Providing a useful insight into problems experienced by plug-in vehicle owners in the world’s largest automotive market, the ‘New Energy Vehicle Experience Index’ study released last week shows that quality issues found by consumers within the first two to six months of ownership relate more to traditional areas such as the interior, exterior and driving experience.

That said, complaints relating to core components of an electrified vehicle, such as the motor and battery pack, were also commonly cited, and owners’ interaction with their vehicle’s operating system (OS) was identified as a key area in need of improvement.

On the latter, the study found that 64 per cent of respondents had never tried the feature of internet-based vehicle software updates, while the most commonly reported problems under the OS banner were limited functionality (31%), poor interface (26%), poor/slow network (19%) and system crash/slow (16%).

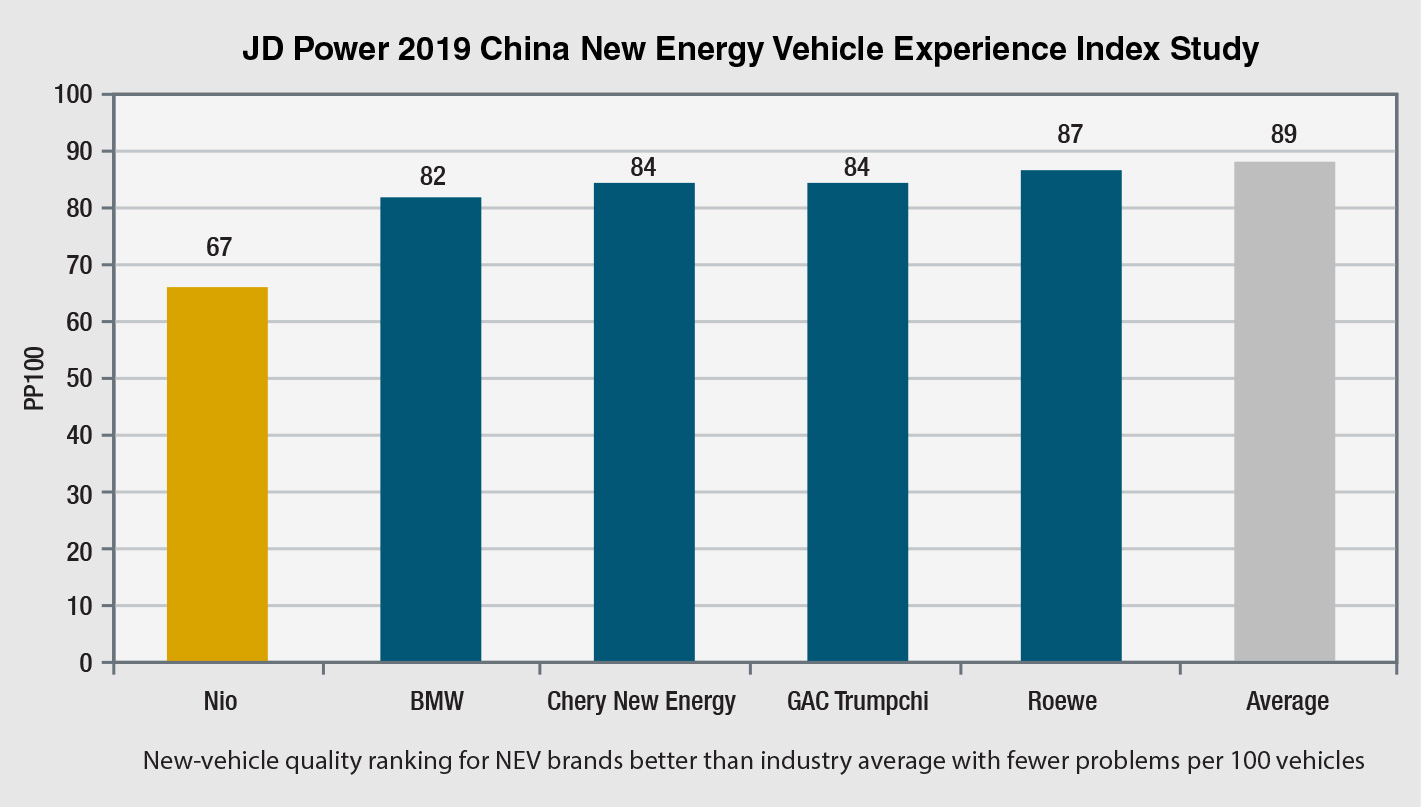

The highest-ranking brand in the study, EV start-up Nio, does not operate in Australia but was a clear winner with the lowest score, 67, based on problems cited per 100 vehicles.

BMW was a notable second on 82 PP100, while only three others from a total of 21 brands (and 41 models) included in the study were also underneath the industry average of 89 PP100 – Chery New Energy and GAC Trumpchi (tied for third on 84) and SAIC’s Roewe (87).

Roewe has been under consideration for launch in Australia to sell alongside its fast-growing stablemate MG, with both brands sharing alternative powertrains and MG set to enter the local market with an EV first via the eZS small SUV next year.

