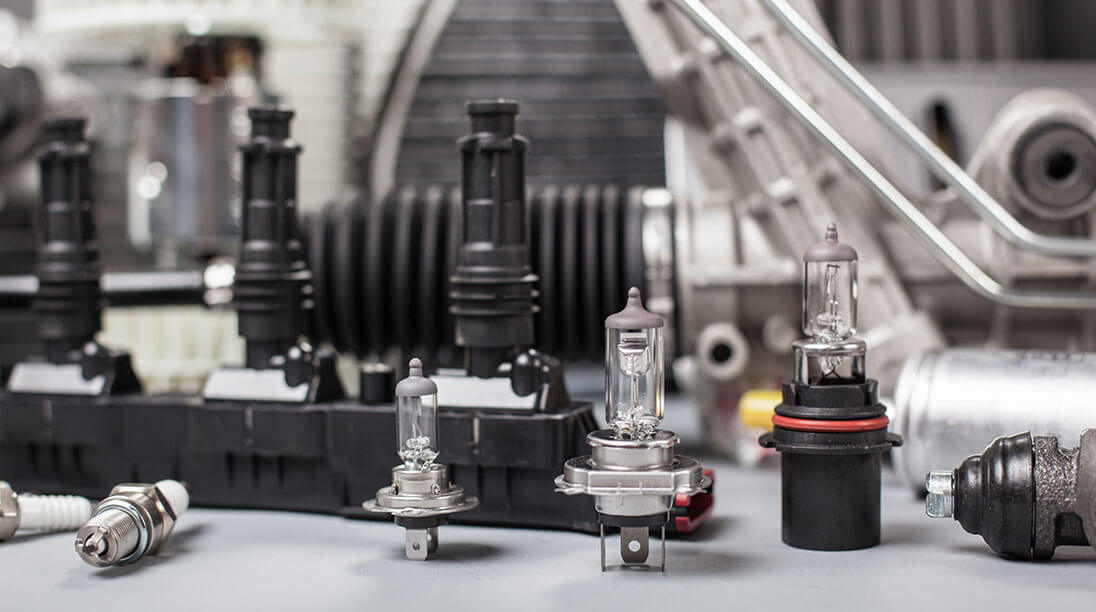

The United Kingdom spend – which is topped by purchases of items such as tyres, batteries and brakes – is expected to rise by more than three quarters by 2022 to $A2.8 billion, and expected to continue outspending online purchases of food and cosmetics.

In Australia, market researcher IBISWorld said the online automotive parts and accessories sales industry is “in the growth phase of its economic life cycle”. In its latest report, it said the online car parts industry is estimated to turnover $426 million this financial year.

“While demand for automotive parts and accessories has remained relatively stable, industry growth has come from consumers shifting from bricks-and-mortar stores to online retailers,” it said in a summation of its major report.

“The growing popularity of online shopping, coupled with the lower prices generally on offer from online retailers, has boosted industry demand and revenue over the past five years.”

IBISWorld said growth would slow slightly over the next five years because of retail competition and the increase of newer cars needing less repair. It estimates an annualised growth rate of 7.5 per cent with the 2021-2022 financial year turning over about $610.6 million.

Roy Morgan agrees. In its most recent research, it said 44.2 per cent of the Australians buy at least one product a month using the internet.

eBay UK – Car parts

“Although categories like reading material, women’s clothing, travel and music account for the lion’s share of internet shoppers, smaller categories such as car parts and accessories are slowly building an online market,” it said.

Its latest figures of March 2015 showed 306,000 people bought car parts online compared with 891,000 who bought e-books and 1.04 million who bought women’s clothing.

Roy Morgan said that by comparison, the auto spend didn’t appear to be substantial.

“But when we consider that the mean amount spent is $182, it becomes apparent that the online auto accessories category is quite lucrative,” it reported.

“Whether someone is likely to buy these products online depends on how they feel about cars.

“Not surprisingly, Aussies who self-identify ‘as a bit of a car enthusiast’ top the list, being almost 200 per cent more likely than the population average to buy auto parts online in an average four weeks.”

The category manager for eBay’s auto parts and accessories division in Australia and new Zealand, Mark Johnson, told GoAutoNews Premium that the auto parts and accessories sector was third on the list of high turnover segments processed by eBay. The top-ranking was technology – including televisions, iPhones, iPads and other electronic equipment – followed by lifestyle, including home and garden products.

But he said Australia, unlike the UK, did not have the equivalent high-volume online sales in groceries and cosmetics.

Roy Morgan said “Armed with this kind of detailed attitudinal information about their present and potential customers, online retailers of car accessories are better placed to tailor their marketing communications to resonate exactly the audience they wish to reach.”

IBISWorld said that the largest industry player is Supercheap Auto “which has benefited from its established bricks-and-mortar presence and brand name recognition, which often puts the company at the top of search engine results”.

“Supercheap Auto has gained market share due to the lack of other bricks-and-mortar parts retailers with a foothold in the industry,” it said.

“Repco is yet to establish an online store, while Autobarn does not offer delivery services and only provides a ‘click and collect’ option, where consumers can buy online and pick up the item in-store.”

IBISWorld said the online automotive parts and accessories sales industry has grown significantly over the past five years.

“Strong consumer uptake of online shopping has benefited online automotive parts retailers, particularly as consumers generally view industry operators as better value for money than bricks-and-mortar outlets,” it reported.

“While automotive parts and accessories typically do not need to be tried out before they are purchased, they do need to fit exact specifications that can be outlined in the purchase process.

“The rising popularity of shopping online is driving industry revenue growth, which is forecast to rise at an annualised 11.5 per cent. This represents an outperformance of Australia’s GDP growth, which is projected to rise at an annualised 2.5 per cent over the same period.”

The UK’s car servicing and repair sector grew again in 2016, with turnover rising 2.4 per cent to $A36.6.6 billion, according to figures released this week by the Society of Motor Manufacturers and Traders (SMMT).

eBay UK -Car parts

Additional research, commissioned by SMMT from independent consultancy Frost & Sullivan, shows that in 2016, UK motorists increased their annual spending on car maintenance by 1.7 per cent to an average of $A1198.

“This was due, in part, to the replacement of more high tech components, which require new skills and equipment to fit,” the SMMT said.

“While tyres, lubricants and filters are still the most commonly replaced items, the research shows that demand is rising fastest for telematics devices and tyre pressure monitoring sensors.”

The SMMT said the data shows the automotive aftermarket industry’s contribution to the economy which in the UK in 2016, amounted to $A21 billion and created 1400 new jobs.

“Consumers are also increasingly turning to other digital services for their maintenance needs and online comparison websites, common in the insurance and finance sectors, are now entering the aftermarket,” it said.

“An estimated 100,000 people in the UK are currently using these sites to compare workshop offerings and prices, and this is set to grow significantly.

“This all makes clear the need for aftermarket companies to continue adapting their business models, and increasing their investment in mobile platforms to remain competitive.

“By 2022 the UK automotive aftermarket is projected to be worth about $A47.5 billion, with an employee base of 400,000.

By Neil Dowling

Read More: Related articles

Read More: Related articles