In Australia, evidence is emerging from dealers reporting slow sales of used Teslas and difficulties by dealers in fetching advertised prices.

One dealer told GoAutoNews Premium that new Teslas remained in demand by buyers wanting the latest EV technology. These buyers were generally financially able to buy a new EV, were very interested in technology and wanted the latest equipment.

But, while buyers of used Teslas also wanted technology, he said that they worked to a budget and were concerned about issues such as battery life.

He quoted a Tesla Model S on an Australian used-car lot that was already reduced in price and was still having difficulty attracting interest.

The trend is global. In the UK, Automotive Management Online (AM Online) publication reported that used EV prices were falling “four times faster than their diesel-fuelled equivalents.”

“EVs are declining at a rate of 2.1 per cent at year one and 10,000 miles, compared to 0.9 per cent for petrol and 0.5 per cent for diesel and hybrid cars,” it said.

It said UK dealers were avoiding used EVs as customer demand stalled on “consumer pushback”. This has been triggered by rising energy prices and media coverage of queues at public charge points.

“Manufacturers are starting to deliver EVs in greater volume and, at the same time, finance repayments are looking more appealing on a new EV than they might in the used sector. It makes for a difficult part of the market for used car retailers to operate in.”

UK vehicle valuation service, Cap HPI, warned that further ‘significant reductions’ in used EV prices were being factored in after Tesla’s Model 3 lost a quarter of its value in less than four months.

Cap HPI said that Tesla had made almost a third of its 2022 new car registrations in the UK in December alone.

In the US, used prices are falling with some analysts saying Tesla’s production has increased to the point that there are no cars on the order books.

The sale rate is now in line with the car’s production volume. To keep inventories from inflating and cars waiting in storage, Tesla has reduced the price of the cars and slowed production.

Fortune magazine in the US said this had put downward pressure on used car prices.

It quoted US automotive analyst Doug DeMuro as saying: “A year ago you could buy one and flip it for ten grand more than you paid, that is not the situation today.”

In Australia, Carloop founder Riz Akhtar, who researches the EV market and supplies data on trends, said the slide in Tesla used prices had been aggravated by Tesla this month reducing the new-car price – by as much as $4000 – which has also eroded values.