Where the criteria was met, the study also produced individual model rankings in the mass-market plug-in hybrid segment, with the BYD Tang edging out the Roewe ei6 for class honours, while the Nio ES8 – which was put through hot-weather testing in Australia earlier this year – was the standout in the mid-size/large battery EV segment, ahead of Roewe’s ei5.

JD Power China general manager of auto product Jeff Cai highlighted the importance of manufacturers of electrified vehicles not overlooking traditional quality problems while fast-tracking ‘new energy vehicles’ to market and as they focused their resources on core NEV technology.

“With the fading of government support, consumers will be paying more attention to new energy vehicles,” Mr Cai said.

“New-vehicle quality, as one of the most important elements for product competitiveness and consumers’ purchase decision, largely determines which side consumers will prefer when making choices between fossil-fuel vehicles and new-energy vehicles.

“Although challenging, new-energy vehicle manufacturers should not overlook the solutions to traditional quality problems while developing NEV core technologies and view it as an opportunity to win the favour of the market and consumers.”

The top three most frequently cited problem areas by NEV owners in the study were common to all vehicles, coming in the interior (16.3 PP100), exterior (15.8) and driving experience (14.7) categories, while complaints about the battery and electric motor were considerably less at 7.4 and 3.4 PP100 respectively.

Aussie link: Nio has topped JD Power China’s inaugural electrified vehicle quality study, and its ES8 SUV – which underwent development testing in Australia – was the best-ranked medium/large EV.

In terms of NEV-specific problems, the main areas of complaint were insufficient power (2.7 PP100), slow charging speed (1.9), abnormal reduction of endurance mileage/driving range (1.8) and abnormal powertrain noises (1.4).

Electrified vehicles from luxury marques outperformed models from mass-market brands, with only 69 PP100 reported for the prestige sector. This compares to more problems experienced with NEV brands marketed by established Chinese car-makers (90 PP100).

In terms of satisfaction with the overall user experience, JD Power found that vehicle appearance ranked highest with 7.6 points on a 10-point scale, followed by driving experience and interior design (including colour and material quality), both on 7.5.

Scores for battery performance and in-vehicle hi-tech features were slightly lower at 7.4.

The study is based on responses from 2770 owners who purchased their electrified vehicle between September 2018 and March this year. It was fielded from March through to May this year in 30 major provinces across China.

New-vehicle quality in the study is measured by examining problems experienced by owners in two categories: design-related problems and defects/malfunctions.

There are nine problem categories in which specific diagnostic questions are asked, namely: features, controls and displays; interior; exterior; seats; driving experience; battery; audio, communication, entertainment and navigation; electric motor, transmission; and heating, ventilation and air-conditioning (HVAC).

The Chinese study comes as JD Power also last week released its first ‘Mobility Confidence Index Study’ in the United States that found consumers lack confidence in the future of both battery-powered and self-driving vehicles – two key areas that are dominating R&D resources and product planning schedules among the world’s major motor vehicle manufacturers.

Run in partnership with global survey software company SurveyMonkey, the index is based on a 100-point scale and puts confidence levels for EVs at just 55 and autonomous vehicles even lower at only 36.

The results are based on responses from 5270 consumers about EVs and 5749 about autonomous cars.

According to JD Power, the 55-point rating for EVs indicates that consumers have a “neutral” level of confidence about the future of electric cars, with attributes scoring the lowest including the likelihood of purchasing an EV (39), reliability of electric compared to petrol-powered vehicles (49), and the ability to stay within budget compared to petrol, diesel or hybrid vehicles (55).

With this in mind, most respondents (61%) believed there were positive environmental effects of EVs, and almost half (48%) said the cost of charging compared with the cost of petrol would be advantageous.

But concerns about the availability of charging stations and an EV’s driving range were expressed by 64 and 59 per cent of those surveyed respectively, with 77 per cent expecting EVs to have a driving range of 300 miles or more (483km) and 74 per cent only willing to wait 30 minutes or less to recharge a vehicle to travel about 200 miles (322km).

More than three-quarters of respondents (77%) had no experience with an EV whatsoever, and of those, only 40 per cent said they would consider purchasing or leasing one – results that point to an uphill battle for manufacturers attempting to reach critical mass in the US market.

The low confidence index score for self-driving cars stemmed from negative responses to attributes such as feeling comfortable in the vehicle (34) and being on the road with others (35).

JD Power says consumers were particularly concerned about tech failures/errors (71%), vehicle hacking (57%) and liability as a result of a collision (55%), although respondents proved to be more hopeful than worried (65% vs 34%) about the overall benefit of technology in their lives.

“Out of the box, these scores are not encouraging,” said JD Power’s executive director of driver interaction and human machine interface research, Kristin Kolodge.

“As auto-makers head down the developmental road to self-driving vehicles and greater electrification, it’s important to know if consumers are on the same road—and headed in the same direction.

“That doesn’t seem to be the case right now. Manufacturers need to learn where consumers are in terms of comprehending and accepting new mobility technologies—and what needs to be done.”

By Terry Martin

Read More: Related articles

Read More: Related articles