Ford’s final Australian-made Falcon Ute rolled off the Broadmeadows production line in late-July this year, ahead of the full factory shut-down two weeks ago, while Holden’s Commodore-based Utility is expected to continue until GM closes its manufacturing operations late next year.

The 4×2 and 4×4 pick-up segments in Australia continue to grow year-on-year, with buyers increasingly favouring the practicality of four doors, a substantial tray and in some cases, off-road capability, over mid-size and large sedans, wagons and less capable soft-roaders.

Interest in pick-ups as family transport has also increased as manufacturers place greater emphasis on ride quality and performance, as well as safety and comfort features.

In the past 18 months, new-generation models or significant upgrades have arrived for the biggest players in the segment, including the all-conquering Toyota HiLux, Ford’s increasingly popular Australian-developed Ranger, Mitsubishi’s Triton, Nissan’s Navara, Mazda’s BT-50 and Holden’s Colorado.

Last goodbye: The final Falcon Ute rolled off the Broadmeadows production line in late-July this year.

The locally-built utes will be the last of their breed as the only large passenger sedan-based utes available anywhere. Smaller sedan-based utes are offered in many emerging markets including South and Central America.

Given the slowing sales of the Aussie workhorses in recent years though, will the demise of the iconic utes reverse strong sales in the pick-up segment, specifically the 4×2 segment? It appears unlikely.

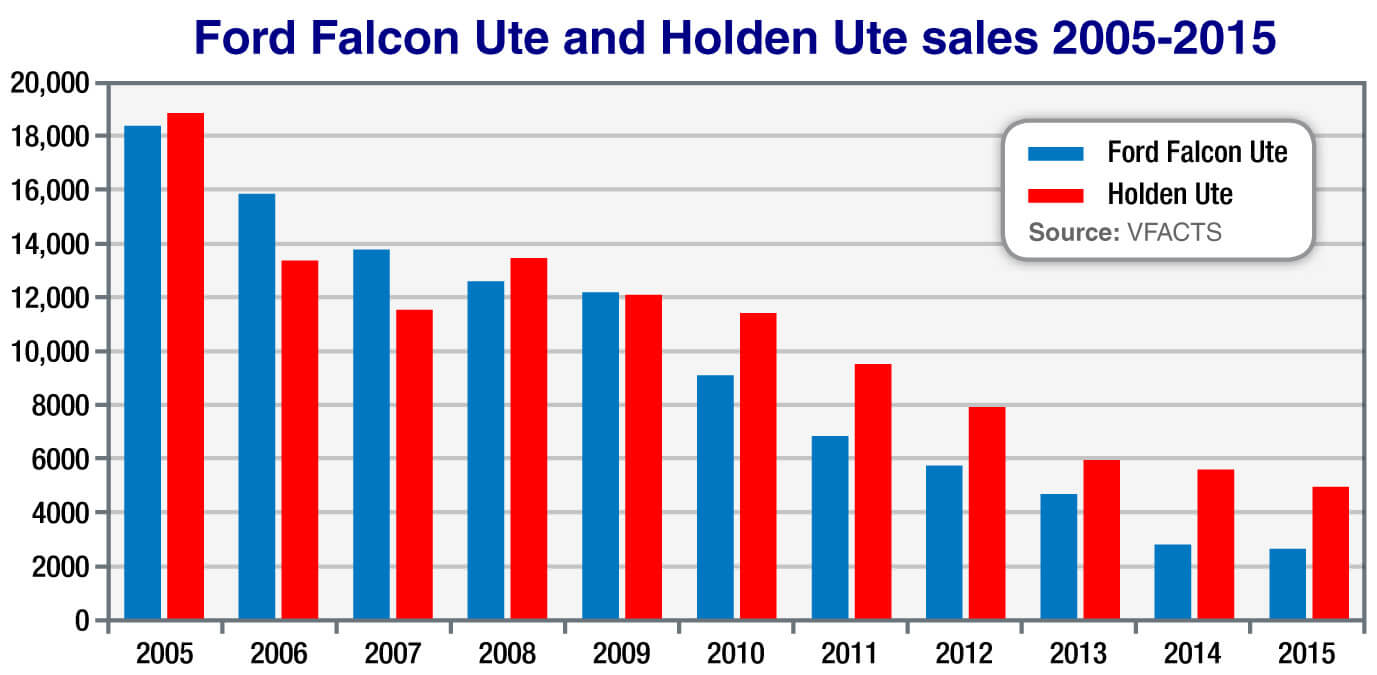

The Falcon Ute’s sales have been steadily declining for years. In the early-to-mid noughties it averaged between 1300 and 2000 units per month, slipping to below 1000 units in 2010, before dropping to 200-300 per month in 2015.

To the end of September this year, the Falcon Ute has recorded 2022 sales, just 2.8 per cent off the same period last year. It is likely being kept afloat this year by buyers keen to get their hands on a piece of Australian automotive history.

In 2001, before the proliferation of the one-tonne brigade, the Falcon Ute enjoyed a healthy, and segment-leading 31.5 per cent share of the 4×2 pick-up segment, ahead of the Holden Commodore Utility that had a 21 per cent share.

So far this year, Holden has recorded 3719n sales for its Utility, representing a slight 3.6 per cent decline compared with the first nine months of 2015.

Holden Utility sales have fluctuated over the years, averaging between 800 and 1900 units a month in the early-to-mid-2000s, dipping to 500 to 1000 units by 2011, to a low of 250 to 450 last year.

The market share for the Aussie pair has dropped to 6.0 per cent for the Falcon Ute and 11 per cent for the Holden in the 4×2 class, well behind the 24.6 per cent stake the HiLux commands and the 13.3 per cent of the Ranger.

Tradies and other small business buyers who have been loyal to the Australian pair are likely to move into other offerings in the one-tonne 4×2 or 4×4 segment when stocks dry up.

But fans who have purchased a Ford or Holden ute for recreational purposes, or through loyalty to the brands and Australian-built cars, have few alternatives.

Many will buy one of the last examples of the ute and hold on to them, while others will be forced to consider a variety of options in the pick-up, SUV or passenger car segments, depending on their preference.

As the sales of the Australian models have declined however, interest in their predominantly Thai-built competitors has sky-rocketed. But the focus has shifted from two-wheel drive to 4x4s.

In 2005, 79,534 Australians bought a 4×2 pick-up and last year the segment recorded 40,657 sales. In contrast, 62,728 4×4 pick-ups found homes in 2005 compared with 134,003 last year.

So far this year, the 4×2 market is up by 12.8 per cent to 33,762 units, while 4×4 registrations have increased by 11.2 per cent to 110,359.

The introduction of new models has had a mostly positive impact on the growing 4×4 segment, with the Ranger, Navara and HiLux all recording double-digit year-to-date growth, while the Colorado and BT-50 are also up by about 8.0 per cent each.

By Tim Nicholson

Read More: Related articles

Read More: Related articles