The latest data from Cox Automotive Australia (Cox) shows dealer used-car prices were down 0.9 per cent in May.

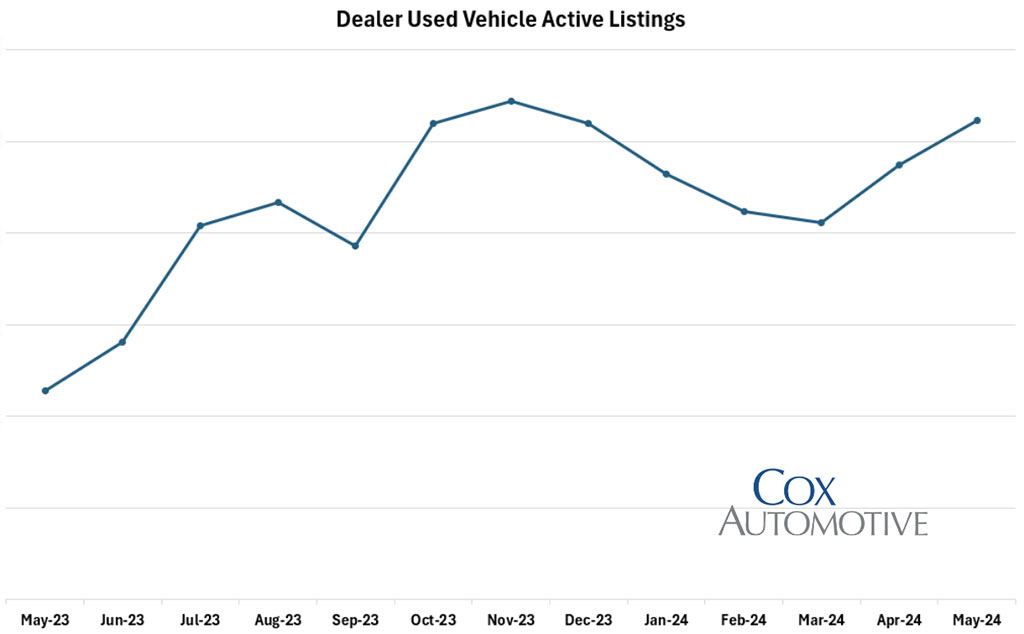

“While sales of dealer-listed used vehicles grew 6.7 per cent for the month and are up by 4.9 per cent for the year, dealer inventory hit the second-highest level in the past 12 months and is up a more robust 16.1 per cent year-over-year,” Cox stated in its May report obtained by GoAutoNews Premium this week.

The wholesale auction market saw a recovery in sales volume with Manheim Australia recording the highest passenger and light commercial monthly tally in almost four years.

Auction volume is up more than 40 per cent this year on strong OEM, fleet-management, government, and dealer asset volumes.

On a month-to-month (MoM) basis, Manheim’s monthly auction sales were up 10.3 per cent in May and 40.6 per cent up year-on-year.

Cox reported that the number of used and demonstrator vehicles actively listed in retailers grew 2.3 per MoM in May as inventory swelled to its highest point since November 2023.

The used vehicle numbers come from the Cox retail database sourced from dealer-facing SaaS inventory and retail solutions. This data represents a significant proportion of Australia’s total dealer-used vehicle market.

“Almost half of all dealer used and demo listings (47.7 per cent) are SUVs, 30.2 per cent are traditional passenger vehicles, and 21.6 per cent are light commercial utes and vans,” Cox said in its May report.

“Only 0.5 per cent of listings are an EV or PHEV, as the market awaits the first significant wave of pre-owned vehicles.”

Despite the inventory growth overall Market Days’ Supply ended May at 64 days, down from 65 days in April and below the CAA benchmark of 70 days. As recently as December 2023 the MDS figure was 68 days.

The top five most common vehicles in dealer used inventories are the Ford Ranger (stock up 3.7 per cent MoM), Toyota Hilux (down 1.3 per cent), Toyota Corolla (up 11.4 per cent), Toyota RAV4 (up 13.7 per cent), and Mitsubishi Triton (up 4.6 per cent).

