AUSTRALIA’S corporate watchdog today sent shudders through the automotive retail industry, confirming plans it was now prepared to ban flexible commissions on car financing. But all was not as it seemed.

As dealers read the detail of today’s announcement they found that the news was not only not bad, but that ASIC had listened to their point of view and that it was, as one dealer put it: “a wonderful outcome for the industry”.

One dealer told GoAutoNews Premium that if ASIC was going to ban flex commissions – which is has – then under the new arrangement it envisaged this was the best possible outcome.

The most fundamental change in the arrangements is that the financier, not the dealer’s finance manager, will set the interest rate which will reflect the credit-worthiness of the buyer. Dealers will not be able to increase the interest rate and increase the commission as a result.

But in order to be more competitive, dealers will be allowed to reduce the interest rate set by the financier by up to 2 per cent and reduce commissions accordingly.

ASIC will also allow origination fees providing they are set by the financier and are reasonable.

The arrangements involve an 18-month transition period.

Dealers have also accepted ASIC’s view that that financiers will continue to generate similar levels of interest margin from car loans and therefore should have similar levels of commission available to pay car dealers

One leading dealer told GoAutoNews Premium: “The essential difference is that the financier sets the rate rather than the dealer as dealers do at present.

“Under the new rules, the finance manager in the dealership will not select the interest rate.

“They will complete the forms and the finance company, based on the information supplied, will set the interest rate at, say, 8.9 per cent and still pay the commission that the dealer would have received before.

“But if the customer says they can get 7.9 somewhere else, under the banning of flex model there was nothing a dealer could do about it. But ASIC now accepts that we can do that deal at 6.9 per cent. The commission will be lower on the lower rate as it should be.

“It is actually more transparent because it is not the dealers setting the rate it is the financier.”

ASIC says that financiers will continue to generate the same revenue as before and therefore should have the same availability to pay commission under one of the structures they will pay out to dealers.

A dealer said: “So dealers at the point of sale will retain the ability to move rates within a 2 per cent range and be compensated for it. As long as the financiers act responsibly and set reasonable rate tiers, our business will continue without missing a beat.”

Leading dealer group, A.P. Eagers, told the ASX today that it arranged car loans totalling more than $850 million in 2016 with its customers and that it was pleased ASIC has “incorporated key industry recommendations into its decision”.

“We believe ASIC’s proposal will establish a level playing field for consumers by prohibiting all car dealerships and finance brokers from increasing interest rates payable by customers above a base rate set by financiers and participating in any benefits from the increase,” the statement said..

“We expect our multiple financiers will adopt a sophisticated pricing-for-risk model that closely correlates with highly competitive consumer loan outcomes already evident across A.P. Eagers dealerships.

“We are pleased ASIC has recognised the important role automotive dealerships play in providing a competitive market for consumer finance.

“We believe ASIC’s decision will provide surety for financiers to continue offering market competitive rates, while allowing dealers to be reasonably compensated for managing customer outcomes at the point of sale. Importantly, we will retain the ability to make reasonable adjustments to consumer rates at the point of sale in order to meet market, consumer and transaction requirements.”

The ASIC decision came after putting the car industry on notice for more than a year ago that it was unhappy with flex commissions.

ASIC said flex commissions are common in car finance but not generally found in other markets.

By way of explanation, the commission said: “Flex commissions allow car dealers to arrange car loans at a higher interest rate than the lowest available rate (700 basis points higher – or more), and thereby earn a much higher commission.

“As a result, some consumers can end up paying thousands of dollars more in interest charges over the life of the car loan.”

It said it would implement the prohibition because of poor outcomes for consumers and “because flex commissions operate in a way that is unfair under the National Consumer Credit Protection Act 2009 (National Credit Act)”.

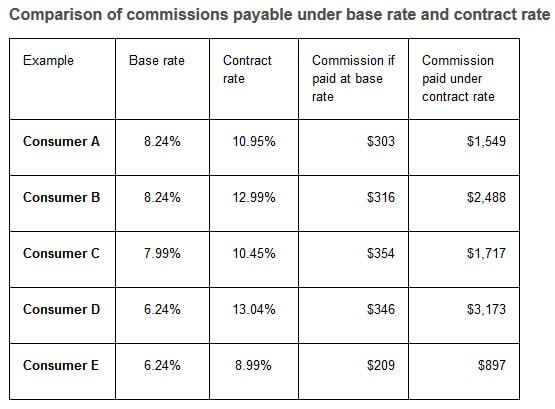

In examples posted in its release today, ASIC said a consumer charged a contract interest rate of 13.04 per cent would earn a commission for the dealer of $3173.

