The 235-hectare development, now in its final design stage, will create an energy hub that would increase the supply of natural gas to Victoria and lead to initiatives such as hydrogen production and gas-powered electricity generation.

Viva Energy Australia CEO and managing director Scott Wyatt said the development can support the transition to a lower carbon energy future and provide potentially valuable new business opportunities for the company.

“At the centre of the energy hub is a proposed LNG import terminal,” he said at Viva’s annual general meeting.

“This would provide a cost-effective method to bring additional gas to the south-east coast markets and meet an expected supply shortage from 2023.”

It is the second project of its type planned for Victoria after AGL announced it would build a floating LNG import terminal in Western Port Bay south of Melbourne.

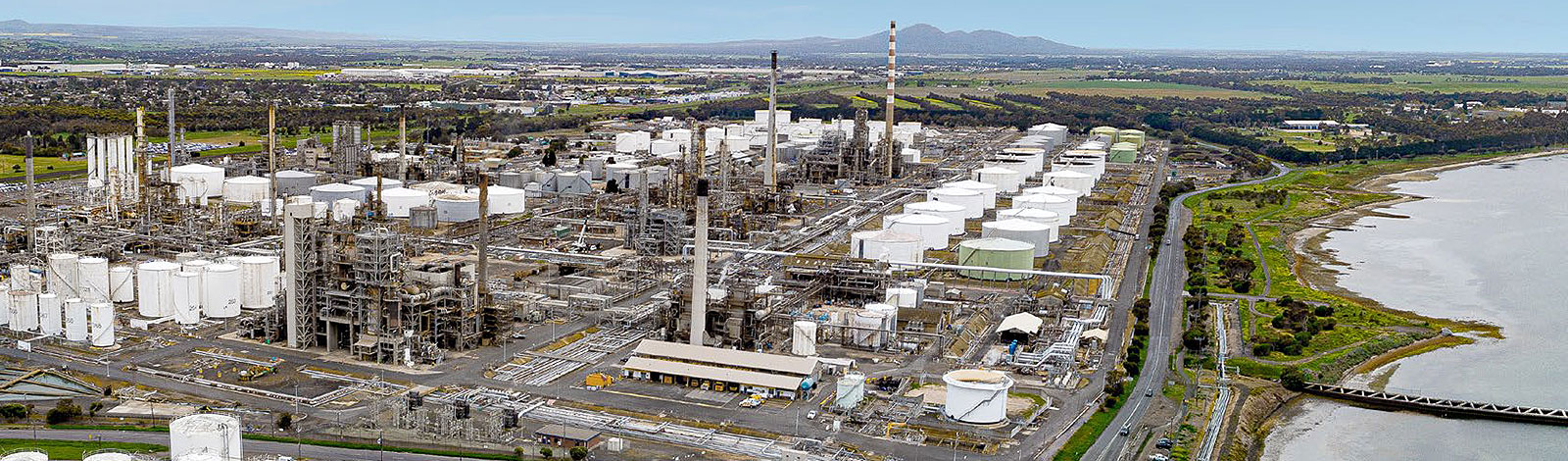

The Geelong refinery, built in 1954 by Royal Dutch Shell and producing 128,000 barrels of liquid fuel a day, supplies about 10 per cent of Australia’s demand. It has access to port infrastructure to support a floating storage and regasification vessel.

Mr Wyatt said natural gas was a key transition fuel which can provide important base load power as coal generation declines, as well as important firming capacity to support renewables as they come on-line.

He said Viva had progressed with engineering feasibility studies and started inviting potential partners to participate.

Geelong is also seen as an ideal site for additional crude and product storage and meets calls by the federal government to have oil reserves in Australia.

The government earlier this year bought about 4.2 million barrels of crude oil, equivalent to almost five days of supply on the Australian market, from the US. It is stored in locations along the Gulf of Mexico coastline and when needed, will take about three weeks to reach Australia.

Viva’s existing refinery at Geelong produces more than 50 per cent of Victoria’s liquid fuel requirements and is Australia’s the only manufacturer of bitumen, hydrocarbon solvents and avgas.

Mr Wyatt said that Viva has significant room for expansion “not only at Geelong, but also across our infrastructure and terminal network throughout Australia”.

“We consider that we can most efficiently address the government’s goals, while also supporting our existing operations,” he said.

“Beyond the LNG project and strategic reserves, there are other opportunities for Geelong to participate in the broader energy transition.

“Vacant land that forms the ‘buffer’ to our refinery is an ideal location for a solar farm which has enough capacity to meet a large proportion of the electricity needs of the refinery and potentially hydrogen production.”

Viva said there is potential for a 27 MW solar photovoltaic farm and battery storage facility on the property.

Viva Energy announced growth in the 2019 year with production up 4.6 per cent compared with 2018 to 14.7 billion litres of liquid fuel.

Weaker refining margins and increased competition reduced earnings to $644.5 million and Viva predicts earnings before tax to be in the range of $257.5 million to $287.5 million in the first six months of this calendar year.

Sales of liquid fuel averaged 65 million litres a week in the second half of 2019, up from 59.5 million litres a week in the first half.

Viva said that this sales growth continued in the early part of this year, with several weeks above 70 million litres a week.

The pandemic impacted sales from late March 2020, falling to below 40 million litres a week in April, but since reverting to 45 million litres a week in May, and showing further improvement in June.

The pandemic also hit sales to the aviation sector this year, pushing them down by 73 per cent compared with the same time in 2019. Viva said aviation sales are expected to slowly recover as domestic flights increase in the second half of this year.

“Other sectors remain relatively unaffected at this stage, and diesel sales have been particularly robust throughout this period,” the annual report said.

By Neil Dowling

Read More: Related articles

Read More: Related articles