The circumstances are regarded as being extraordinary as the pandemic has triggered a spike in demand for new and used vehicles, leading to higher prices.

This situation is being monitored by the Australian Taxation Office, leading to a warning that dealers should ensure their LCT payments are in order.

Pitcher Partners Motor Industry Services partner Steven Bragg told GoAutoNews Premium that this is “an odd situation that we probably would not have thought possible before the pandemic”.

“The broad-based increases in used-vehicle prices have created situations where some vehicles could be subject to further luxury car tax (LCT) when sold a second time,” he said.

Barbagallos in Perth, which is the Western Australian dealer of brands including Lamborghini, Maserati, Ferrari and Rolls-Royce, said it has already seen instances where increased used-car values had triggered a LCT payment.

It said high demand for high-end luxury vehicles meant some used examples sold for an increased value and the buyer had to pay LCT. However, it said vehicles that sold for less than the purchase price did not incur the tax.

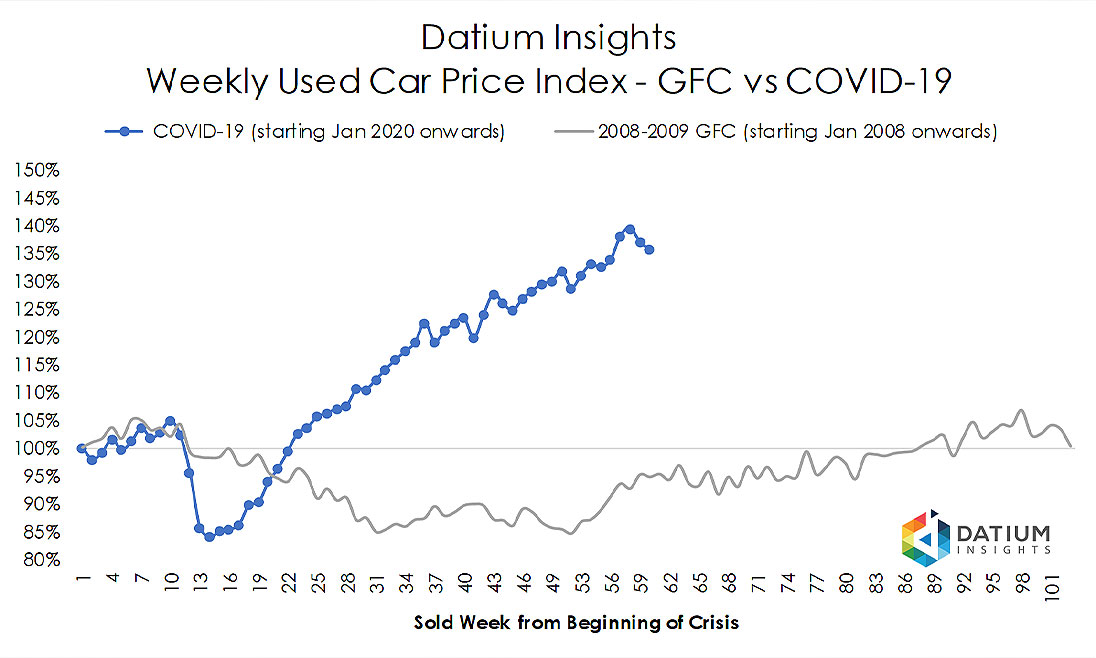

Mr Bragg said the used-car market in Australia has been flying since May 2020 with prices up over 40 per cent, according to Datium Insights research.

The data from Datium (see graph) compares the weekly used-car price index during COVID-19 as compared to the Global Financial Crisis (GFC) of 2009.

“This could lead to a unique situation where LCT could be due on second-hand car sales,” Mr Bragg said.

“While it’s not new, LCT can be troublesome for dealers, especially in a situation where LCT can be due when a vehicle is sold for a second time.”

Mr Bragg said LCT is levied on the person selling the car, typically the dealer, who then passes it on to the buyer.

LCT is specifically applied to imported vehicles, which is now almost every vehicle in Australia, over a certain price threshold. The threshold is assessed every year and is currently $68,740. For vehicles that are deemed to be fuel efficient, the threshold is higher at $77,565.

LCT is charged on vehicles under two years old as shown on the compliance plate.

Dealers should also take note that LCT only applies to vehicles two years old or less, which is measured from the compliance plate date and not from when the vehicle was first sold / registered. This is a common misunderstanding amongst dealers.

Mr Bragg said that if a car is being sold for a second time, a tax credit for the entire amount of LCT paid from when it was first sold will be applied.

“Therefore, under normal circumstances, there would likely be no LCT to be paid,” he said.

“However, if the vehicle appreciates in value then LCT is payable on the increase over the amount it was first sold for.”

He cites an example of a luxury vehicle (not fuel efficient) sold on July 4, 2019 for $100,000. At that time the LCT threshold was $67,525.

LCT is payable on the amount above the LCT threshold exclusive of GST. So that is:

(LCT value – LCT threshold) x 10 ÷ 11 x 33%

($100,000 – $67,525) x 10 ÷ 11 x 33% = $9742.50

On February 12, 2021 (when the LCT threshold rose to $67,740), the same vehicle as above has appreciated in value and sold for $120,000 inclusive of GST and exclusive of dealer charges and other government fees.

The LCT payable in this transaction is:

(LCT value – LCT threshold) x 10 ÷ 11 x 33%

($120,000 – $68,740) x 10 ÷ 11 x 33% = $15,738 – $9742.50 (LCT previously paid) = $5635.50

“As you can see, in a buoyant used-car market, LCT will need to be assessed and included in the sale in these situations,” Mr Bragg said.

“The ATO will be looking for this specific LCT issue as the used market price increases have been well publicised.”

Dealers and private buyers of imported used cars are also warned that their purchases may be liable for GST if the price – inclusive of GST and duty and import costs including transport and shipping (plus GST on these) – is above the threshold.

Steve Bragg

By Neil Dowling

Read More: Related articles

Read More: Related articles