ASIC’s Deputy Chair Peter Kell said: “Most consumers would be surprised to learn that when you are buying a car on finance, the car dealer can, for example, decide whether you will be charged an interest rate of seven per cent or one of 14 per cent – regardless of your credit history. Flex commissions do not operate in a fair and transparent way, and ASIC’s action will ensure that consumers are not charged excessive interest rates.’

Mr Kell said ASIC has conducted two rounds of written consultations with targeted stakeholders, including industry bodies, lenders, car dealers and their associations and consumer groups on various options to respond to the harm caused by flex commissions. Based on this consultation, ASIC has decided on a prohibition as a comprehensive, industry-wide solution that will deliver broad changes for the benefit of consumers.

‘There was a broad recognition that flex commissions create poor consumer outcomes. However, lenders who cease paying flex commissions unilaterally risk putting themselves at a competitive disadvantage. It is therefore necessary to implement the change through an industry wide approach that would ensure a level playing field for all lenders,’ Mr Kell said.

ASIC proposes to use its statutory power to modify provisions of the National Credit Act to prohibit the use of flex commissions so that the amount paid in commissions is not linked to the interest rate, and therefore that the lender has responsibility for determining the interest rate that applies to a particular loan.

ASIC acknowledges that it is desirable to allow car dealers some flexibility to reduce interest rates in order to secure a deal. It is therefore proposing to allow a limited capacity for car dealers to discount the interest rate and receive lower commissions, as this will benefit consumers through a lower cost of credit.

ASIC has prepared a draft legislative instrument to implement the prohibition and is conducting a three-week consultation on technical aspects of the instrument (see the Consultation Paper below).

Mr Kell said, ‘We are confident this prohibition will benefit consumers by removing incentives that increase the interest rates they are charged. We consider that average interest rates on car loans will fall as a result of more efficient pricing models and lower losses through defaults. We expect lenders will work with car dealers in moving to fairer and more sustainable models’.

ASIC welcomes feedback from stakeholders. Submissions are due by March 27 and can be sent to FlexCommissions@asic.gov.au

Further detail about ASIC’s decision to prohibit flex commissions is set out in a Regulation Impact Statement (RIS) that has been approved by the Office of Best Practice Regulation.

Background

The ASIC announcement provided the following background:

Operation of flex commissions

Lenders in the motor vehicle finance industry have a practice of using ‘flex commission’ arrangements to remunerate their distribution network (primarily car dealers but also finance brokers). Under these arrangements:

- the lender and the dealer agree that the cost of credit is not fixed and that a range of interest rates will be available to any consumer (from a ‘base rate’ up to a prescribed maximum rate);

- the dealer has the discretion to determine or recommend the interest rate for a particular loan within that range and will earn a greater upfront commission from the lender the higher the interest rate; and

- the discretion to increase the interest rate from a ‘base rate’ specified by the lender is not determined by objective criteria and so can result in opportunistic pricing arrangements (rather than consumers with similar credit risk levels obtain similar price outcomes).

In a flex commission arrangement, the commission payable on a particular contract is determined by the ‘flex amount’. This term describes the amount of the interest charges payable according to the difference between:

- the base rate or agreed minimum interest rate; and

- the contract interest rate under the loan provided by the lender.

The lender and the intermediary share the flex amount according to a formula agreed in the commission plan. The percentage of the flex amount that could be retained by the intermediary can vary significantly from plan to plan, and can be up to 80% of the interest charges.

Harm from flex commissions

ASIC has obtained information from lenders to assess the impact that increasing the interest rate above the lender’s base rate can have on the amount of commission received by the dealer.

The table below sets out the difference in commission for five transactions reviewed by ASIC, based on the amount payable under the base rate and the amount earned by the car dealer. It shows that, compared to the sum payable if the contract was written at the base rate, intermediaries could earn commissions that were:

- between four to seven times higher than commissions received under the base rate; and

- between $1,246 and $2,827 higher in dollar terms.

ASIC has also obtained data from some of the major lenders offering flex commissions to assess the extent to which consumers are charged higher interest rates. The data covered approximately 25,500 contracts written by seven lenders for May 2013 (noting that the results for this month were typical of consumer outcomes). Our research found that about 15% of consumers (or approximately 3,800 people a month) were charged an interest rate of 700 basis points (7%) or more above the base rate.

ASIC’s view is that a consumer who enters into a contract at 700 basis points or more above the base rate is likely to be less financially literate and more likely to be financially vulnerable. If these consumers were price-sensitive and able to negotiate lower rates (as was the case with the remaining 85% of borrowers) there would be a much smaller percentage of contracts written at higher rates.

By Neil Dowling and John Mellor

Read More: Related articles

Read More: Related articles