THE proposed New Vehicle Efficiency Standards (NVES) raises several unanswered questions regarding their potential impact.

While the NVES was a much-needed government policy, it is very late to the game and both sides of government (past and current) can be attributed blame.

The policy, which is proposing to impose unreasonable timelines for implementation, will have some extreme outcomes that will have some unforeseen impacts on the Australian motor industry.

Amidst these changes, the focus needs to be on the outcomes:

- Will NVES effectively impose an additional ‘carbon tax’ on consumers?

- How will it affect dealers, OEMs and other industry suppliers’ futures?

- What impacts will this have on the supply chain of new vehicles coming to the Australian market?

From the outset, it is important to understand that it is doubtful that Original Equipment Manufacturers (OEMs) have the global capacity to meet the demand sought by NVES in a small, right-hand drive (RHD) market like Australia.

For NVES to have its intended impact, cars that meet the policy’s criteria and are also appealing to consumers, will need to be made available in the Australian market in the timeframe proposed.

Most OEMs will simply not be in position to pivot to align to the new emissions standards. The only real exception here is the plentiful Chinese manufacturers that want to enter this market.

Most Battery Electric Vehicle (BEV) and hybrid production, driven by limited resources, is directed towards the left-hand drive (LHD) markets in the northern hemisphere (refer image LHD vs RHD markets), where EV incentives have been established for a decade or more.

Consequently, if we’re honest with ourselves, Australia isn’t a priority market at the volumes envisaged by NVES nor are there any substantial incentives from the federal government to do so.

Note: 69% of countries are LHD (165 out of 240) Source: Left- and right-hand traffic – Wikipedia

Is NVES effectively an additional ‘carbon tax’?

To consider this point, we will need to look at the calculation of the penalty. The penalty is calculated on the average emissions of all vehicles imported by an OEM or distributor. This average is then compared to the limits set by the NVES.

Any emissions in excess of the NVES limit is then multiplied by $100 and then multiplied by the unit volume imported by the OEM or distributor.

First things first, let’s look at how an individual vehicle stacks up.