The availability of late model used Toyota RAV4s increased significantly as new models returned to the supply pipeline. RAV4 inventory increased by 16.1 per cent MoM for examples aged under two years, and 23.9 per cent for those aged two to four years.

Cox also said that dealer used and demo vehicle sales were up 6.7 per cent MoM and 4.9 per cent YoY, and on a YTD basis are 9.3 per cent higher than the same period in 2023. The aligns quite closely to new market sales growth of 12.2 per cent YTD.

“Driven by growing inventory levels and more discounts on the new vehicle side, dealer-used transaction prices fell for a third straight month and on a market-wide basis are the lowest they have been on average since late 2021,” the report said.

Cox measures price changes through its Dealer Used Vehicle Delisted Price Index, which tracks average sale prices compared to a baseline period of 100 points in December 2019.

The index currently sits at 134, denoting an average 34 per cent used sale price increase (volume-weighted and adjusted by new MSRP) including inflation between December 2019 and May 2024.

Cox said that the index is down 6.8 per cent YoY, and down 9.5 per cent from the all-time high price index of 148.1 which was hit during August 2022 when COVID-era shortages were biting hardest.

It said that 47.8 per cent of dealer used sales in May were SUVs, 30.9 per cent were passenger cars, 21 per cent were light commercials, and 0.3 per cent were BEVs and PHEVs.

Across all segments, 39.7 per cent of sold used vehicles received some level of price cut between listing and sale, by an average of 7.0 per cent per unit.

The top five used vehicles sold regardless of age were the Ford Ranger (up 12.9 per cent MoM), Toyota Hilux (up 13.5 per cent), Toyota Corolla (down 2.7 per cent), Toyota RAV4 (up 10.6 per cent), and Mitsubishi Triton (up 10.8 per cent).

“Digging a little deeper, we saw sales of used Toyota RAV4s aged under two years hike 19.2 per cent MoM, sales of Toyota Camrys aged five to seven years increase by 32 per cent MoM, and sales of Ford Rangers aged eight to 10 increase by 20.9 per cent,” the report said.

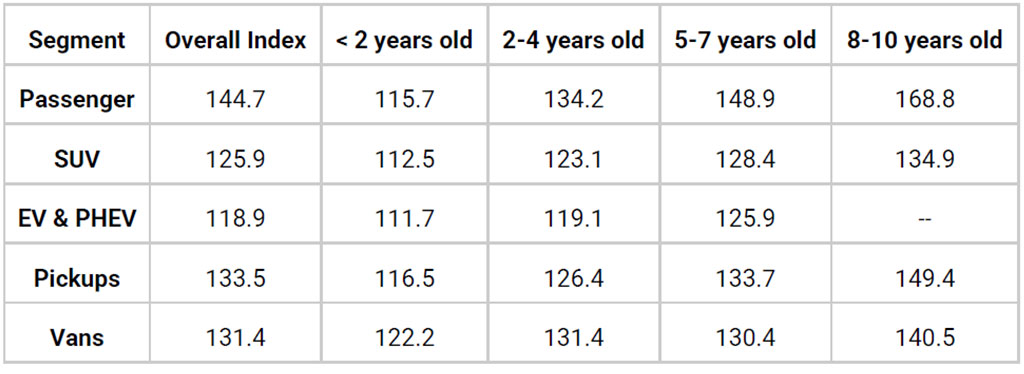

“As has become a familiar trend, there are discrepancies in the price index of vehicles depending on their age and their segment, with older vehicles and traditional low-riding passenger hatches and sedans the most inflated relative to December 2019.”

* The number denotes the per cent increase over the December 2019 100-point baseline. Ergo, overall Passenger Cars are up 44.7 per cent since December 2019 and SUVs are up 25.9 per cent.

** Note that older vehicles tend to remain proportionately more inflated relative to pre-COVID prices, driven in part by household cost of living pressures spurring demand for cheaper vehicles.

