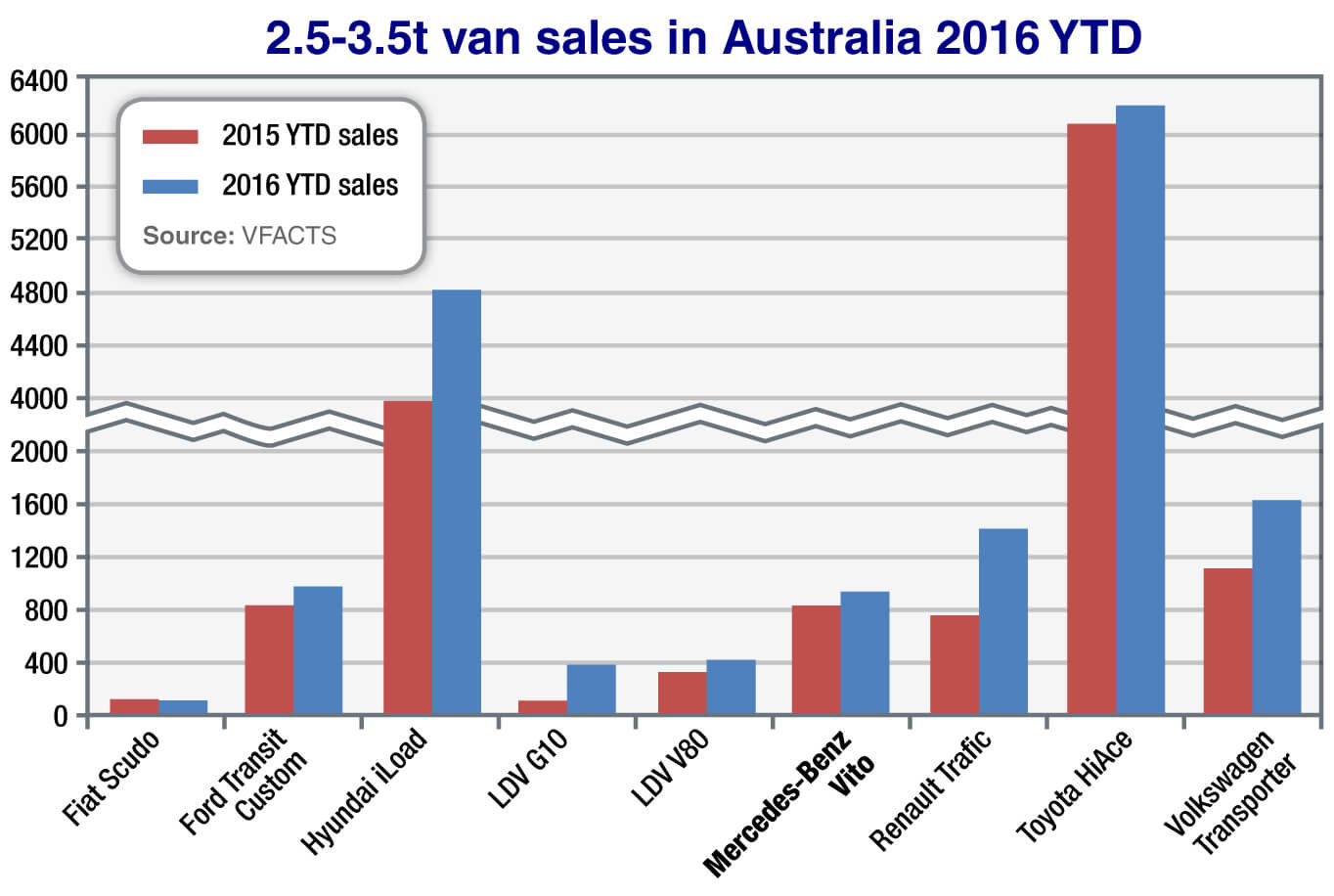

Since the launch of the new-gen Vito in July last year, sales of the mid-size van have lifted by 14 per cent to the end of October this year to 961 units, which equates to a 5.6 per cent share of the segment.

