Read State of the industry: Part One: Click here

What is your dealership worth?

THANKS to current high and estimated future profits, there are many dealer groups and investors looking to acquire dealerships.

This is because automotive dealerships have proven to be excellent investments in both good and bad economic times.

While there are plenty of buyers in the market, there is little consensus on how to value dealerships. The only thing that can be agreed on is that dealerships are worth more today than they were before the pandemic.

Therefore, one of the biggest questions on every dealer’s mind is “what is my dealership worth today?”

The answer is complicated.

First things first.

We need to determine the dealership’s future maintainable earnings (FME). This is covered in detail below but calculating FME is a mix of science and art that could be aided using a crystal ball. The particular factor to determine for buyers is when supply will return to pre-pandemic levels and margins normalise.

The second part of the goodwill equation is the multiple of earnings (Net Profit Before Tax) the buyer is willing to pay for the dealership. We cover the valuation and consolidation trends in the market below.

Current Australian M&A trends

The current market is ‘hot’ when looking at the current M&A activity. The overarching theme of consolidation continues to drive this activity in the Australian market. The listed and large family dealership groups continue to invest heavily into expanding their footprint to new markets (for them) as well as consolidating their position in their existing prime market areas (PMA).

The market has had to shift its approach from traditional dealership valuation techniques and take into account what is widely believed to be temporary and abnormal profits.

Public company spending spree

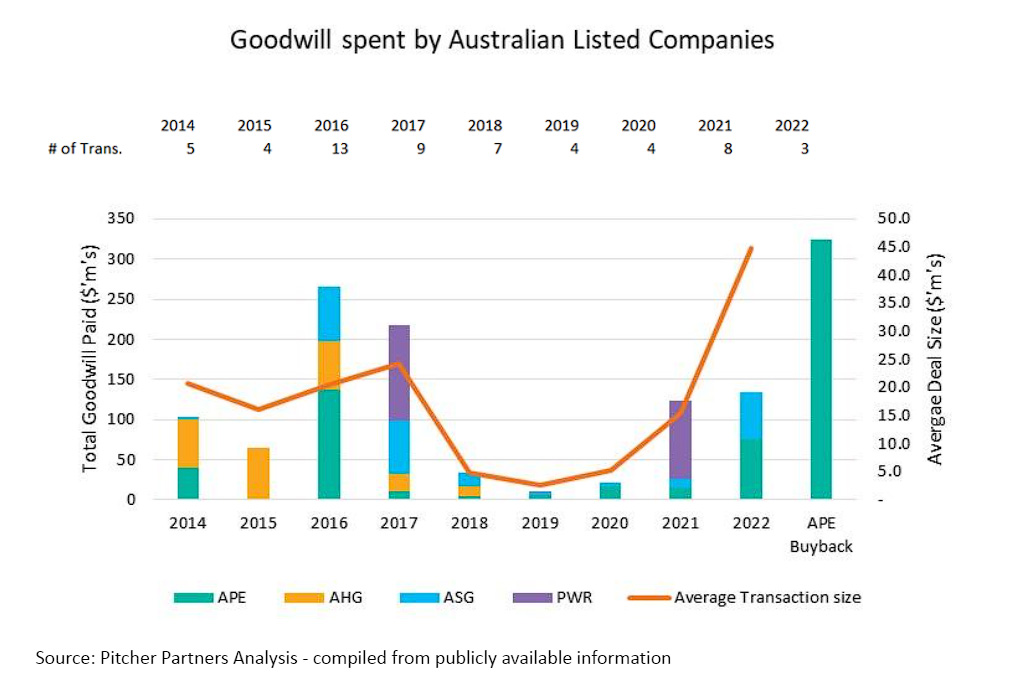

Local M&A has accelerated during the pandemic era as dealerships post record profits despite experiencing a reduction in units sold. In recent years, the Australian listed companies have shown their willingness to purchase strategic assets utilising significant amounts of capital, evidenced by the nearly $1b of goodwill paid in acquisitions since 2014.