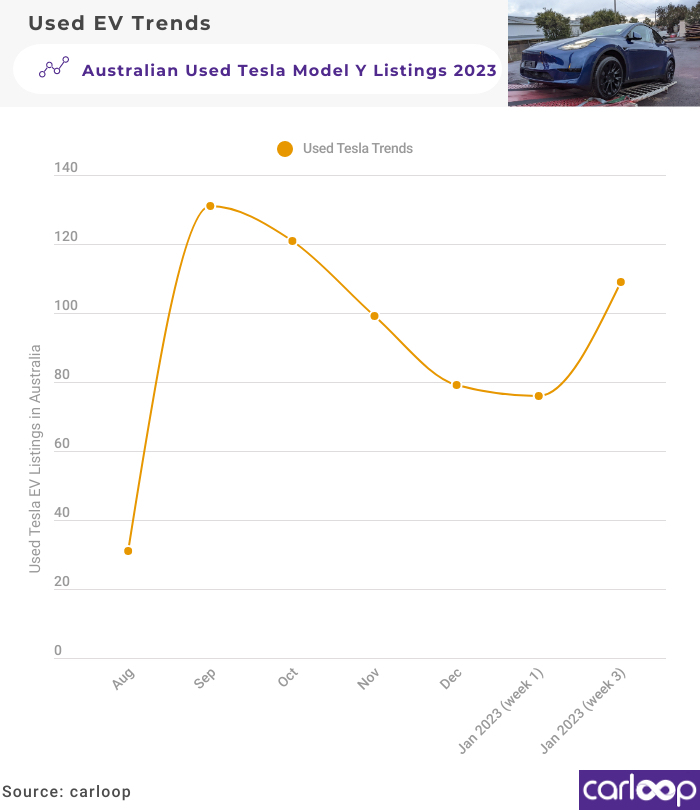

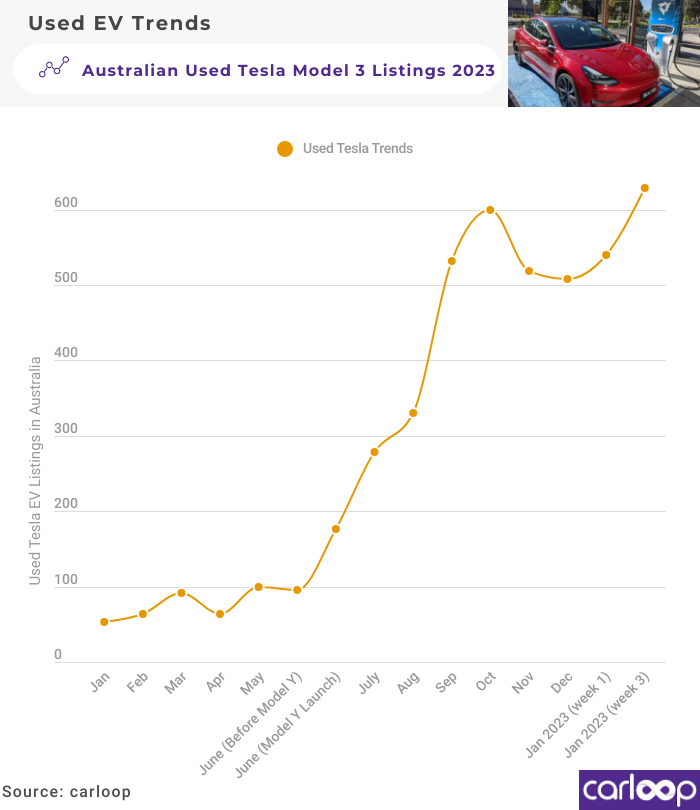

He said Carloop had tracked the listings of EVs – including Tesla – across multiple platforms and in the case of the Model 3, used-car listings showed an increase as the new Model Y was introduced.

“Some owners were selling their Model 3s, after only a couple of years, because of changes to their lifestyle – such as a family which requires a bigger car,” he said.

“They placed an order for the Model Y in anticipation of its launch in Australia and when these used Model 3s hit the market, prices were initially strong at about $70,000 because the car was at a premium.

“As more used Model 3s came on the market, used prices started to fall to the high $60,000s. Then in October and November 2022, there was a relatively large shipment of new Model 3s.

“Because the wait times for Tesla are now not excessive, people are prepared to wait and buy a new Tesla which has also impacted on the used price.”

Mr Akhtar said Tesla new-car buyers aren’t having the same problem as some other high-demand models, such as the Toyota RAV4.

He said that buying new also accessed an EV subsidy available in many Australian states and territories.

“Tesla will apply for the customer rebate on their behalf and the buyer will only pay whatever the rebate doesn’t cover,” he said.

“That could be around $65,000 for a brand new Tesla Model 3. That makes buying new attractive because you won’t have that saving when buying used.

“All this makes it pretty difficult for dealers to try and move those cars.

“On top of that, budget buyers wanting an EV but can’t quite afford a used Tesla have a lot of less expensive, new EVs from other companies including BYD and MG.”

The general consensus is that used EV prices will continue to fall.

AM Online said Tesla’s move to cut its new-car prices would likely lead to compound falling residual values that have already seen the average Model 3 lose 23 per cent of its value on the UK market in the past 12 months.

But it said that Tesla was not alone in suffering residual value decline.

“Tesla’s Model 3 was down 6 per cent month-to-date at the end of last week, with the Model S down 4 per cent and Model X and Model Y each down around 5 per cent,” AM Online said.

“Audi’s etron is down 3 per cent, the BMW i3 down 5 per cent and Fiat 500e also down 5 per cent in the same period.

“By comparison, the average used car in the UK declined by 0.6 per cent month-to-date to the end of last week at three years and 30,000 miles, with older cars faring better.

“Average used car values grew 0.3 per cent at five years and 80,000 miles and by 1.3 per cent at 10 years and 100,000 miles during the same period.

“Dealers are out to buy again and, all-in-all, it’s all quite positive apart from the EV picture.”

GoAutoNews Premium approached Tesla for a comment on this story.

By Neil Dowling

Read More: Related articles

Read More: Related articles