Derrick Bishop, a global fleet expert, also disputed claims made by the NSW Minister for Finance, Services and Property, Dominic Perrottet, who promised $1.2 billion of savings would flow from privatizing the government’s extensive vehicle fleet.

Mr Bishop questions this benefit, saying that all the NSW Government was do is shifting the cost from its books to “what could be a more expensive model”.

He said that ultimately taxpayer would not see any savings and claimed that many observers “including government insiders doubt if this is a responsible use of public funds”.

Last month the NSW minister released a list of fleet managers and vehicle leasing companies that will control the privatized fleet.

He has appointed SG Fleet and Smartfleet as fleet managers and lease companies Alphabet Fleet (BMW Australia Finance Ltd), Custom Service Leasing, FleetPartners, Interleasing (McMillan Shakespeare), LeasePlan and Toyota Fleet Management (Toyota Finance Australia). The new outsourcing group starts from July 1 this year.

Mr Perrottet said when flagging the move last year: “The Government shouldn’t be competing with the private sector for fleet leasing and management services.”

“This arrangement will be more cost-effective, increase competition and allow government to access best practice in fleet management.”

Mr Bishop is the managing director of Bishop Fleet Optimisation (BFO) which is a fleet utilisation consultancy with offices in the US, Australia and New Zealand. His studies of fleet usage show the large government fleets can cost hundreds of millions of dollars a year by running far more cars than they need.

Mr Bishop has been opposed to the outsourcing. He claims that his company’s efficiency studies carried out with government agencies around the world showed that the NSW model “would not reduce the cost burden on taxpayers”.

“Simply cost-shifting $1 billion from the government’s capital expenditure is not a saving,” he said. “Taxpayers will have to pay more for private companies to own and manage the fleet.”

Speaking to GoAutoNews Premium from his US office he said: “The chances of (outsourcing) success are very low” because of the cost structure of vehicle fleets.

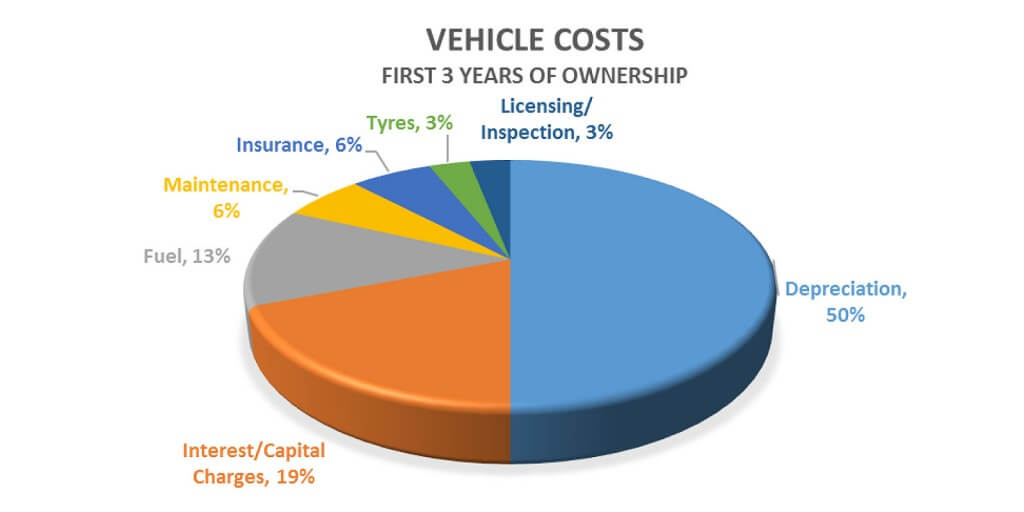

“Depreciation (50 per cent) and finance charges (19 per cent) make up almost 70 per cent of light fleet costs in the first three years of ownership.

“The numbers vary by fleet but it is the magnitude of each cost component that is important.

“Depreciation, at 50 per cent, is the elephant in the room.

