. Used vehicle operators must react to change and should not wait in vain for a return to old market dynamics,” Mr Nothard said

He said that as the repercussions of production shortages persist, the industry must prepare for ongoing transformations in vehicle stock profiles, new fuel types, varied ages, and distinct mileage profiles in the used vehicle parc.

He said the EV market is poised for continued volatility as volumes rise, retailers gain confidence, stocking dynamics evolve, and price entry points decrease.

“Volumes of used EVs are growing fast, but consumer demand remains damagingly low,” he said.

“The used market for them is yet to find its feet – all of which is fuelling the instability of values. These negatives will surely be diluted as the sector continues to evolve, as prices lower, range and technology improves, and pricing becomes more attractive thanks to competition from new entrants.”

Mr Nothard said Cox Automotive believes an anticipated surge in demand will prompt retailers to swiftly replenish their stock levels for a strong start to 2024.

“Ongoing value realignment is creating a market division between retailers and vendors.

“Dealers will strategically manage a mix of old and newly priced stock. At the same time, the fleet and leasing sector continues its vehicle de-fleeting process with residual values set before the pandemic bounce.”

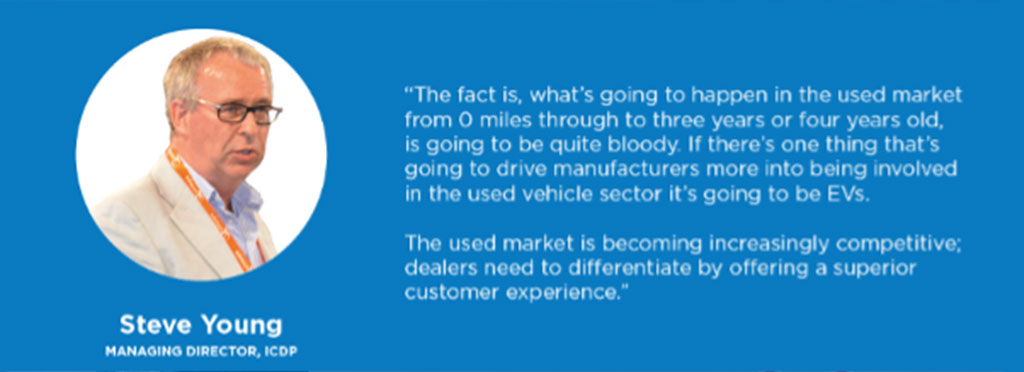

The managing director of the International Car Distribution Program (ICDP) Steve Young wrote in the report that things are set to become ‘bloody’ when it comes to vehicles from zero-to-four years old.

He said: “The used market is becoming increasingly competitive; dealers need to differentiate by offering a superior customer experience.”

He added that EVs would become a driver that would get OEMs more involved in the used vehicle market.

Chris Ashton-Green, the founder and CEO of Regit, a digital service for car owners said he believes manufacturers may feel as though they have missed out on the used market in terms of sales and access to customer data.

He said: “If manufacturers are going to maximise what they can get from used cars long-term, they will need to adopt localised customer retention strategies, as what works in one region may not work in another.”

Ian Plummer, commercial director of Auto Trader UK, says the reshaping of the used market in recent years has underscored the value of data and requires a greater emphasis “on retail values rather than trade” and meeting the challenge posed by a drop in the supply of younger vehicles.

“This has brought unique challenges,” he said. “Not least the necessary reconditioning impacting both overheads and stock turn.”

By John Mellor

Read More: Related articles

Read More: Related articles