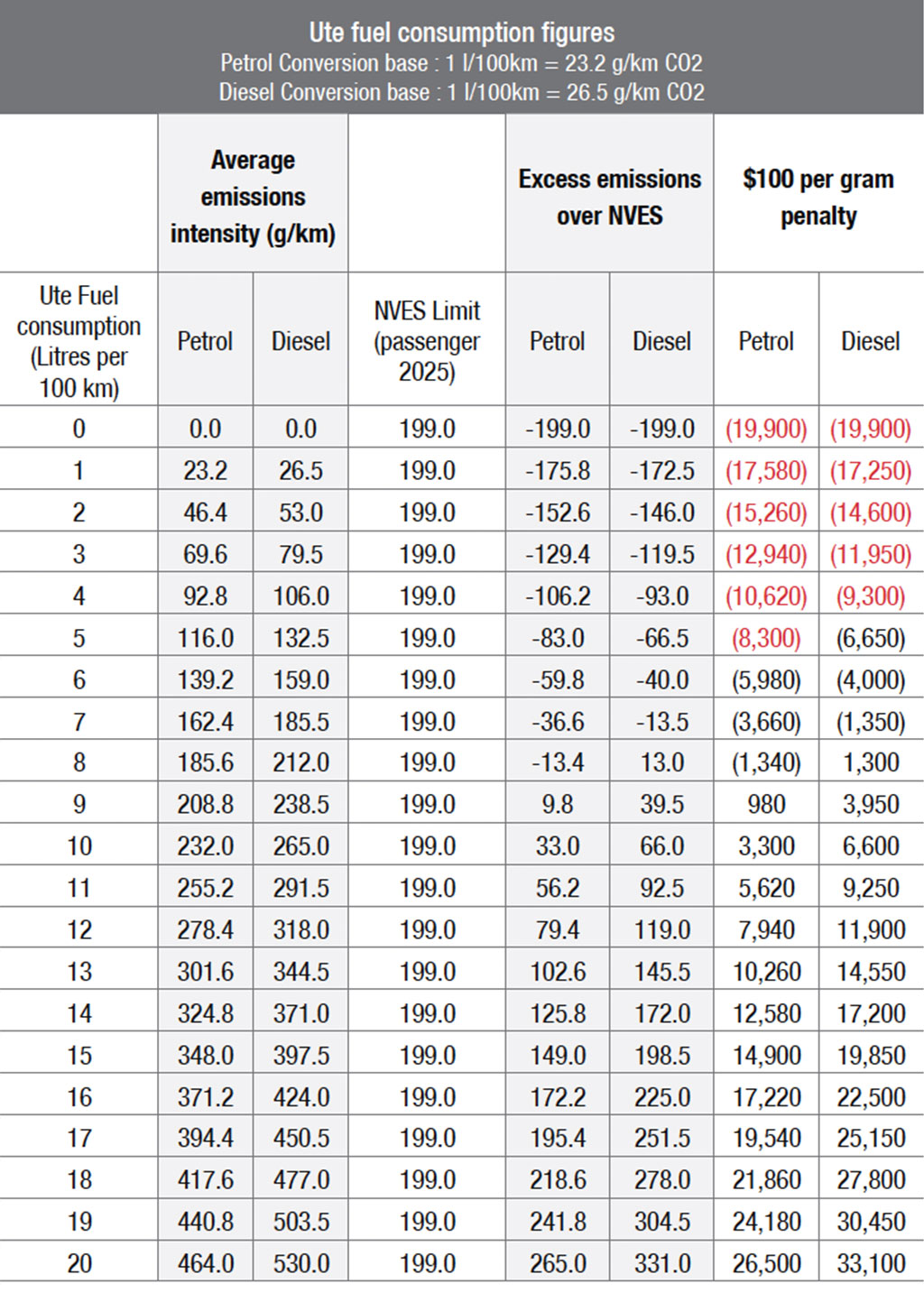

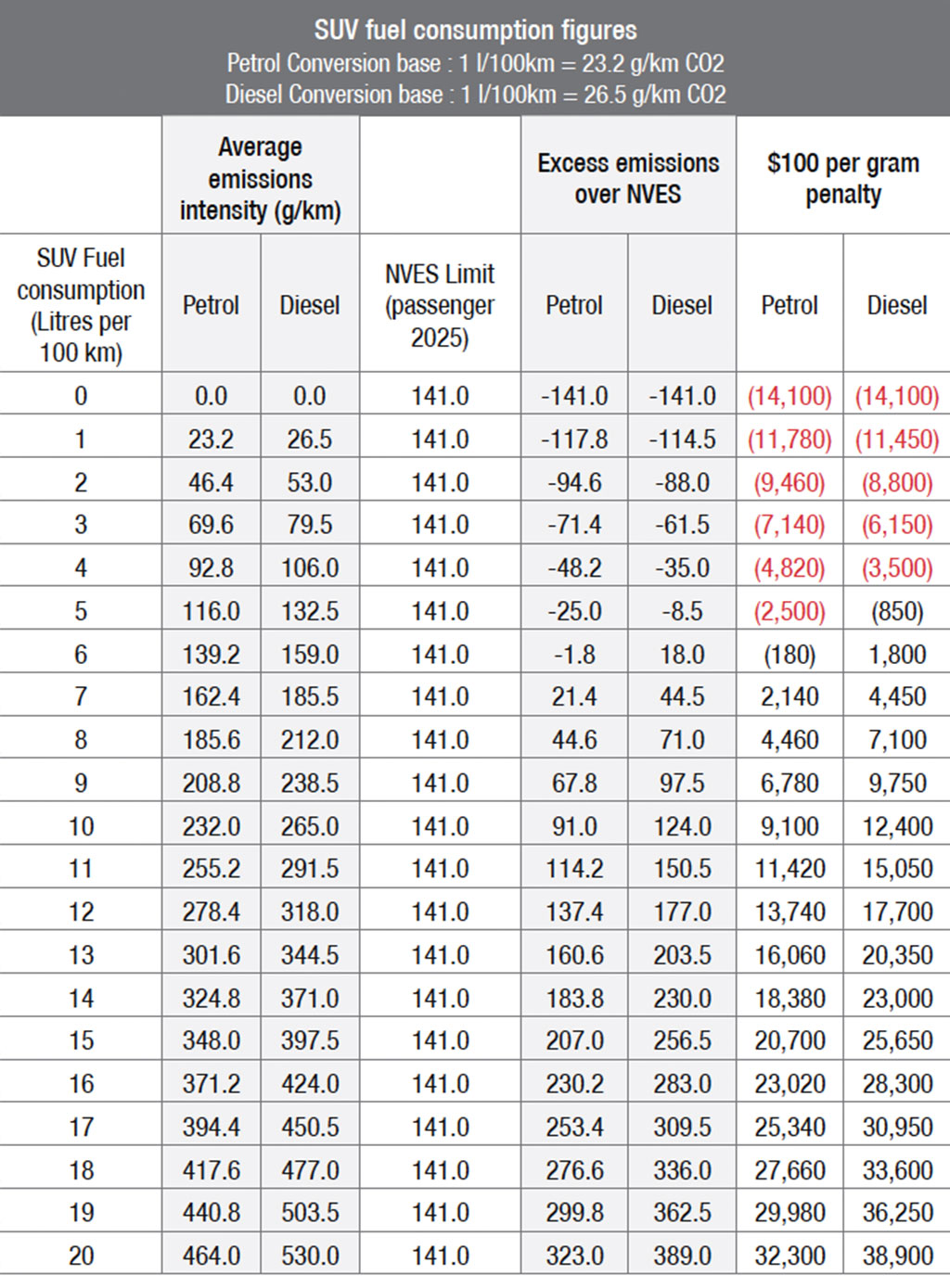

Carbon dioxide emissions intensity per kilometre is directly related to vehicle fuel consumption values. The table below provides fuel consumption figures and the corresponding carbon dioxide emissions intensity for petrol and diesel.

Another way to relate carbon dioxide emissions intensity to fuel is per litre of fuel consumed. For example, 1 litre of petrol will produce about 2.32 kg of carbon dioxide and 1 litre of diesel will produce about 2.65 kg of carbon dioxide on average.*

In the table below, we have modelled the potential penalties for an SUV that burns from 0 to 20 litres of petrol or diesel per 100km. We