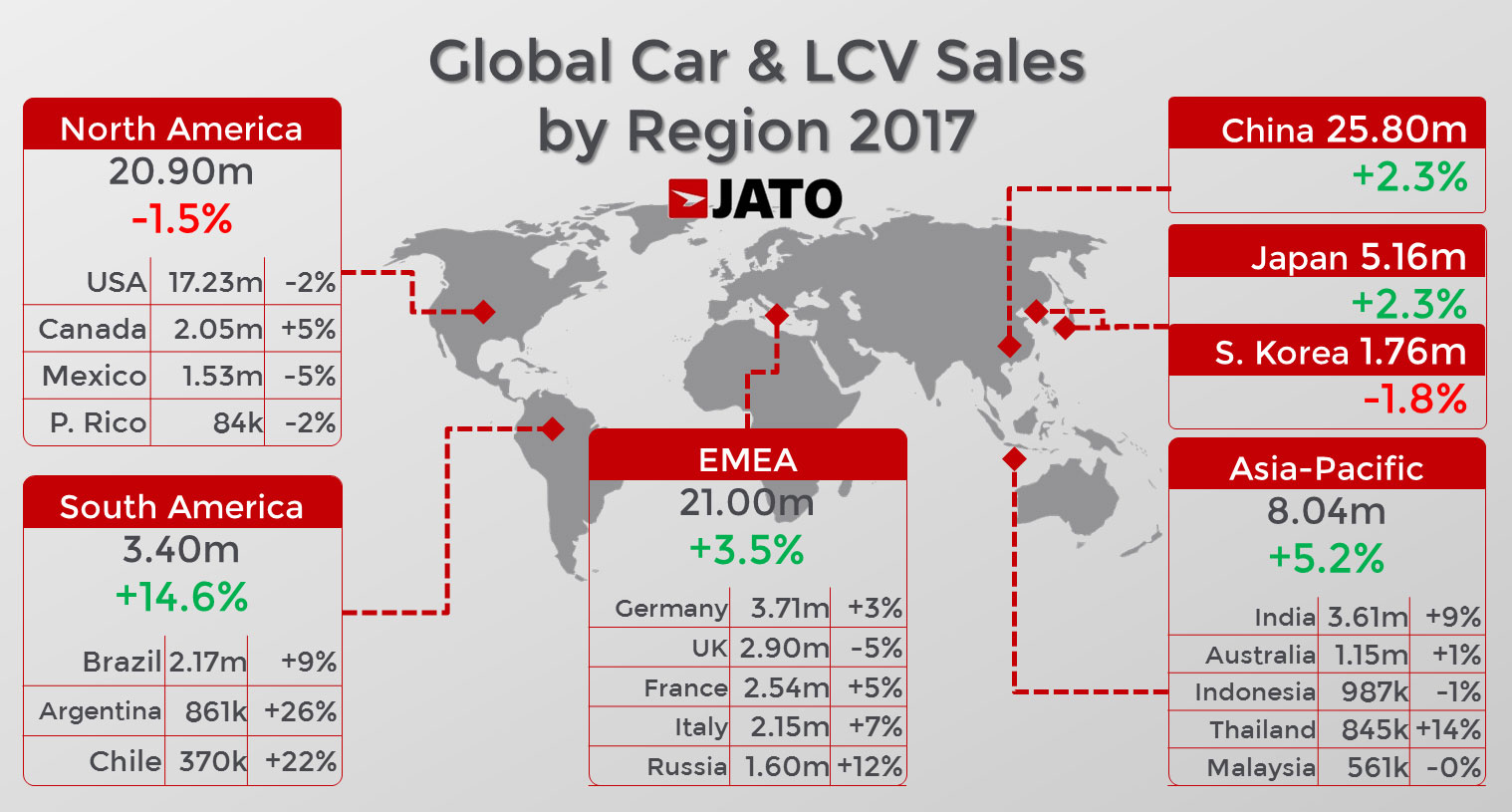

Each of the three regions recorded double-digit increases in 13 markets – notably Russia, Thailand and Argentina – that offset sales declines in the United States, United Kingdom, Mexico and South Korea, and slowing growth in China.

JATO said that the Asia-Pacific market (excluding China, Japan and South Korea), was bolstered by increased sales in India, Thailand, New Zealand and Singapore, while the Latin American region benefited from the improved economic situation in Brazil.

In its assessment of 52 major automobile markets, JATO reported that global sales of passenger cars, SUVs and LCVs were up 2.4 per cent – or 2.05 million units – to 86.05 million in 2017 compared with the 84 million vehicles sold in 2016.

India continued its rapid growth with an increase of 8.8 per cent in 2017 over 2016 to 3.6 million, with JATO saying it could leapfrog Germany (3.7 million) and become the world’s fourth-largest automotive market.

“The results in 2017 show that despite the crisis with diesel fuel and localised issues such as Brexit causing European uncertainty, the automotive market as a whole is continuing to grow,” said JATO global analyst Felipe Munoz.