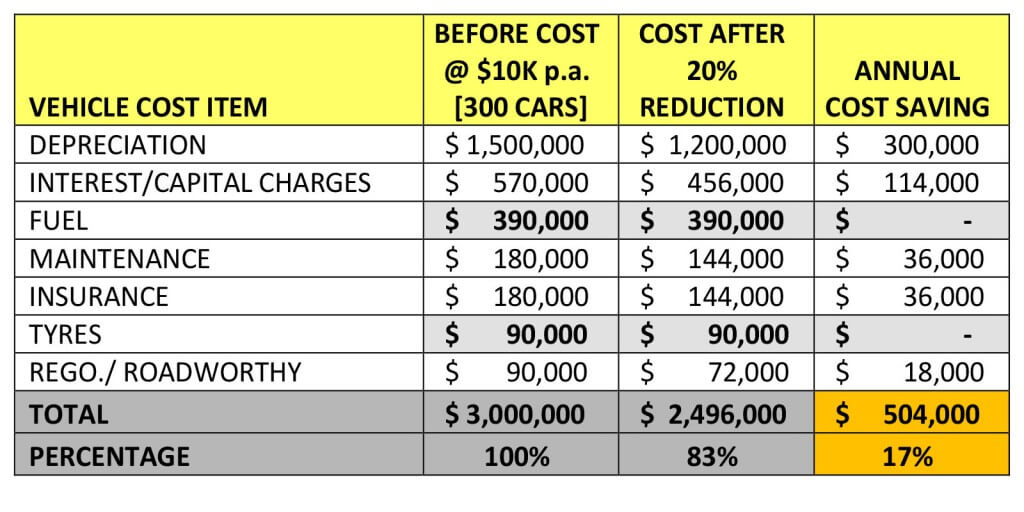

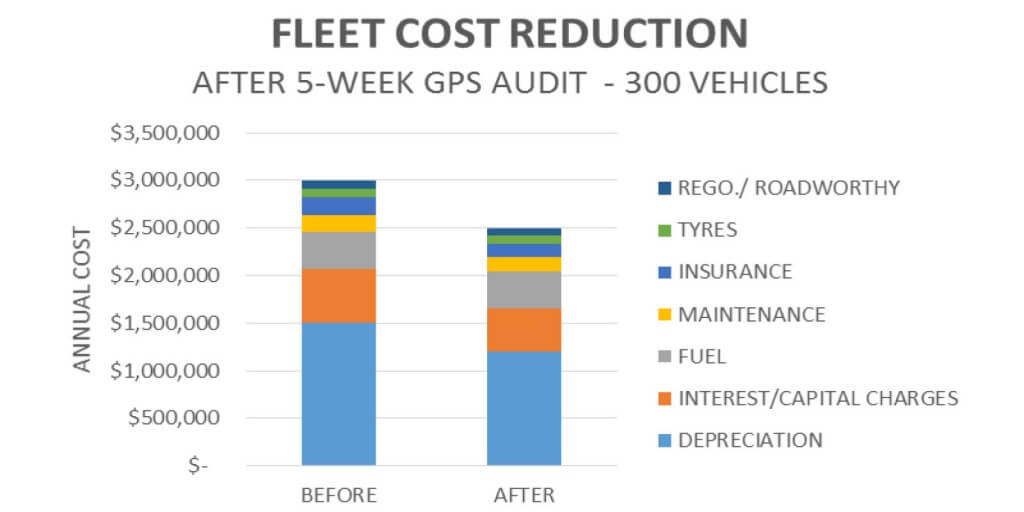

“For a company to be more cost-effective than a government agency, it has to reduce costs by buying the vehicles cheaper, sell the vehicles at the end of term for more, and get rid of surplus vehicles.”

But Mr Bishop said that because government and private fleet managers are paid on a per-vehicle basis, both are reluctant to dispose of surplus vehicles because it affects their revenue.

“So it is very unlikely that either model will reduce fleet size; (even though that is) where the real savings are found,” he said.

“Evidence of this fleet waste abounds. Our fleet utilisation studies indicate that Australian State fleets still hold 15,600 surplus vehicles. That needlessly cost taxpayers $131 million each year.

“If State Premiers are looking for savings, look no further.”

Finance, which accounts for about 19 per cent is the fleet cost, is the second area where savings could be made but private fleet companies would struggle to do so because not many – if any – private fleet managers can obtain money cheaper than the government rate.

“Private sector company shareholders want a return on equity that is well above the government rate,” he said. “Otherwise they would leave their money in Treasury notes or a bank.

“If anything, finance costs will increase which is a problem.

“So about 70 per cent of a fleet cost is depreciation that ownership does not change and finance costs may actually increase. That is not a good start.”

The remaining 30 per cent of costs include fuel (13 per cent), maintenance (6 per cent), insurance (6 per cent), tyres (3 per cent) and so on.

Mr Bishop said these costs are the only places left where savings can be made to equal or better the government.

“Fuel consumes about 13 per cent of vehicle costs in the first three years of ownership,” he said.

“A private company that saves 10 per cent on its fuel bill only effectively saves 1.3 per cent (10 per cent of 13 per cent). This hardly moves the needle on overall costs.”

He added that the opportunity for fuel savings was limited because most Australian government and non-government agencies have already followed fuel reduction methods of other countries by downsizing the engine size of their vehicles.

Mr Bishop added that it would be unlikely that any outside supplier could fuel its vehicles at a lower cost than the government.

“Vehicle maintenance makes up 6 per cent of costs. If the private company can save 10 per cent here – and it wouldn’t be much more – then this represents a 0.6 per cent saving (on the total cost). Again, it’s not a lot.”

Insurance also costs about 6 per cent and Mr Bishop said most governments self-insure “so it’s not possible to make a saving here”.

“Even if a private company could reduce the government’s insurance bill by 10 per cent, then the change to the total cost of ownership would fall by only 0.6 per cent.”

Mr Bishop said that of the 30 per cent remaining that a private group could make savings, the actual saving is likely to be 3 per cent or less.

“So there’s effectively nowhere in this 30 per cent cost segment that a private company could retrieve a 20-30 per cent saving to give investors or shareholders a market return on their investment,” he said.

“But what happens if these costs go up? How will being outsourced be cheaper and where are the savings to the taxpayer?”

Mr Bishop said that the only way to make any meaningful impact on fleet costs is to cut surplus vehicles but “the one thing that private companies don’t want is to cut vehicle numbers because more vehicles means greater profits.”

“So the taxpayer will continue to foot the bill.”

Mr Bishop said “the solution was to keep the fleet within the government and make it more efficient.

“Outsourcing must make sense. But in this case there is no clear benefit. The upside risk on cost is considerable and taxpayers will almost certainly lose out.

by Neil Dowling

Read More: Related articles

Read More: Related articles