The collapse sounds a warning especially for fleet managers who are sitting on large numbers of EVs amongst company cars and who face potential adjustments to their loan-to-value ratios.

Onto had a fleet of 7000 EVs and a customer base of 20,000 subscribers. The company said it had “run out of cash.” and was unable to secure additional funding from its shareholders.

Administrators say they will continue business operations while looking for options.

Joint administrator Gavin Maher of Teneo Financial Advisory said Onto had suffered from the steep fall in electric vehicle residual values in the first half of 2023, from rising interest rates as well as the squeeze on disposable income in the UK .

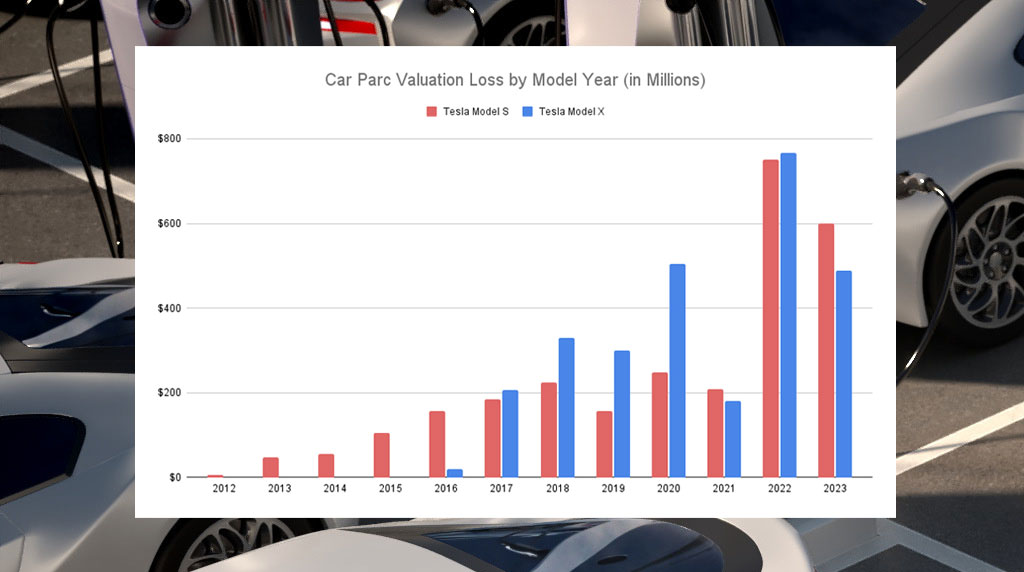

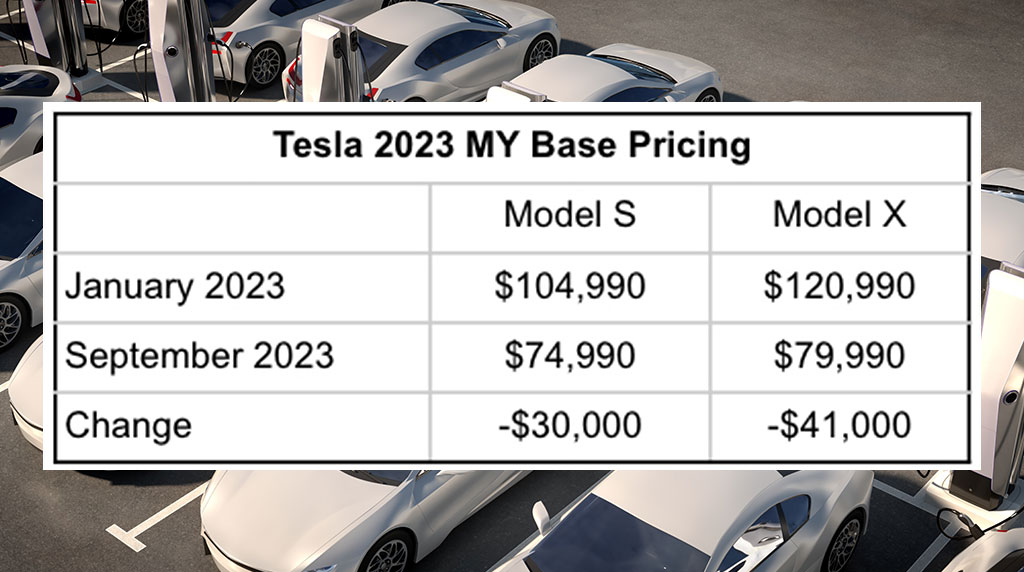

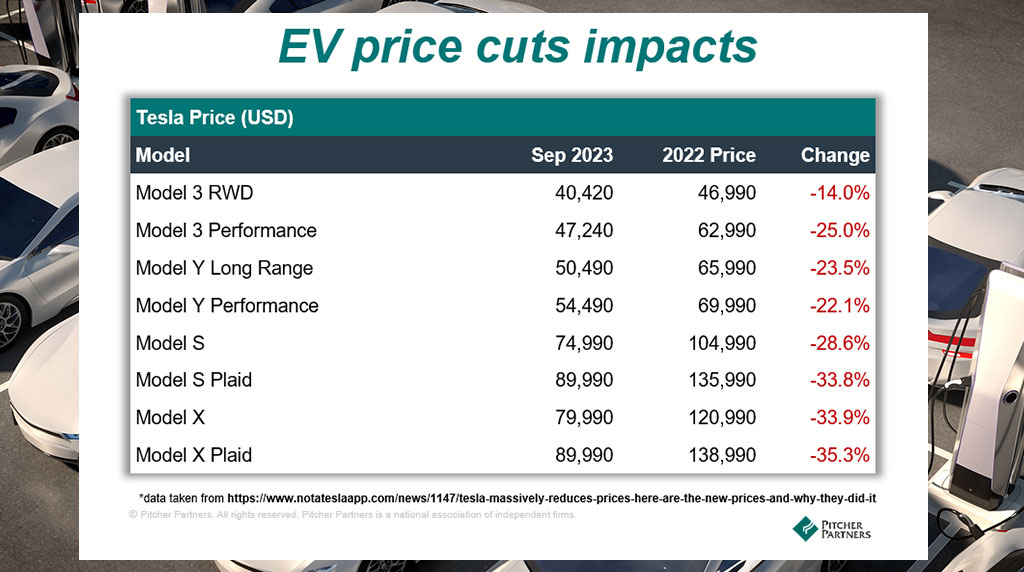

Pitcher Partners’ Steven Bragg told GoAutoNews Premium that residual value was a critical part of managing a fleet and one that can easily be disrupted – with catastrophic business results – when an OEM moves the MSRP.

He cited Tesla’s recent moves to drop the prices of its models and the pressure this put on Tesla residuals and the resale value of other EV car makes.

Mr Bragg discussed this in GoAutoNews Premium last month (click here).

But Mr Bragg said it wasn’t unique to EVs. He said the drive train “doesn’t really matter.”

“If the OEM brand drops the price on a model it will have an eventual knock-on effect to the residual value of that model’s used vehicle car parc; not only that brand’s used models but also comparable models from other brands,” he said.

“The ‘new paradigm’ here is direct-to-customer (DTC) and agency sales models which employ the one-price model for the geographic markets which they operate.

“This means the price drops are immediately felt and can catch fleets and owners off guard.

“Under the franchise model the price drops are usually done via marketing, incentives, bonuses, free services, over allowances and other inducements.

“These cannot be easily determined and therefore the MSRP is maintained for longer and the market remains stable.

“The real impact here in my opinion is that financiers will need to be conservative in financing EVs and will likely require bigger deposits to manage the risk of further price drops.”He said that as an example of the problems facing fleets – and one likely encountered by Onto in the UK – was that if a company had 1000 EVs at an average cost of $80,000, it had a fleet value of $80 million. The loan-to-value ratio (LVR) is 80 per cent and the initial loan is $64 million ($80,000 x 1000 x 80%). The book carrying value of the EV fleet is $80 million.

The loan-to-value ratio (LVR) is 80 per cent and the initial loan is $64 million ($80,000 x 1000 x 80%). The book carrying value of the EV fleet is $80 million.

“If the OEM cuts the price of EVs in the fleet by $10,000, the fleet residual value would decrease by $10 million (1000 EVs at $10,000 each).

