AS THE Australian motor industry gears up for 2024 (after a record breaking 2023), dealerships are facing an array of challenges that demand strategic foresight and adaptability.

At Pitcher Partners we have been delving into the top 10 challenges that are shaping the landscape and here we explore how industry players can navigate through these tumultuous times.

1. Margin compression has returned, and unprepared dealerships will experience significant financial strain:

For many brands, the order books are lean and dealers have already chewed through them throughout CY23 setting a record in sales volumes (read deliveries) of 1.2 million units.

The resurgence of margin compression needs to be an urgent concern, exacerbated by the increasing supply of cars from OEM brands and waning customer demand due to rising prices and finance rates.

We are trending towards a market in 2024 that looks more and more like the market in 2019. In 2019, the average dealer was making less than 1 per cent return on sales (RoS), not the 3-4 per cent we have seen in the last three years.

On top of this, the price of new cars in 2024 have increased 30-50 per cent compared to 2019 and the cash rate in Australia is 4.35 per cent today vs. 1.5 per cent at the beginning of 2019 before dropping to 0.75 per cent. (Refer chart below from the RBA).

The danger is 2024 is likely a year where the walk from the penthouse to the outhouse will be very short.

The old saying of ‘bad habits develop in good times’ feels like history repeating itself. Dealerships must choose between implementing proper road-to-sale processes (something that was abandoned in recent years) or resort to discounting to weather the storm.

We are seeing our dealer clients’ stock and OEM advertising rising significantly in the last quarter of 2023 and dealers are already in a position where they need to discount heavily to exit their stock problems.

The answer is simple; manage your stock (see below) and get back to proactive selling implementing the road-to-a-sale.

2. Strategic stock management will be back ‘en-vogue’:

We are already back to overstocking dilemmas in new cars for some brands in Australia; let that sink in.

The importance of managing stock levels is resurging in 2024. Dealerships will need to implement manual release for floor planning of new vehicle stock (where they can) and regain control of ordering.

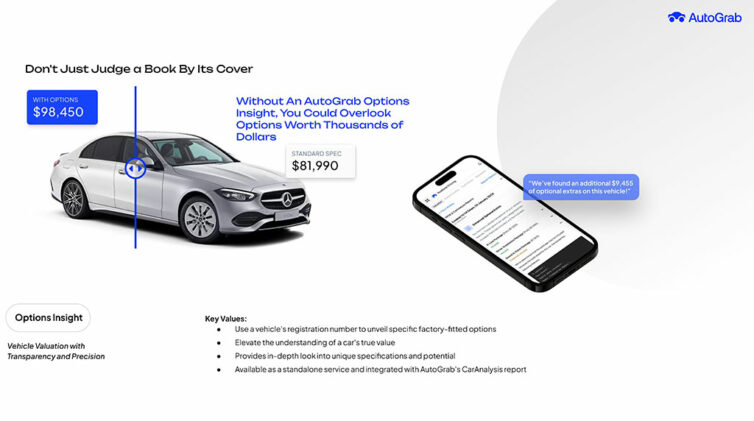

This applies not only to new cars but also to the used car market. Dealers will need to buy and sell used cars in the same market by optimising stock turnover to 30 days’ supply maximum (12 stock turns per year). Buying right for used cars has always been the key to profit and emphasises the need for pricing and stock management tools like AutoGrab to make sure you get it right.

3. Used cars valuations will decline further

As noted above, stock management will be key in 2024. We are in a falling used car market and dealers’ customers will be returning to the dealership with vehicles purchased during the Covid years at inflated values.

The negative equity position of these customers will be significant and the temptation to over-trade to get the new car sale will be high. Dealers need to separate valuations from the new car department.

This will be mission critical. The risk of leaving trade in valuations with the new car department could be fatal by overloading the used car department with overvalued stock.

Use all the tools at your disposal and ensure you get market insights from the likes of AutoGrab, Carsales, Cox, and other sources.