then looked at the 2025 NVES limit for passenger vehicles (141 g/km assuming the vehicle weight is the reference mass in running order) and calculated the penalties for the petrol and diesel variants.

The results are staggering when considering most SUVs burn rate is over 8l/100km, ranging from $4,460 to $38,900.

As you can see, the impacts on a car-by-car basis can be detrimental to the OEM and ultimately the consumer.

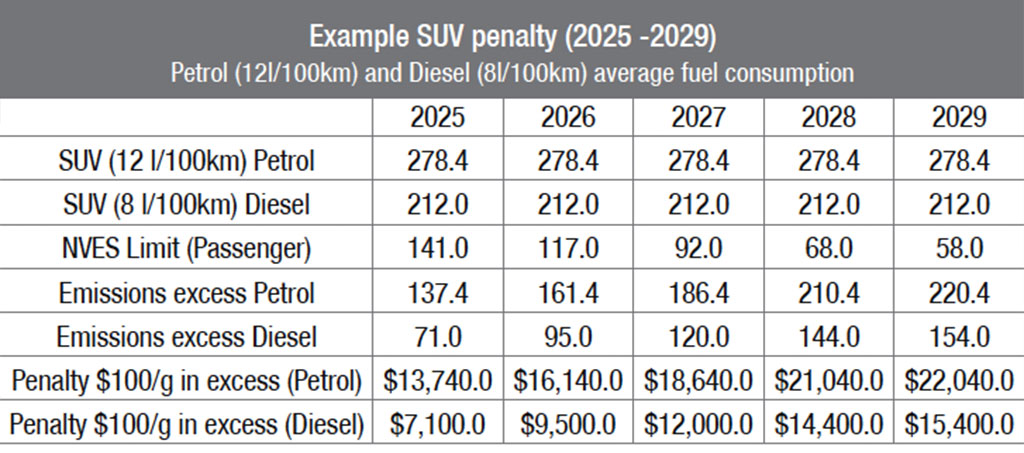

The NVES limits are proposed to decrease yearly from 2025 – 2029. This only inflates the impact as can be seen in the below table using a hypothetical SUV that averages 12l/100km for petrol variant and 8l/100km for diesel variants.