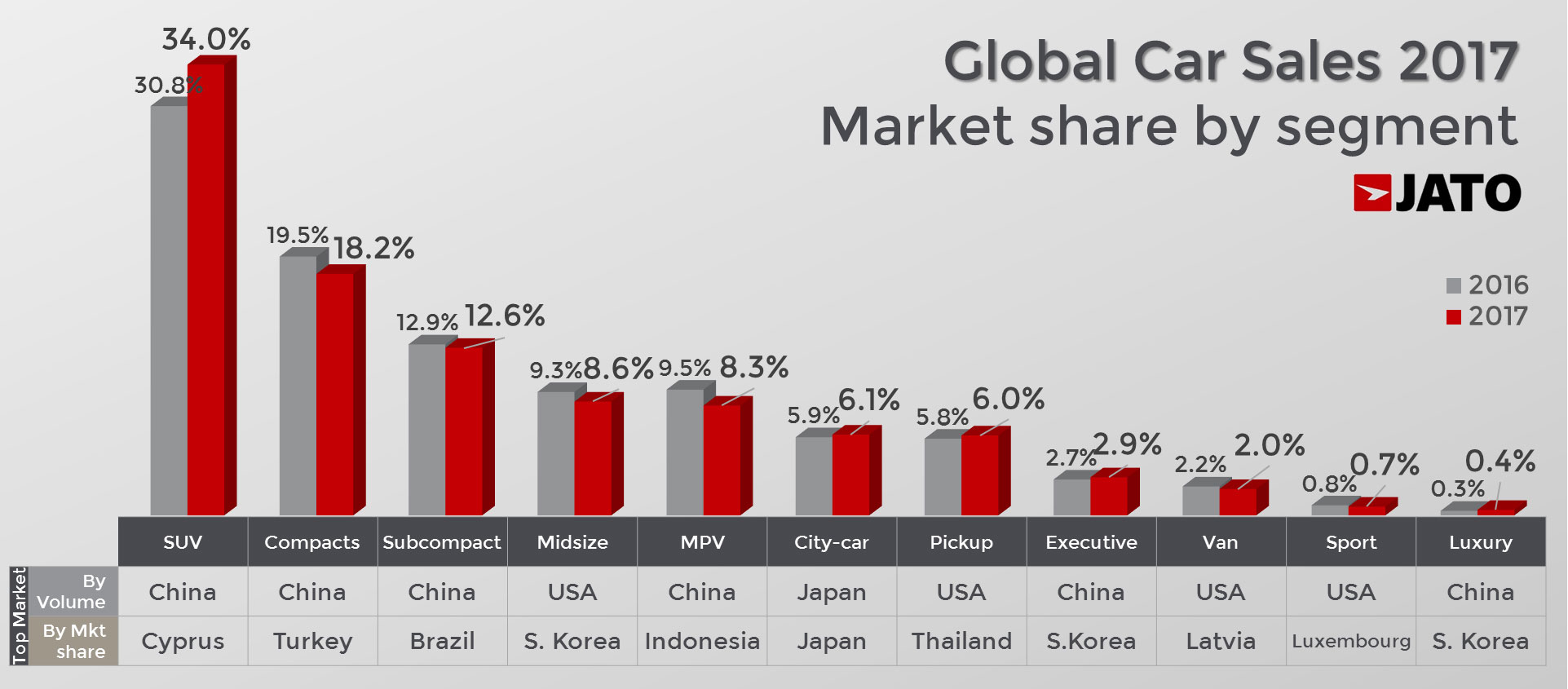

In vehicle segments, SUVs now represent just over half of Australian sales but the greater Asia-Pacific region (including Japan and South Korea) and Latin America are less enthused and sales growth is lower in 2017 compared with China, North America and Europe.

JATO said this indicates there was still scope for SUVs to grow as their popularity spreads.

SUVs reached a new record market share in 2017, accounting for 34 per cent of the total market for the period.

Results for the 52 main global markets show that 27.85 million SUVs were sold in 2017, up 3.14 million units on 2016, a 12.7 per cent increase.

Compact SUVs accounted for almost 40 per cent of total SUV sales, growing by 9.2 per cent, the lowest growth rate of all SUV sub-segments.

Growth in the SUV segment was largely driven by the mid-size SUV (D-SUV) sub-segment, which grew by 16.6 per cent. Large SUVs (E-SUVs) posted significant growth of 15.7 per cent, with the North American region accounting for almost two in three vehicles sold, as volume in China doubled.

JATO said that as buyers flocked to the SUVs, other segments declined with small (down 4.5 per cent) and mid-size passenger cars, wagons and people-movers being affected the most.

But city-car sales continued to grow during the year due to demand in the Japanese market which posted a 14.4 per cent increase on last year, due to the dominance of ‘kei’ cars.

Utes also posted strong results, as demand in North America remained strong and their popularity increased in Europe, Latin America and the Asia-Pacific region.

“The Ford-F Series was once again the world’s best-selling car, as it further exerted its dominance over the Toyota Corolla, which came in second,” JATO said.

“As usual, the Ford-F Series took the top spot as a result of strong US demand, which accounted for 80 per cent of its total volume.

“The Nissan X-Trail/Rogue was the world’s best-selling SUV and the overall fourth best-selling vehicle, selling 814,000 units in 2017, an increase in volume of 6.5 per cent.

“Honda and Volkswagen both had strong years, placing three models inside the world’s top 10. The performance of the Volkswagen Tiguan was also notable, with outstanding demand in China.

“Other notable performances were from the Baojun 510, Toyota C-HR, Geely Emgrand, the all-new Jeep Compass, the Peugeot 3008 SUV and the Chevrolet Cavalier which were all new launches that proved popular in 2017.”

By Neil Dowling

Read More: Related articles

Read More: Related articles