4. Cost structure re-evaluation:

With some dealerships already facing monthly losses, a critical look at cost structures is imperative.

We have noted that new car break-even points (the cost to sell a car) in recent years have moved to more than $3000 per unit. Preparing for the possibility of normalised grosses in the realm of $2000 per unit ($3000 less than 2023 levels), means every car will be sold at a loss. This isn’t new territory for dealers, this is where we were in 2019.

Dealer groups must make difficult decisions now to ensure resilience in the face of tougher economic headwinds ahead in 2024.

A good gauge to see how CY24 will play out in your dealership’s results is taking your monthly P&L for 2023 and replace the average gross profit in both new and used cars with $2000 per unit. If the result is still positive, you’re running a lean cost structure business. If the result is a loss or break-even, you need to act now to prepare for what’s coming in CY24.

The key costs to review in the new and used car departments will be salesperson retainers, commission structures and increasing minimum productivity to back over 15 units per month.

Thinking to the future, dealers cannot operate a business where people are 70 per cent of your costs and 100 per cent of your gross profit.

Learn from the supermarkets. Turn your customers into stock pickers, baggers, scanners, and cashiers. Vehicle service has too many non-productives. Technology can replace most of the non-productive jobs in service.

When was the last time after your $300 Coles shop someone took you through the invoice and walked you to your washed car? These things exist because the OEM wants them and you are paying for them and, by the time they take over fully, service will not exist.

If you have one hundred people today, plan for 40-50 in five to10 years’ time. Technology and outsourcing will replace the rest.

5. Building your own brand loyalty (retention):

In the face of the challenges listed, dealer groups should focus on building their own brand and cultivating customer loyalty. Owning the customer relationship becomes paramount for sustained success.

Customer loyalty (retention) will become critical in 2024 because late cycle retail buyers will be hard to find, trade-in values will be high, family budgets are stretched and securing financing to purchase will be difficult.

Dealers will have to pivot from waiting for customers to come to the showroom, to proactively finding customers, and the showroom teams are not match fit. Therefore, early conversations, deal game planning upfront (particularly in relation to finance) and daily appointing targets will be critical to create deals.

Sales managers will need to control all price negotiations to control grosses and will need to double-close most deals in 2024.

Customer loyalty will be the key to survival going forward.

Dealers have two key groups taking their market share:

- The OEM’s who really want to get much closer to your customers.

- The direct sellers – aggregators and online.

But still your customers keep coming back to dealers. Why, because dealers make it easy (there is no other reason). Keep this as your principal focus, whilst your competitors work out how to be easy to deal with, you hold the advantage.

But still your customers keep coming back to dealers. Why, because dealers make it easy (there is no other reason). Keep this as your principal focus, whilst your competitors work out how to be easy to deal with, you hold the advantage.

Invest in your complete cradle-to-grave customer journey (online and physical). Really learn to manage your customers individually through the life cycle.

The time for platitudes is over. You can’t rely on selling cars from the same site; it is simply not sustainable in a rapidly evolving market. You need to use the industry-based suppliers and build a fool proof system. If not, you will lose.

Ask the previous owners of Duttons Garage how they are feeling right now. They built a brand and sold it for a significant sum. There is nothing wrong with that. Remember, the current future is about building someone else’s brand, which is why the new sales model developed by the OEM is called agency.

If you have a different plan, take the initiative now and create your own destiny. If you want to continue to play car dealer, make your own rules.

Next week: Top 10 Challenges for 2024 – Part Two

6. Cybersecurity vulnerabilities

7. The Rise and Rise of Chinese-Built vehicles

8. Electric vehicle revolution

9. Fuel and emissions standards

10. Agency and direct-to-customer sales model adoption postponed further

Bonus takeaways:

Facility optimisation and future planning

Fleets will dominate volumes in 2024

Disruptive markets present massive opportunities

Steven Bragg is the lead partner of the motor industry services group at Pitcher Partners Sydney.

By Steven Bragg

Read More: Related articles

Read More: Related articles