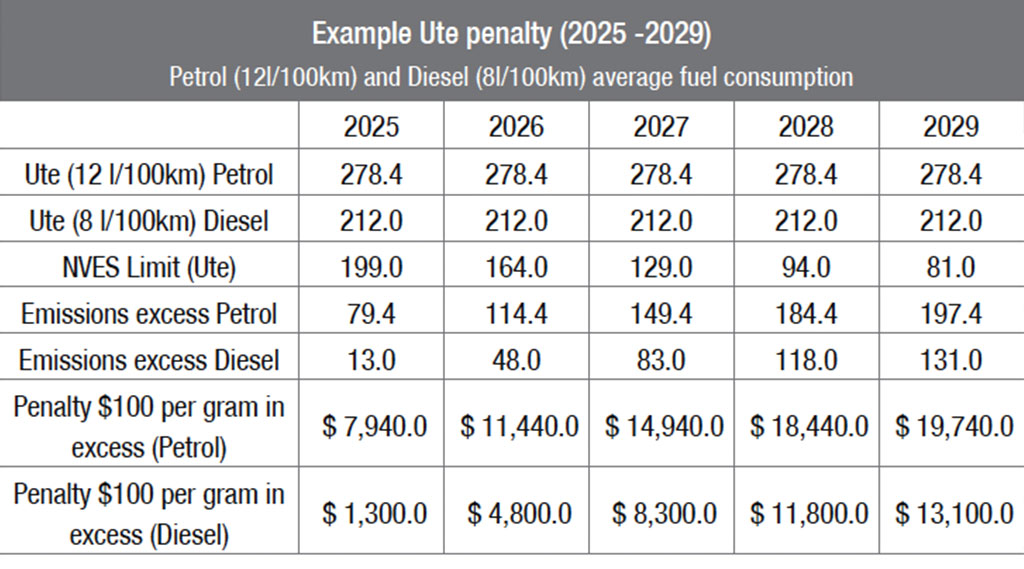

The penalty for the petrol variant starts at $13,740 in 2025 and increases to $22,040 by 2029. The diesel variant penalty starts at $7,100 in 2025 and increases to $15,400 by 2029. This may potentially drive more consumers to choose diesel over petrol. A similar impact is shown in the below tables when considering Utes.

A similar impact is shown in the below tables when considering Utes.

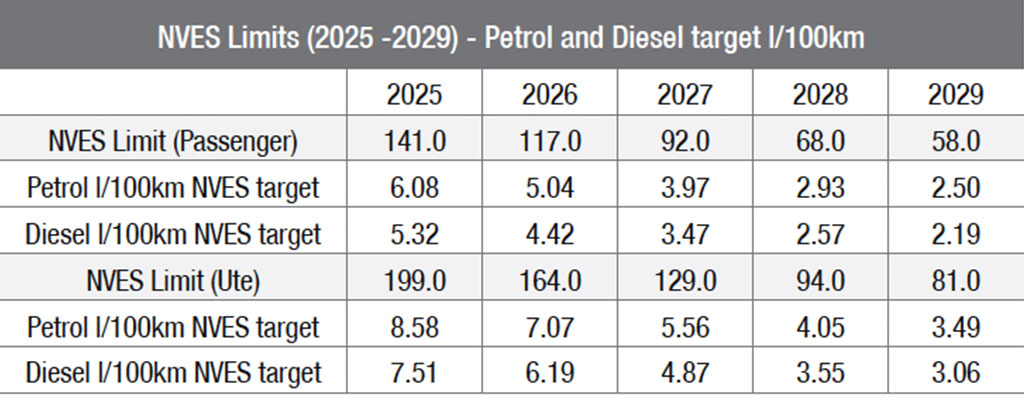

To simplify NVES, its setting target fuel consumption levels at a l/100km level per the below table.

To simplify NVES, its setting target fuel consumption levels at a l/100km level per the below table.

Therefore OEMs, dealers and customers alike will need to consider the fuel consumption rates when making their production, distribution, pricing, sales & marketing and end consumer purchase decisions.

Petrol passenger vehicles will need to have a consumption rate of 2.5l/100km or less in 2029 to avoid the NVES penalty. For utes, the fuel consumption target for petrol variants will be 3.49l/100km.

How will it affect dealers, OEMs and other industry supplier’s future?

The above calculations were done on a hypothetical SUV and Ute. This is not the way the penalties are calculated (i.e., the penalty is not on individual vehicles). The NVES penalties are calculated on the average emissions intensity (g/km) of all vehicles imported by the OEM or distributor with any excess over the limit being penalised at $100 per gram.