Manheim auctions had a strong May result in terms of sales volumes, driven by a healthy supply of desirable ex-government vehicles, onboarding a number of new customers, and healthy volumes from fleet management organisations (FMOs) that use Manheim auctions for asset disposal.

“The May 2024 result was the strongest since mid-2020, as physical and digital auction volumes returned towards pre-COVID levels,” Cox said.

“The largest sources of vehicles sold through Manheim’s national auctions came from dealers, OEMs, FMOs, and government fleet departments such as councils.

“This latter point is not surprising given government fleet sales are up 32.4 per cent in the new market, almost three-times the pace of the overall market. That means more inflow of assets for disposal.”

Meanwhile, Cox’s public-facing car buying service Sell My Car achieved its best result in terms of volume delivered to auctions since September 2017.

This drives much of the vibrancy in Manheim’s clearance lanes, focusing on older and more affordable stock.

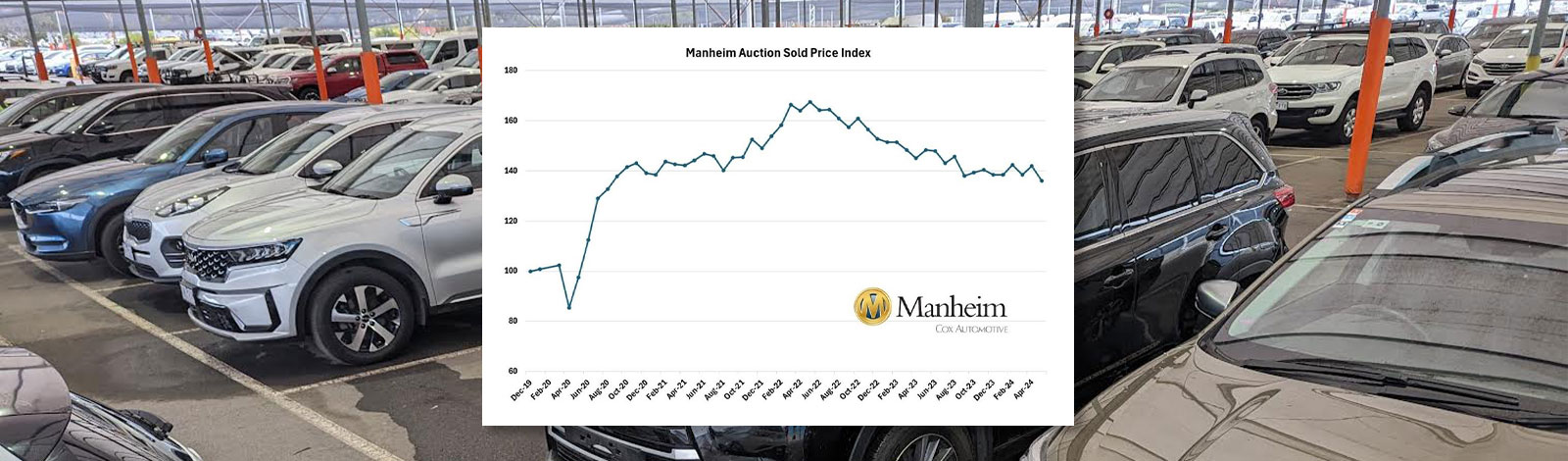

“Average wholesale transaction prices continue to slowly return to earth after spiking during COVID,” the Cox report said.

“The Manheim price Index sits at 136, denoting an average 36 per cent price increase on wholesale vehicles of all types and ages since December 2019.

“This Index is down 8.4 per cent YoY and down 18.9 per cent since the wholesale market peaked in May 2022.

“The message both to vendors as well as prospective wholesale auction buyers (dealers and the public) is that average purchase prices in this market are down almost 20 per cent over the past two years.”

The top five most purchased vehicles at Manheim auctions in May were the Ford Ranger (up 17.7 per cent MoM), Toyota Camry (up19 per cent), Isuzu D-Max (down 9.5 per cent), Toyota Corolla (even), and Holden Colorado (up 2.0 per cent).

By Neil Dowling

Read More: Related articles

Read More: Related articles