“This breaches the LVR covenant, which is now 91.4 per cent ($64 million loan against $70 million fleet residual value).

Now 80 per cent of the fleet residual value is $56 million. The difference between the $64 million loan and the new loan value is $8 million.

“Therefore, the company needs to find $8 million to reduce the outstanding loan to $56 million and remain compliant with its LVR covenant.”

Autograb UK CCO Tony Williams, said in a post, the value of used EVs has dropped by nearly half in the past 12 months on the back of increased supply of cars into the market and well publicised cuts in new EVs from Tesla and others.

He said that market reports showed EVs had 12 months of falling values month-on-month with an overall decrease of 44.3 per cent.

“I am not here to be anti EV and have been an advocate of being astute in approaching residual values that have been subject to extreme market conditions,” he wrote.

“We are maybe at a point where global vehicle production recovery may exceed global vehicle consumer demand and see OEMs use their traditional marketing tools to maintain sales volumes – discounts, subventions and increased shorter term sales all of which are unlikely to support resale values of any powertrain vehicle,” Mr Williams said.

The post triggered BYD Europe’s head of remarketing and UK fleet sales, Malcolm Fryer, to note that residual values had fallen “by around a third in the UK on average in the past year.”

Based in Warwick, Onto’s business had grown since launch to have more than 7000 EVs in its fleet by the start of 2023, and it introduced more than 20,000 people to electric cars via a subscription, said the administrators.

Sky News reported earlier this year that one of Onto’s investors, Legal and General, had told the company it would offer no more funding after investing £22.5 million in May and June, on top of previous funding.

Onto held a £60 million funding round in 2022, at which it was described by Legal and General as “an ambitious company with a talented management team that will play a vital role in accelerating the transition to electric vehicles”.

Onto was founded in 2018 by co-founders Rob Jolly and Dannan O’Meachair, with a mission to provide a more accessible and affordable way for people to switch to electric cars.

Onto’s website states: “There’s an electric car for everyone.”

“Onto makes the switch radically simple with our all-inclusive car subscription that includes insurance, servicing, and public charging (unless you select a no-charging subscription). Browse our curated selection and find your perfect match, delivered to you in just 72 working hours across the UK.”

The website offers subscriptions on Teslas, Fiats, Peugeots, Hyundais, Volkswagens and Audis.

Read more:

Agency “harms car owners and OEMs”

By Neil Dowling

Read More: Related articles

Read More: Related articles