Hypothetically, if the average emissions of all passenger vehicles for an OEM in 2025 are 142g/km, then the penalty is $100 per unit (142g/km less 141g/km = 1g/km x $100 = $100 penalty).

While a $100 penalty per unit doesn’t seem too impactful, the multiplying factor of the volumes sold by an OEM can be devastating. Refer below a table of hypothetical penalties on OEM or distributors of brands in the Australian market.

As you can see in the below table, for the higher volume OEM brands the impact of even a small penalty is very significant.

Impacts on the supply chain of new vehicles

Impacts on the supply chain of new vehicles

The quantum (see table above) of these penalties along with the timeframes proposed by NVES will have significant impacts on OEMs, distributors, and dealers.

OEMs may decide to limit the models offered to avoid the penalties. They may limit volumes of certain high emission intensity vehicles. Some OEMs might decide the penalties will not be absorbed by the consumer if passed on and therefore the only decision is to exit the Australian market altogether.

This is not to say the OEMs, distributors and dealers will not be able to find a way to comply with the NVES emissions limits and time frames. What it does mean is that surely some will not succeed.

Other unintended consequences of NVES

NVES will likely make adversaries of low emission vehicle drivers and high emission vehicle drivers as the lower emission driver will be subsidising the high emission driver.

Will it come to them and us? I pay more so that they can pay less.

That means, if Joe Public purchases a low emission intensity vehicle, the ‘credit’ of the low emission vehicle is applied to Bob Citizen’s purchase of a high emission intensity vehicle (the OEM average emission intensity per NVES).

Using the averages, the lower emission intensity vehicle purchaser is effectively subsidising the high emissions intensity purchaser. I don’t believe this will stand as the low emissions customer will want a discount for the penalties they offset for higher emissions vehicles. That will effectively force the OEM to pass through the NVES penalty on a car-by-car basis to the individual consumer.

Will consumers hold onto their cars for longer?

Given the short time frame proposed by NVES, this could translate into effectively a ‘carbon tax’ for consumers as noted above. While many customers may be willing to pay the tax to drive their desired cars, the added expense can be as high as $20,000 plus in total for some SUVs and utes. This will drive some consumers to defer buying a new car, holding onto their existing vehicle for longer or purchasing a used higher emissions vehicle.

This will ultimately increase emissions in a lot of individual cases (and will not reduce emissions as sharply as the government modelling would suggest).

EVs will likely remain more expensive

Due to production costs and supply shortages, EVs are likely to remain approximately 30 per cent more expensive than Internal Combustion Engine (ICE) vehicles, even with the new ‘carbon tax’ included. This means the uptake of EVs, and EV model choice will likely not have improved despite NVES.

On top of the affordability issue with EVs, NVES will likely not have its intended effect of increasing EV model choice as OEMs make hard decisions about the Australian market.

OEMs will not have the global capacity to meet the demand sought by NVES in a small, right-hand drive (RHD) market like Australia. For NVES to have its intended impact, cars that meet the policy’s criteria and that are appealing/affordable to consumers will need to be made available in the Australian market in the timeframe proposed.

Most Battery Electric Vehicle (BEV) and hybrid production, driven by limited resources, is directed towards the left-hand drive (LHD) markets in the northern hemisphere, where EV incentives have been established for a decade or more.

The hard truth is many OEMs will not be in position to pivot to align to the new emissions standards.

The only real exception here is the plentiful band of Chinese manufacturers that want to enter this market.

Maybe that is the intended outcome.

1: source: unit juggler (click here)

For the record, I am (as well as Pitcher Partners) in support of a new vehicle efficiency standard. We, like most people that live on earth and breathe air, do not want to pollute.

However, a balanced view must be sought when policy is proposed that will have a major impact on the lives and livelihoods of a significant portion of the population.

This article seeks to understand the possible outcomes and unintended consequence for an 4emissions policy that has not considered the current realities of the motor industry (lack of consultation with the right parties), the Australian market (understanding where we fit in the global supply chain) and is rushed to catch up with other global jurisdictions when we can learn from their mistakes (perhaps a fool’s ambition).

Read more:

Toyota tells dealers: We are okay

Toyota clarifies NVES position

By Steve Bragg

Read More: Related articles

Read More: Related articles