Paul Swyny

AUSTRALIA is poised to rapidly embrace online car financing in a move precipitated by the increase in digital technology and a willingness of Australian customers to try new finance options.

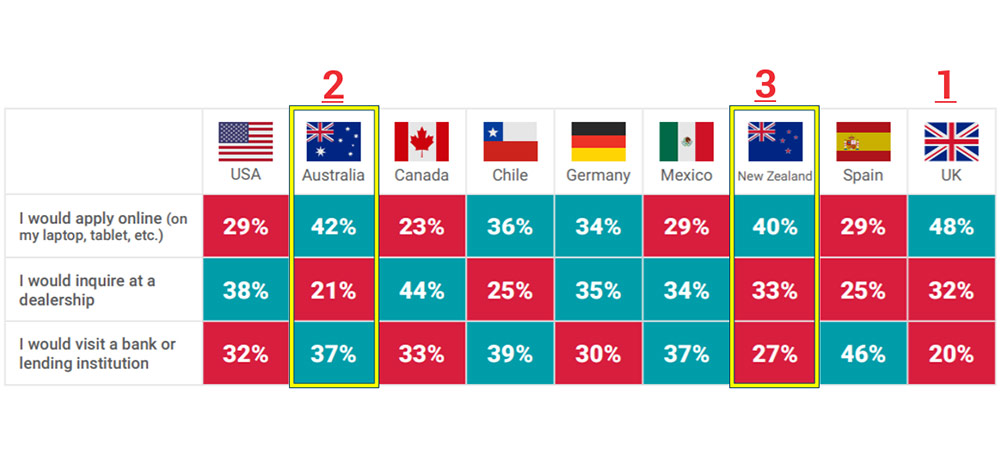

A nine-country survey by US-based banking analytics and credit scoring firm FICO found that Australia is one of the more progressive countries where buyers are now prepared to use online platforms to finance their next car.

FICO reported that 45 per cent of respondents surveyed in Australia had sourced their existing loans from a car dealership.

But FICO Australia client partner Paul Swyny said the survey found that when they return to finance another car, 42 per cent said they would look at getting their finance online.

“So we have a disconnect between the way they used to receive loans and the way they now expect to get a loan,” he told GoAutoNews Premium.

Australians also upset the norm when it came to prioritising financing and vehicle selection, with 36 per cent researching loans and finance options before going to a dealership or online to shop for a vehicle.

It is one of the highest percentages of customers surveyed and beaten only by Chile (at 47 per cent).

By comparison, 62 per cent of Australians shopped for the vehicle first, then inquired about financing.

“These are exciting times for the finance industry and there is a shake-up coming in the industry,” said Mr Swyny.

“I think, starting halfway through next year, the convergence of new lending technologies and Australian banking regulations there will be the biggest changes coming to digital financing.

“So that in over two-to-five years, big changes will happen in the way Australians deal with financing their cars.

“There will be more competition for loans, including more fintechs (financial technology businesses) moving into the sector.

“The bigger financial organisations and car dealerships will have to improve their offerings to the consumer to remain at the forefront of their industry.”

Mr Swyny said one of those ways is to make accessing finance more convenient for the consumer.

“Dealers need to have the conversation about finance with the customers as they come through the door,” he said.

“There are a number of possibilities, as simple as a consumer walking in and seeing the car they like and using a digital self-service portal they can type in their information and get all the offers available.

“They can also sit down with the dealership’s finance person and go through the whole process.

“The key facet is that all this will be in real time. This can be offered by the digital intelligent risk management technology.

“It can take 30 minutes for a person to complete a finance application at the moment. If we can cut that down and make it easier and make it happen while they are in the dealership it will make it better for everyone.”

Mr Swyny said that the changes coming to the finance industry include comprehensive credit reporting and open banking. Open banking is a new reporting method for banks that allows consumers to elect to share their bank details and history with other financial organisations.

“This means that third parties can be given access to your personal data,” he said.

“It’s important to note here that the consumer is in control of who gets access to their data – they must authorise the transfer of data from their bank to a third party.

“It’s about making it easier for consumers and getting them to understand how much they can borrow.”

In Australia, only about 29 per cent of consumers first learn what level of financing they qualify for before shopping for their vehicle.

“This may be an opportunity to better educate consumers on the buying experience,” he said.

“Globally, the most important thing customers want to know is the monthly repayment. Everything else revolves around that. The second biggest is the interest rate.

“In Australia, it was slightly different. The survey found that the most important aspect of the loan was the monthly repayment, followed by the length of the loan and then, in third, the interest rate.”

The FICO survey covered a total of 2200 adult consumers across nine countries – the US, Canada, Mexico, Chile, Australia, New Zealand, Germany, Spain and the UK – with respondents aged between 18 and 64 years and who acquired a loan on a new or used vehicle within the past three years.

By Neil Dowling

Read More: Related articles

Read More: Related articles