Sales of the Vito are neck-and-neck with the Ford Transit (992 YTD), but well behind the Renault Trafic (1463), Volkswagen’s T6 Transporter (1675), the Hyundai iLoad (4850) and Toyota HiAce (6236).

Speaking with GoAuto at the Swedish reveal of the Concept X-Class this week, Mercedes-Benz Vans Australia managing director Diane Tarr said the company was happy with the consumer response to the new Vito, given the competition in the busy segment.

“It’s a tough segment,” she said. “We have got all the players, from the Asians through to the Europeans. It is price competitive. We are fully aware of the need to be price sensitive.

“We have a really good package and options and we will continue to monitor the market and find those opportunities wherever we can. With the front-wheel-drive vehicle ($36,990 plus ORCs entry-level) 111CDI, that really enables us to be more price competitive in that space.”

The 2.5-3.5-tonne light van segment that the Vito sits in is up by 19.5 per cent to the end of October this year, with all models except the ageing Fiat Scudo recording growth.

Vetoed van: The Mercedes-Benz Citan van is unlikely to make it Down Under in its current generation, but the next-generation version is a chance.

Ms Tarr said the Australian arm was “permanently having discussions with Germany” about ensuring it has the right model mix for its local line-up and highlighted the introduction of the Australian-market Valente MPV as an example.

“We are looking at furthering the range of the Vito platform,” she said. “The Valente was an opportunity we saw in the mid-price range people-mover space that is not a product that is or was at that time pushed from headquarters. We identified that, we created our own name and our own vehicle and built that up for Australia and that has been going really well.”

Ms Tarr said while some Vito buyers are drawn to the van because of the Mercedes-Benz brand, others were put off because of the assumption that it might be too expensive to buy.

“When we have done research, we certainly have feedback that customers are attracted to the brand,” she said.

“They know there is a high level of expectation they will get from safety, quality and performance. And certainly in some areas they also look at that as a representation of their business, in terms of what they represent for their business.

“But it can also create challenges for us. The perception that it is expensive. We are very focused on a total cost of ownership plan.

“In the fleet space, absolutely that is a key focus for us. We also have, in the retail space, our service plans which really brings in that ownership affordability and conversation with the customer and we have seen a great increase in that space of ongoing ownership.”

Ms Tarr ruled out a switch in sourcing for Australian-spec Vitos from Mercedes’ Vitoria, Spain factory to the newly-built Chinese plant to potentially save costs.

“We are comfortable with sourcing, we are getting the right support from the Vitoria factory,” she said. “China you would think would help us from shortened supply but the China factory is very focused on the local market, so the options are very limited for us.”

With the X-Class ute joining the Vito and Sprinter in 2018, Ms Tarr said an Australian launch for the Renault Kangoo-based Citan small commercial van – which had been ruled out in 2014 – would have to wait a bit longer.

“Unfortunately it’s still a no. We did look at it again quite recently and we are really keen, our network is very interested in bringing that into the portfolio. We have just still got a bit of homework to do. We are hoping in the next generation when the Citan is available, we can look at it and that will give us an opportunity to bring it into the market.”

Meanwhile a new-generation Sprinter large van is also in the late stages of development and will no longer be linked with Volkswagen, which is going out on its own for its new Crafter that previously shared its underpinnings with the Sprinter.

While there is no timing or details on the next Sprinter, Ms Tarr said she would welcome any opportunity for the Australian market to be involved in the development or testing for the new model.

“I am hopeful that with the ute coming on board and us being part of a core market, that it has opened up our headquarters’ minds to explore testing in other countries.”

As previously reported, GoAuto understands that engineering evaluation versions of the X-Class ute will start to arrive in Australia for local testing in the coming months.

Despite its age, the Sprinter is the second best selling model in the heavy commercial van segment, with 2144 sales to the end of October (down 12.6 per cent) to sit behind Isuzu’s N-Series (3838), but ahead of the Renault Master (1354), Fiat Ducato (1004) and VW Crafter (446).

By Tim Nicholson

Read More: Related articles

Read More: Related articles