A REPORT by Pitcher Partners is saying that fleet sales are set to dominate the Australian new car market this year and that the share of the market claimed by private buyers (which generally send higher margins the way of dealers compared with fleet purchases) is likely to decline.

While the prospect of selling fewer cars at a higher margin and more cars at a lower margin might not seem to be good news for auto retailers, the upside is that the increased sales of fleet vehicles will- generate service sales on top of the one million service opportunities that flow from the existing annual sales. (See footnote regarding service sales).

The factors at play are that private buyers are not making enquiries at the rate they were as cost-of-living pressures bite and families exhaust their savings while fleet managers, who have been biding their time while dealers filled private orders first, are now finally getting access to the cars they need to refresh their vehicles.

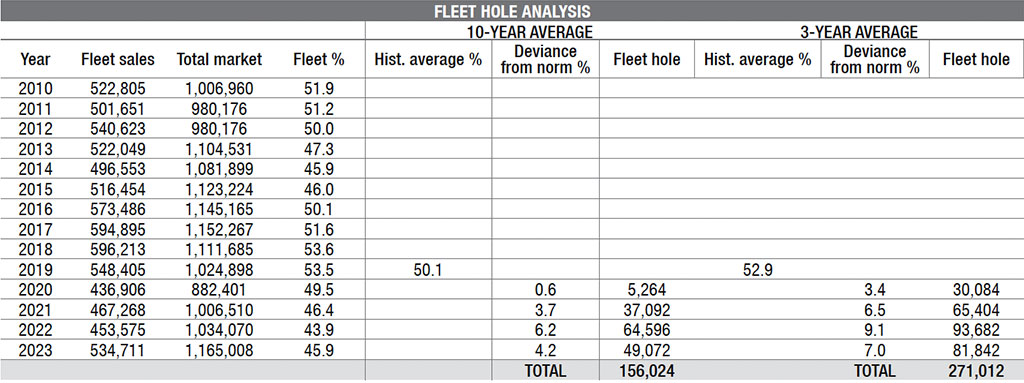

Pitcher Partners analysis of buyer types calculates that somewhere between 150,000 and 270,000 units were missing from fleet sales that were not made during the stock shortages.

Steve Bragg, lead partner of motor industry services at Pitcher Partners said that during the shortages, dealers and OEMs were pushing their available cars to private buyers where greater margins were available.

“This meant fleet managers were left at the end of the queue.

“We think there were a lot more missing sales than are currently showing up in the sales data and that, with the shortfall that occurred, business owners and fleet managers in companies and governments are going to need to find something like as many as 350,000 more vehicles on top of the ‘normal’ fleet market to replenish the vehicles that are currently missing,” Mr Bragg said.

In its latest report on the state of the market, Pitcher Partners advised dealers: “It is time to show the fleet department some love.”

The report said that with vehicles in short supply in the past few years now becoming increasingly available, fleet managers will finally be able to begin to turn over their fleets.

There were signs of that last year, the report said. In 2022 fleet vehicles accounted for just 43.9 per cent of the market (453,576 units) and last year that rose to nearly 46 per cent (534,711 units).

In the two years just prior to Covid, fleets sales were running at 53.6 per cent with nearly 600,000 fleets sales in 2018.

If 2024 was to run at the 53.6 per cent achieved in 2018 in a market of around 1.1 million, it would produce fleet sales of 625,000 units.

“We expect this trend to continue as 2024 will be the year of fleet and government sales but expect privately-bought vehicles to decrease year on year,” the report said,

As the above table shows, fleets have historically accounted for approximately 50 per cent of total unit volume since 2010 while in the last three years it is 45 per cent. “Considering that since 2020, fleets account for about 45 per cent of total units, this implies that the focus had shifted from fleet sales in favour of private consumers as they are the more profitable option on the vehicle sale.

“Considering that since 2020, fleets account for about 45 per cent of total units, this implies that the focus had shifted from fleet sales in favour of private consumers as they are the more profitable option on the vehicle sale.

“We estimate that there are about 150,000 to 270,000 and potentially as many as 350,000 units unsold to fleets, which has resulted in an ageing fleet,” Mr Bragg added.

“Once you factor in government incentives to drive EV adoption through the Electric Car

Discount Bill the figures Pitcher Partners have quoted are higher,” the report said.

“The Bill has resulted in the increase in novated leases of electric vehicles to take advantage of FBT exemptions. As these purchasers were likely to be ‘private’, if they were removed from the calculation, the fleet unit volume as a percentage of the market, would be considerably lower.

If the fleet sales for CY24 maintain CY23 levels of around 535,000-plus catch up on say 100,000 of missing replacement vehicles, fleet sales could well make up 60 per cent of the new car market in 2024.

Footnote regarding fleet service. The initial view might be that this is bad business for dealers. However, it is actually beneficial as long as the dealer group can retain the service work.

Fleets need to be regularly serviced to ensure they are readily available, on-road for use and to maintain strong resale values.

Mr Bragg said: “Strong fleet sales on top of the service departments that will be chock-a-block full of first-year services (1.2m vehicles returning from CY23) should hold dealers in good stead for 2024.

“The imperative for dealers is to ensure they lock in their customers to the servicing and make sure they return for the two-five year services.

The report said: “The bottom line is that fleet sales have not maintained the growth trajectory that units sold have been on, and as we notice underlying consistency in the 50 per cent mark, we would expect this ratio to convert back to the mean as soon as next year, as demand from privates starts declining”.

Steven Bragg is the lead partner of the motor industry services group at Pitcher Partners Sydney.

By John Mellor

Read More: Related articles

Read More: Related articles