Notes:

- Automotive Holdings Group (AHG) ceased trading on the ASX 27 September 2019 after an on-market take-over by Eagers Automotive (APE)

- Autosports Group (ASG) IPO 16 November 2016

- Peter Warren Automotive Holdings (PWR) IPO 26 April 2021

The industry has been through a period of high gross margins and low interest rates resulting in bloated earnings. This is evident from reviewing the publicly listed company’s financial statements with significant cash reserves and decreasing debt to equity ratios.

Eagers Automotive has announced an on-market buy back of 10 per cent of their outstanding share capital, based on 15 September 2022 market capitalisation, a $325m investment.

This will keep Eagers in good stead if the market were to turn as it is prudent to allocate more cash to share repurchases rather than dividends during a broader economic downturn.

The large, listed groups also are not shy when it comes to market consolidation and deploying capital. Sydney-based Suttons Group has recently purchased the 9.1 per cent stake in Peter Warren Automotive Holdings from Quadrant Private Equity for $50m.

These transactions reflect the further wider consolidation in the retail automotive industry as evidenced in the below table.

Australia’s new car market revenues are estimated to be approximately $59bn annually (AADA dealernomics website).

It is Pitcher Partners MIS view that the large dealership groups need to grow turnover to at least $3.0b annually in the medium term. At this size, they will be able to navigate the once-in-a-century change occurring in the industry (Electric Vehicles and Agency); assuming that efficient operating expense management and optimal capital structures are in place.

Current and future maintainable earnings and deal structure trends

Dealerships in Australia are typically valued at goodwill plus net tangible assets to arrive at their enterprise value. The goodwill component is usually calculated as a multiple of normalised earnings, or Net Profit Before Tax.

Before the pandemic, buyers would use current earnings plus or minus any normalisations when calculating earnings to apply a multiple dependent on many different factors to determine goodwill.

As referred to above, in the current (post-pandemic) market, a phrase has resurfaced due to recent inflated profits – future maintainable earnings (FME).

FME is the profit the buyer realistically expects the dealership to be able to consistently deliver in the medium to long term. This interrelationship between current earnings and FME is the driving factor behind the multiples that we are seeing in the market.

Higher goodwill values are obtained through the uplift in earnings (driving higher FME) while multiples remain relatively constant.

Multiple of FME

| Metro | Provincial | Rural | ||

| Luxury | 4-6x | 4-5x | 3-5x | |

| Prestige | 3.5-6x | 3-5x | 2.5-5x | |

| Volume | 3.5-6x | 3-5x | 2-5x |

Source: Pitcher Partners Analysis

We are seeing that buyers and sellers are splitting the benefits of the positive trading conditions we are experiencing that are leading to higher earnings.

Sellers who want to cash in on the good times are considering their options, especially if there are no succession plans for the dealership group in place.

Meanwhile cashed-up buyers from local and international groups are willing to meet in the middle for strategic and quality franchises/locations. The overarching theme is that both buyers and sellers need to be willing to compromise to get the best outcome.

There are scarcely any deals where one party is willing to lose out. It is best for each party to come to the table and have an open, honest discussion of the valuation for the dealership where both buyer and seller are happy with the price and achieve the best outcomes for both parties.

Recently, the Motor Industry Services team at Pitcher Partners is increasingly seeing a change in the structure of deals. We are seeing a return of the structure where the existing owner/dealer principal (DP) will retain a minority interest in the dealership.

The benefit of this type of deal structure is two-fold:

- The day-to-day running of the dealership remains in the hands of the minority owner/DP, so the buyer can fund the business’ future growth and does not need to replace the key management team in the dealership

- The minority owner/DP can cash out a significant portion of the value of the dealership/group in the ‘good times’ and ultimately crystallise the return on what can be multiple generations of investment into the family business.

This structure benefits both buyer and seller, as the seller still has ‘skin in the game’ and therefore has a greater care for the ongoing success of the dealership. The buyer can also leverage the local relationships the seller has built up in the community. This is typically something that is not easily transferable.

Of course, this is not the only deal structure available with many dealerships still selling 100 per cent of their business in the traditional asset or share sale structure.

More next week.

Read State of the industry: Part One: Click here

By Steve Bragg

Read More: Related articles

Read More: Related articles